Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A company is thinking about replacing an old machine with a new one. The old machine cost $1.3 million. The new machine will cost

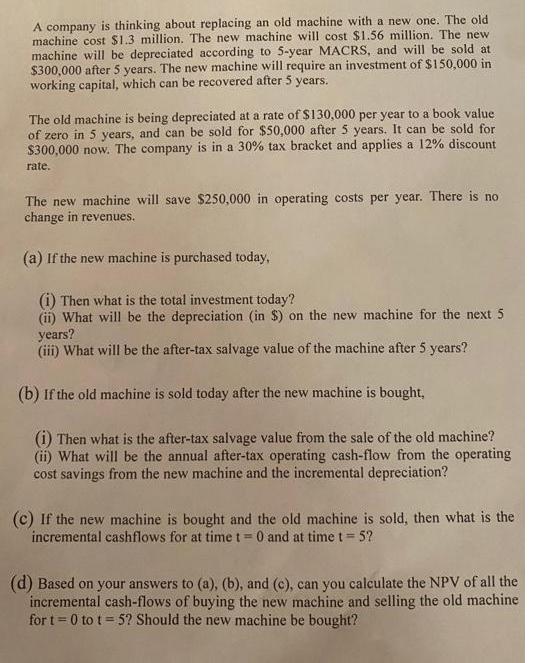

A company is thinking about replacing an old machine with a new one. The old machine cost $1.3 million. The new machine will cost $1.56 million. The new machine will be depreciated according to 5-year MACRS, and will be sold at $300,000 after 5 years. The new machine will require an investment of $150,000 in working capital, which can be recovered after 5 years. The old machine is being depreciated at a rate of $130,000 per year to a book value of zero in 5 years, and can be sold for $50,000 after 5 years. It can be sold for $300,000 now. The company is in a 30% tax bracket and applies a 12% discount rate. The new machine will save $250,000 in operating costs per year. There is no change in revenues. (a) If the new machine is purchased today, (i) Then what is the total investment today? (ii) What will be the depreciation (in $) on the new machine for the next 5 years? (iii) What will be the after-tax salvage value of the machine after 5 years? (b) If the old machine is sold today after the new machine is bought, (i) Then what is the after-tax salvage value from the sale of the old machine? (ii) What will be the annual after-tax operating cash-flow from the operating cost savings from the new machine and the incremental depreciation? (c) If the new machine is bought and the old machine is sold, then what is the incremental cashflows for at time t= 0 and at time t= 5? %3! (d) Based on your answers to (a), (b), and (c), can you calculate the NPV of all the incremental cash-flows of buying the new machine and selling the old machine for t =0 to t = 5? Should the new machine be bought?

Step by Step Solution

★★★★★

3.47 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

GIVEN DATA in computation of initial incremental cash outflows year particulars amount pv discounted ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started