Answered step by step

Verified Expert Solution

Question

1 Approved Answer

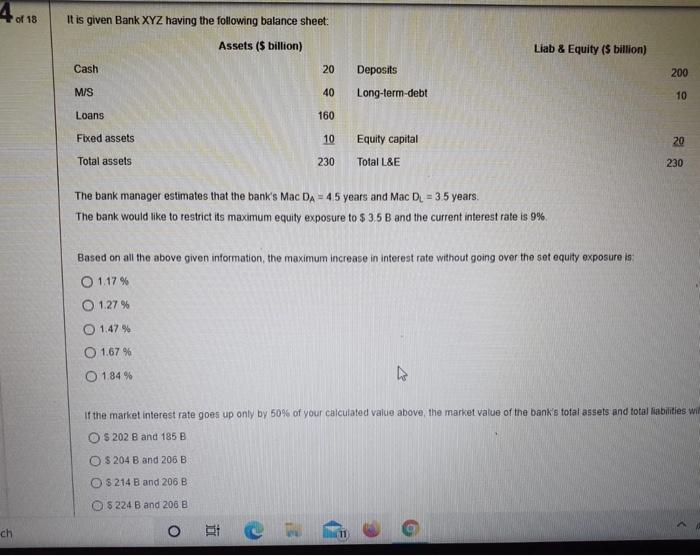

Aot 18 It is given Bank XYZ having the following balance sheet: Assets ($ billion) Liab & Equity (S billion) Cash 20 Deposits 200

Aot 18 It is given Bank XYZ having the following balance sheet: Assets ($ billion) Liab & Equity (S billion) Cash 20 Deposits 200 M/S 40 Long-term-debt 10 Loans 160 Fixed assets 10 Equity capital 20 Total assets 230 Total L&E 230 The bank manager estimates that the bank's Mac DA = 4.5 years and Mac D. = 35 years. The bank would like to restrict its maximum equity exposure to $ 3,5 B and the current interest rate is 9%. Based on all the above given information, the maximum increase in interest rate without going over the set equity exposure is: O 1.17 % O 1.27 % O 1.47 % O 1.67 % O 184 % If the market interest rate goes up only by 50% of your calculated value above, the market value of the bank's total assets and total liabilities wif O$ 202 B and 185 B O $ 204 B and 206 B O$ 214 B and 206 B O $ 224 B and 206 B ch 11

Step by Step Solution

★★★★★

3.51 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

First Duration gap D A LA x D L 45 210230 x 35 13043 EA Duration gap x i1 i Or 3523...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started