Answered step by step

Verified Expert Solution

Question

1 Approved Answer

5. The management fee to be paid to the management company is 2 percent of net room 6. Fire insurance protection was secured on

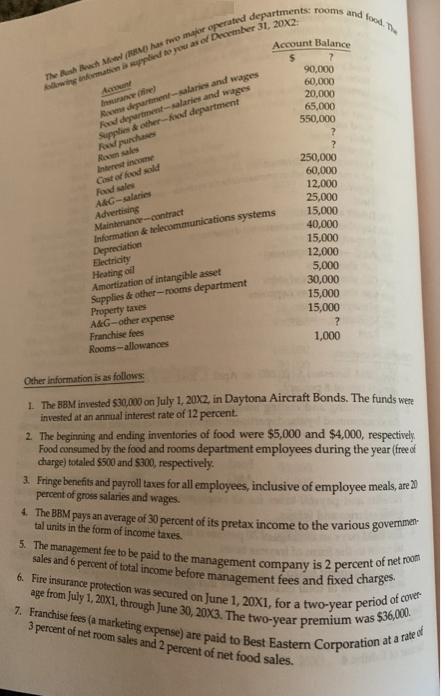

5. The management fee to be paid to the management company is 2 percent of net room 6. Fire insurance protection was secured on June 1, 20X1, for a two-year period of cover 7. Franchise fees (a marketing expense) are paid to Best Eastern Corporation at a rate of age from July 1, 20X1, through June 30, 20X3. The two-year premium v Account Balance Account Insurance (re) Rocms department-salaries and wages Food department-salaries and wages Supplies & other-food department Fd purchases Room sales Interest income Cost of food sold Food sales A&G-salaries Advertising Maintenance-contract Information & telecommunications systems Depreciation Electricity Heating oil Amortization of intangible asset Supplies & other-rooms department Property taves A&G-other expense Franchise fees Rooms-allowances 90,000 60,000 20,000 65,000 550,000 250,000 60,000 12,000 25,000 15,000 40,000 15,000 12,000 5,000 30,000 15,000 15,000 1,000 Other information is as follows 1. The BBM invested $30,000 on July 1, 20x2, in Daytona Aircraft Bonds. The funds wer invested at an annual interest rate of 12 percent. 2 The beginni Food consumed by the food and rooms department employees during the year (free of charge) totaled $500 and $300, respectively. 3. Fringe benefits and payroll taxes for all employees, inclusive of employee meals, are 20 percent of gross salaries and wages. and ending inventories of food were $5,000 and $4,000, respectively 4. The BBM pays an average of 30 percent of its pretax income to the various governimar tal units in the form of income taxes. sales and 6 percent of total income before management fees and fixed charge 3 percent of net room sales and 2 percent of net food sales. was $36,000. Prepare an income statement for 20X2 for the BBM based on the format of Exhibit 4. The Income Statement 139 Required:

Step by Step Solution

★★★★★

3.42 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

LlaRKINGL BEC IULY CMonths Bond interest 12x 30000 A9 1S00 A Giou Valaries ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started