Question

1. A $10,000 callable bond is purchased on September 10, 2020. It pays semi-annual coupons at j2 = 6% on September 10 and March

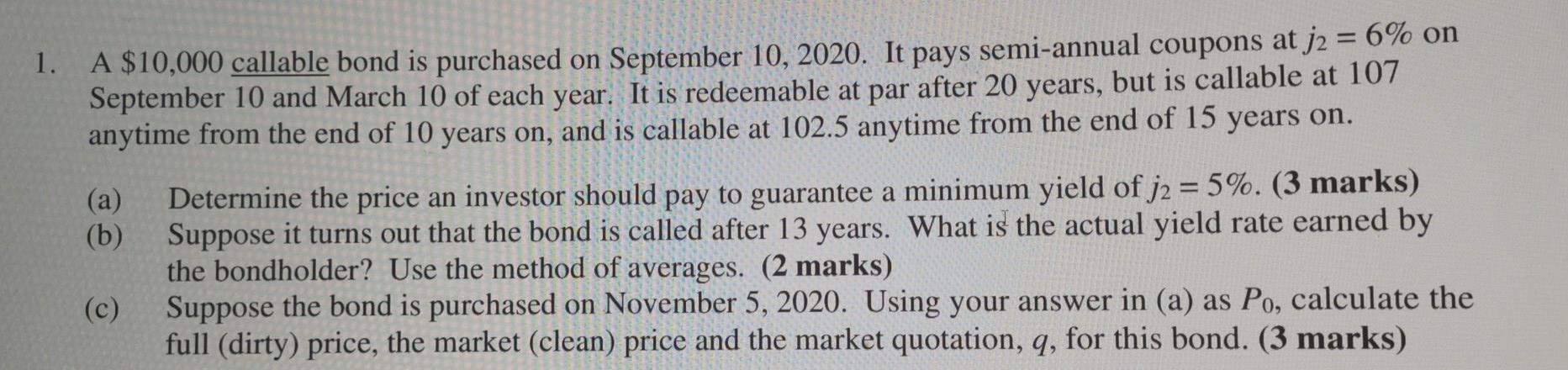

1. A $10,000 callable bond is purchased on September 10, 2020. It pays semi-annual coupons at j2 = 6% on September 10 and March 10 of each year. It is redeemable at par after 20 years, but is callable at 107 anytime from the end of 10 years on, and is callable at 102.5 anytime from the end of 15 years on. (a) Determine the price an investor should pay to guarantee a minimum yield of j2 = 5%. (3 marks) Suppose it turns out that the bond is called after 13 years. What is the actual yield rate earned by the bondholder? Use the method of averages. (2 marks) (b) (c) Suppose the bond is purchased on November 5, 2020. Using your answer in (a) as Po, calculate the full (dirty) price, the market (clean) price and the market quotation, q, for this bond. (3 marks)

Step by Step Solution

3.45 Rating (145 Votes )

There are 3 Steps involved in it

Step: 1

w If 10000 6 X 59 1000...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Contemporary Business Mathematics with Canadian Applications

Authors: S. A. Hummelbrunner, Kelly Halliday, Ali R. Hassanlou, K. Suzanne Coombs

11th edition

134141083, 978-0134141084

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App