Question

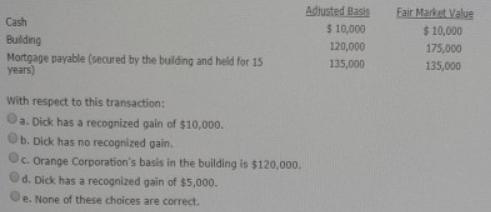

Dick, a cash basis taxpayer. Incorporates his sole proprietorship. He transfers the following items to newly created Orange Corporation. Adiusted Basis $ 10,000 120,000 Eair

Dick, a cash basis taxpayer. Incorporates his sole proprietorship. He transfers the following items to newly created Orange Corporation.

Adiusted Basis $ 10,000 120,000 Eair Market Value Cash $ 10,000 Bulding Mortgage payable (secured by the building and held for 1S years) 175,000 135,000 135,000 With respect to this transaction: a. Dick has a recognized gain of $10,000. b. Dick has no recognized gain. Oc. Orange Corporation's basis in the building is $120,000. Od. Dick has a recognized gain of $5,000. e. None of these choices are correct.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Here only answer a can be answered as other information i...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Concepts In Federal Taxation

Authors: Kevin E. Murphy, Mark Higgins, Tonya K. Flesher

19th Edition

978-0324379556, 324379552, 978-1111579876

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App