Answered step by step

Verified Expert Solution

Question

1 Approved Answer

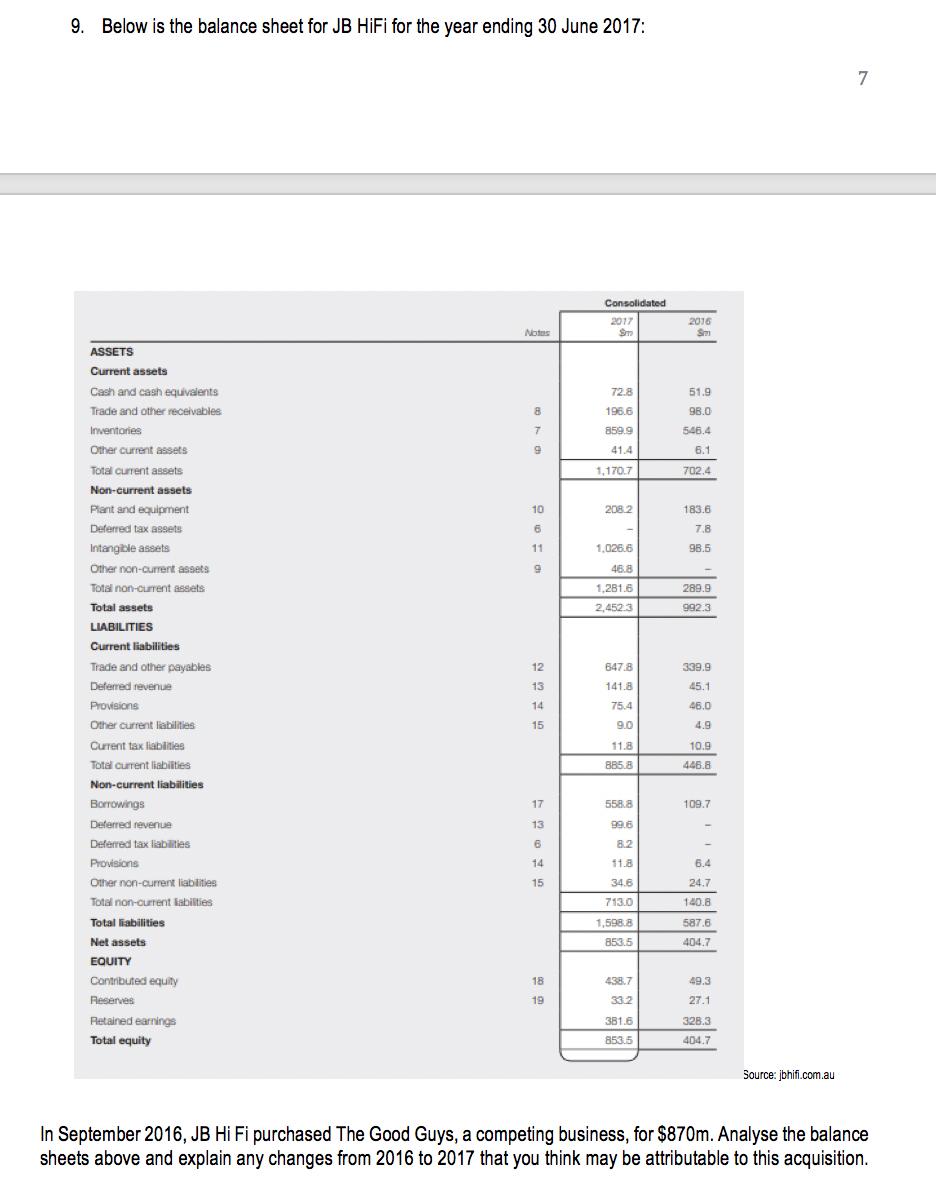

9. Below is the balance sheet for JB HiFi for the year ending 30 June 2017: 7 Consolidated 2017 2016 Notes Sm Sm ASSETS

9. Below is the balance sheet for JB HiFi for the year ending 30 June 2017: 7 Consolidated 2017 2016 Notes Sm Sm ASSETS Current assets Cash and cash equivalents 72.8 51.9 Trade and other receivables 196.6 98.0 Inventories 859.9 546.4 Other current assets 9. 41.4 6.1 Total current assets 1,170.7 702.4 Non-current assets Plant and equipment 10 208.2 183.6 Deferred tax assets 6 7.8 Intangible assets 11 1,026.6 98.5 Other non-current assets 46.8 Total non-current assets 1,281.6 289.9 Total assets 2,452.3 992.3 LIABILITIES Current liabilities Trade and other payables 12 647.8 339.9 Deferred revenue 13 141.8 45.1 Provisions 14 75.4 46.0 Other current liabilities 15 9.0 4.9 Current tax liablities 11.8 10.9 Totel current liabilities 885.8 446.8 Non-current liabilities Borrowings 17 558.8 109.7 Deferred revenue 13 99.6 Deferred tax liabities 6 8.2 Provisions 14 11.8 6.4 Other non-current liabilities 15 34.6 24.7 Total non-current kabilties 713.0 140.8 Total liabilities 1,598.8 587.6 Net assets 853.5 404.7 EQUITY Contributed equity 18 438.7 49.3 Reserves 19 33.2 27.1 Retained earnings 381.6 328.3 Total equity 853.5 404.7 Source: jbhifi.com.au In September 2016, JB Hi Fi purchased The Good Guys, a competing business, for $870m. Analyse the balance sheets above and explain any changes from 2016 to 2017 that you think may be attributable to this acquisition.

Step by Step Solution

★★★★★

3.39 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

The Balance Sheet of JB HiFi as of June 2017 looks promising as the values as compared to 2016 are a...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started