Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Sami Ltd grants 1,000 options to each of its 50 employees on 1 July 2019. Each grant is conditional on the employee working for

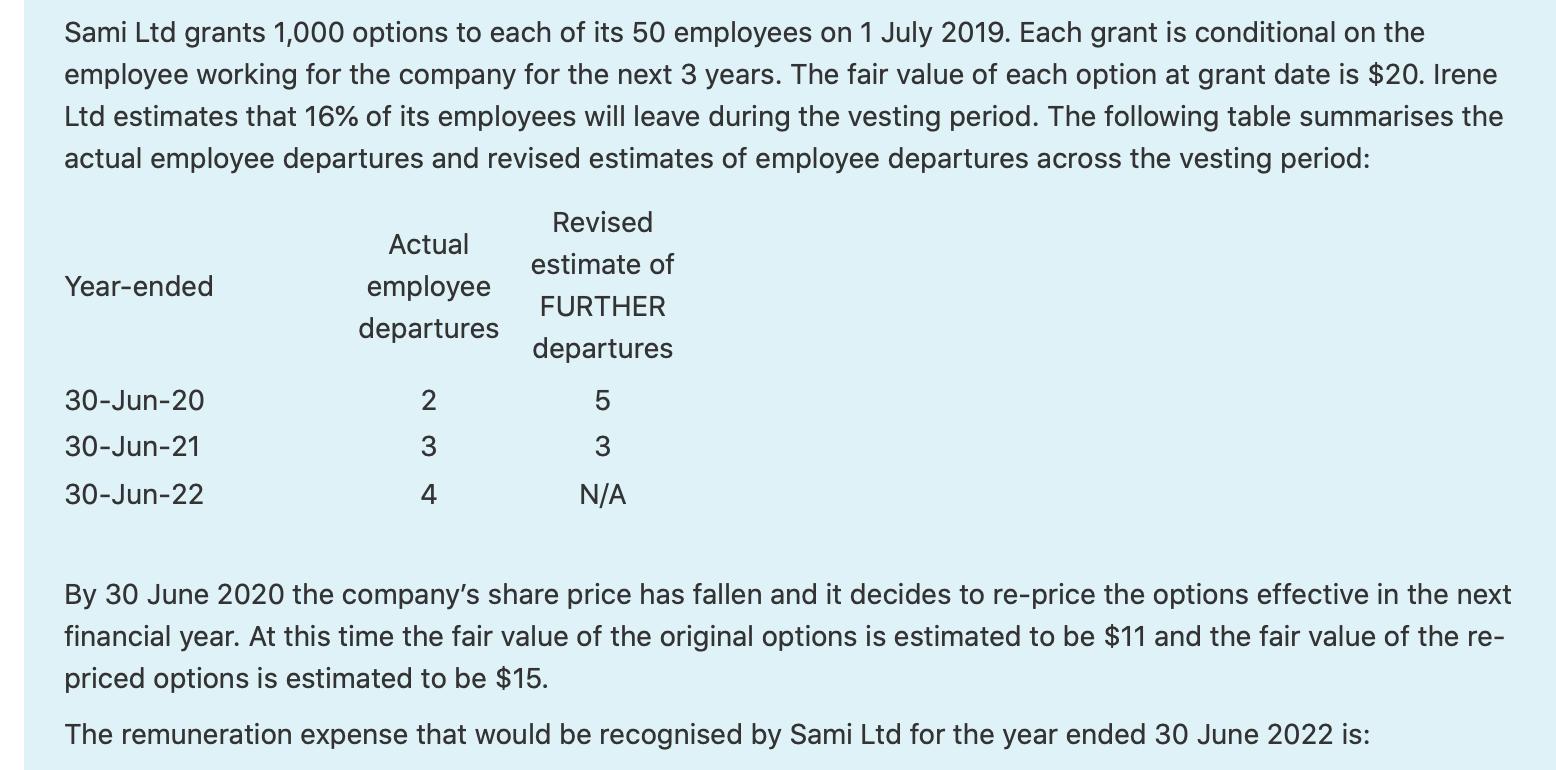

Sami Ltd grants 1,000 options to each of its 50 employees on 1 July 2019. Each grant is conditional on the employee working for the company for the next 3 years. The fair value of each option at grant date is $20. Irene Ltd estimates that 16% of its employees will leave during the vesting period. The following table summarises the actual employee departures and revised estimates of employee departures across the vesting period: Revised Actual estimate of Year-ended employee FURTHER departures departures 30-Jun-20 2 30-Jun-21 3 3 30-Jun-22 4 N/A By 30 June 2020 the company's share price has fallen and it decides to re-price the options effective in the next financial year. At this time the fair value of the original options is estimated to be $11 and the fair value of the re- priced options is estimated to be $15. The remuneration expense that would be recognised by Sami Ltd for the year ended 30 June 2022 is:

Step by Step Solution

★★★★★

3.48 Rating (164 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started