Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Assume the following are the fiscal year income statement and balance sheet of Whole Foods Market, Inc. Income Statement ($ thousands) 2016 $4,701,289 3,052,184

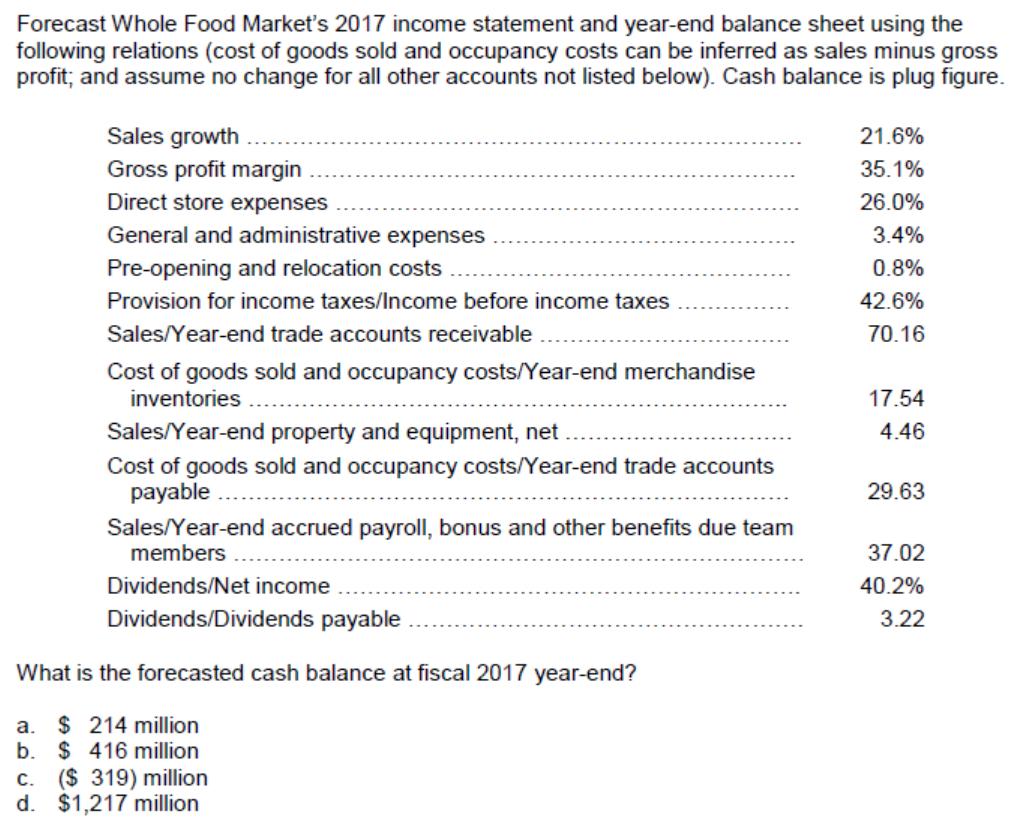

Assume the following are the fiscal year income statement and balance sheet of Whole Foods Market, Inc. Income Statement ($ thousands) 2016 $4,701,289 3,052,184 1,649,105 1,223,473 158,864 37,035 Sales Cost of goods sold and occupancy costs Gross profit Direct store expenses General and administrative expenses Pre-opening and relocation costs Operating income Other income expense 229,733 Interest expense (2,223) Investment and other income 9,623 Income before income taxes 237,133 Provision for income taxes 100,782 Net income $ 136,351 Forecast Whole Food Market's 2017 income statement and year-end balance sheet using the following relations (cost of goods sold and occupancy costs can be inferred as sales minus gross profit; and assume no change for all other accounts not listed below). Cash balance is plug figure. Sales growth Gross profit margin 21.6% 35.1% Direct store expenses 26.0% General and administrative expenses 3.4% Pre-opening and relocation costs 0.8% Provision for income taxes/Income before income taxes 42.6% Sales/Year-end trade accounts receivable 70.16 Cost of goods sold and occupancy costs/Year-end merchandise inventories 17.54 Sales/Year-end property and equipment, net 4.46 Cost of goods sold and occupancy costs/Year-end trade accounts payable 29.63 Sales/Year-end accrued payroll, bonus and other benefits due team members 37.02 Dividends/Net income 40.2% Dividends/Dividends payable 3.22 What is the forecasted cash balance at fiscal 2017 year-end? $ 214 million b. $ 416 million a. C. ($ 319) million d. $1,217 million

Step by Step Solution

★★★★★

3.51 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

Correct option a 214 million Income Statement Sales 4701289 x 1 216 571676742 Cost of Goods Sold and ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started