Answered step by step

Verified Expert Solution

Question

1 Approved Answer

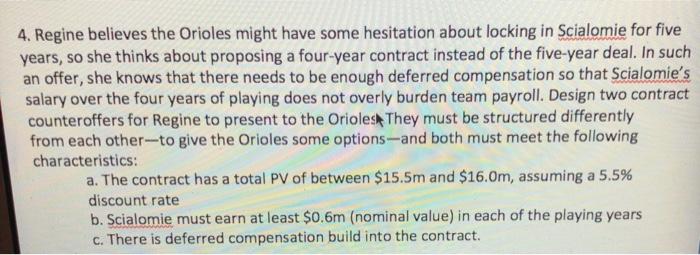

4. Regine believes the Orioles might have some hesitation about locking in Scialomie for five years, so she thinks about proposing a four-year contract

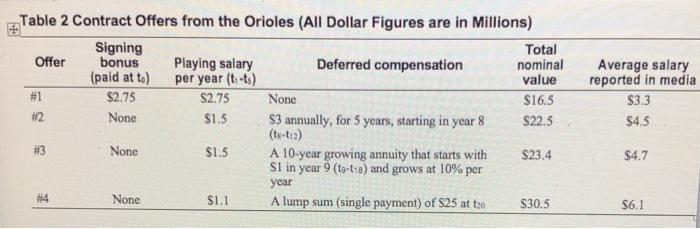

4. Regine believes the Orioles might have some hesitation about locking in Scialomie for five years, so she thinks about proposing a four-year contract instead of the five-year deal. In such an offer, she knows that there needs to be enough deferred compensation so that Scialomie's salary over the four years of playing does not overly burden team payroll. Design two contract counteroffers for Regine to present to the Oriolesk They must be structured differently from each other-to give the Orioles some options-and both must meet the following characteristics: a. The contract has a total PV of between $15.5m and $16.0m, assuming a 5.5% discount rate b. Scialomie must earn at least $0.6m (nominal value) in each of the playing years c. There is deferred compensation build into the contract. Table 2 Contract Offers from the Orioles (All Dollar Figures are in Millions) Signing bonus (paid at to) $2.75 Total nominal value Offer Playing salary per year (t-ts) Deferred compensation Average salary reported in media #1 S2.75 None $16.5 $3.3 #2 None $1.5 S3 annually, for 5 years, starting in year 8 (ts-t12) S22,5 $4.5 #3 None A 10-year growing annuity that starts with Sl in year 9 (to-ta) and grows at 10% per $1.5 $23.4 $4.7 year # 4 None $1.1 A lump sum (single payment) of S25 at t30 S30.5 $6.1

Step by Step Solution

★★★★★

3.32 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

Answer Deal 1 15881 million Deal 2 15588 million Explanation Using time value of money decision tree ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started