Answered step by step

Verified Expert Solution

Question

1 Approved Answer

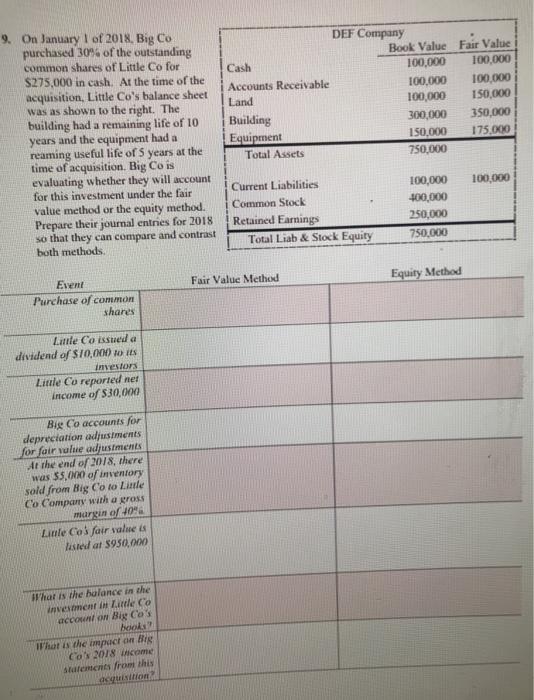

9. On January 1 of 2018, Big Co purchased 30% of the outstanding common shares of Little Co for $275,000 in cash. At the

9. On January 1 of 2018, Big Co purchased 30% of the outstanding common shares of Little Co for $275,000 in cash. At the time of the acquisition, Little Co's balance sheet was as shown to the right. The building had a remaining life of 10 years and the equipment had a reaming useful life of 5 years at the time of acquisition. Big Co is evaluating whether they will account for this investment under the fair value method or the equity method. Prepare their journal entries for 2018 so that they can compare and contrast both methods. Event Purchase of common shares Little Co issued a dividend of $10,000 to its investors Little Co reported net income of $30,000 Big Co accounts for depreciation adjustments for fair value adjustments At the end of 2018, there was $5,000 of inventory sold from Big Co to Little Co Company with a gross margin of 40% Linle Co's fair value is listed at $950,000 What is the balance in the investment in Little Co account on Big Co's books? What is the impact on Big Co's 2018 income statements from this acquisition? Cash Accounts Receivable Land Building Equipment Total Assets Current Liabilities Common Stock Retained Earnings DEF Company Total Liab & Stock Equity Fair Value Method Book Value 100,000 100,000 100,000 Fair Value 100,000 100,000 400,000 250,000 750,000 300,000 350,000 150,000 175,000 750,000 100,000 150,000 Equity Method 100,000

Step by Step Solution

★★★★★

3.47 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started