Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Review the WestJet balance sheet for fiscal year-end December 31, 2017, in Appendix III, Identify three accounts on the halance Oi accounts where a

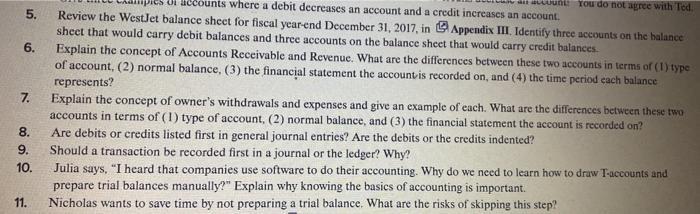

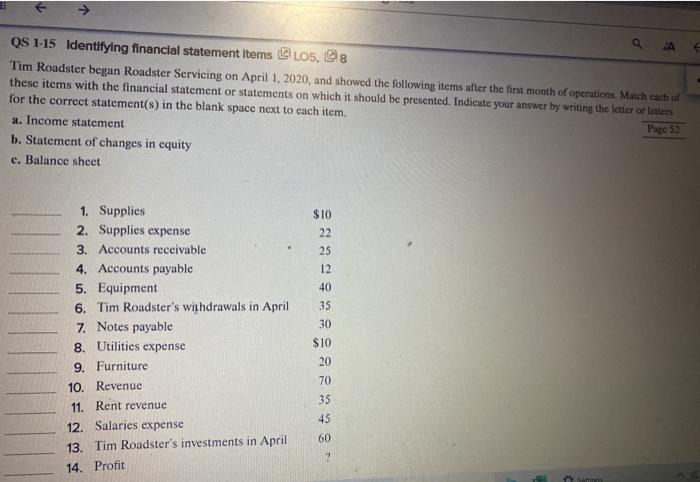

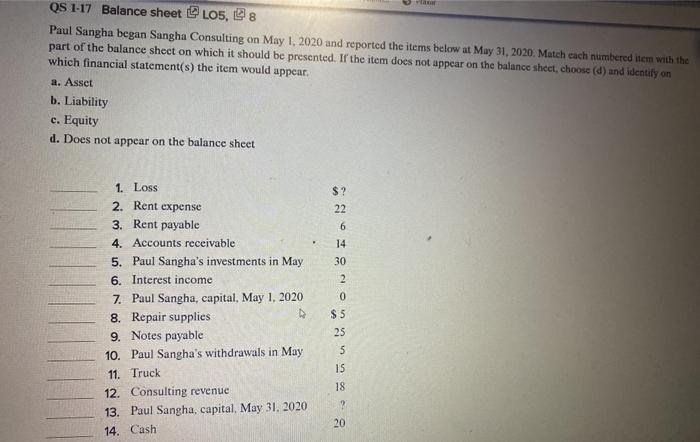

Review the WestJet balance sheet for fiscal year-end December 31, 2017, in Appendix III, Identify three accounts on the halance Oi accounts where a debit decreases an account and a credit inereases an account. UUNL TOu do not agree with Ted. 5. sheet that would carry debit balances and three accounts on the balance sheet that would carry credit balances. Explain the concept of Accounts Receivable and Revenue. What are the differences between these two accounts in terms of (1) type of account, (2) normal balance, (3) the financial statement the account-is recorded on, and (4) the time period each balance represents? Explain the concept of owner's withdrawals and expenses and give an example of each. What are the differences between these two accounts in terms of (1) type of account, (2) normal balance, and (3) the financial statement the account is recorded on? Are debits or credits listed first in general journal entries? Are the debits or the credits indented? 9. 7. 8. Should a transaction be recorded first in a journal or the ledger? Why? Julia says, "I heard that companies use software to do their accounting. Why do we need to learn how to draw T-accounts and prepare trial balances manually?" Explain why knowing the basics of accounting is important. Nicholas wants to save time by not preparing a trial balance. What are the risks of skipping this step? 10. 11. 6. Explain. 21. What transactions increase and decrease equity? 22 Your favourito QS 1-15 Identifying financial statement items G LO5, 98 JA Tim Roadster began Roadster Scrvicing on April 1, 2020, and showed the following items after the first month of operations. Match cach of these items with the financial statement or statements on which it should be presented. Indicate your answer by writing the letter or letters for the correct statement(s) in the blank space next to cach item. a. Income statement Page 52 b. Statement of changes in cquity c. Balance sheet 1. Supplies $10 2. Supplies expense 22 3. Accounts receivable 4. Accounts payable 25 12 5. Equipment 6. Tim Roadster's withdrawals in April 7. Notes payable 8. Utilities expense 40 35 30 $10 20 9. Furniture 70 10. Revenue 35 11. Rent revenue 45 12. Salaries expense 60 13. Tim Roadster's investments in April 14. Profit Seminos QS 1-17 Balance sheet e LO5, 8 Paul Sangha began Sangha Consulting on May 1, 2020 and reported the items below at May 31, 2020. Match cach numbered item with the part of the balance sheet on which it should be presented. If the item docs not appcar on the balance sheet, choose (d) and identify on which financial statement(s) the item would appear. a. Asset b. Liability c. Equity d. Does not appear on the balance sheet 1. Loss 2. Rent expense 3. Rent payable $? 22 6. 4. Accounts receivable 14 5. Paul Sangha's investments in May 30 6. Interest income 7. Paul Sangha, capital, May 1, 2020 8. Repair supplies 9. Notes payable 10. Paul Sangha's withdrawals in May $ 5 25 15 11. Truck 18 12. Consulting revenue 13. Paul Sangha, capital, May 31. 2020 20 14. Cash

Step by Step Solution

★★★★★

3.40 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

Three accounts on the balance sheet that would carry debit balances a Accounts Receivable b Equipment c Notes Payable Three accounts on the balance sheet that would carry credit balances a Accounts Pa...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started