Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Joe earns $39,000 per year, and he's paid monthly. His monthly 401k contribution is $292.50. Lauren earns $52,800 per year, and she's paid monthly.

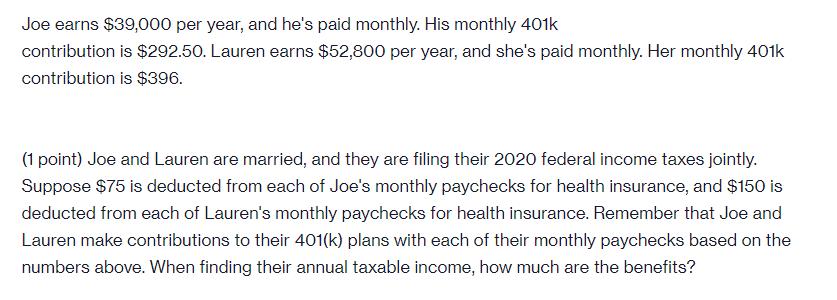

Joe earns $39,000 per year, and he's paid monthly. His monthly 401k contribution is $292.50. Lauren earns $52,800 per year, and she's paid monthly. Her monthly 401k contribution is $396. (1 point) Joe and Lauren are married, and they are filing their 2020 federal income taxes jointly. Suppose $75 is deducted from each of Joe's monthly paychecks for health insurance, and $150 is deducted from each of Lauren's monthly paychecks for health insurance. Remember that Joe and Lauren make contributions to their 401(k) plans with each of their monthly paychecks based on the numbers above. When finding their annual taxable income, how much are the benefits?

Step by Step Solution

★★★★★

3.54 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

Solution 1 When tinding Joe and lausen tanoble income the benfits Ose Joe ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started