Answered step by step

Verified Expert Solution

Question

1 Approved Answer

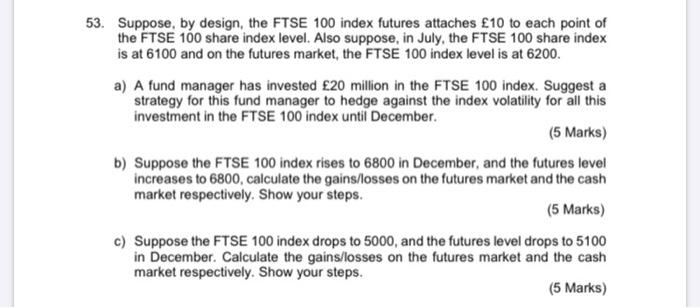

53. Suppose, by design, the FTSE 100 index futures attaches 10 to each point of the FTSE 100 share index level. Also suppose, in

53. Suppose, by design, the FTSE 100 index futures attaches 10 to each point of the FTSE 100 share index level. Also suppose, in July, the FTSE 100 share index is at 6100 and on the futures market, the FTSE 100 index level is at 6200. a) A fund manager has invested 20 million in the FTSE 100 index. Suggest a strategy for this fund manager to hedge against the index volatility for all this investment in the FTSE 100 index until December. (5 Marks) b) Suppose the FTSE 100 index rises to 6800 in December, and the futures level increases to 6800, calculate the gains/losses on the futures market and the cash market respectively. Show your steps. (5 Marks) c) Suppose the FTSE 100 index drops to 5000, and the futures level drops to 5100 in December. Calculate the gains/losses on the futures market and the cash market respectively. Show your steps. (5 Marks)

Step by Step Solution

★★★★★

3.42 Rating (146 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started