Tamar Co. manufactures a single product in two departments. All direct materials are added at the beginning of the Forming process. Conversion costs are

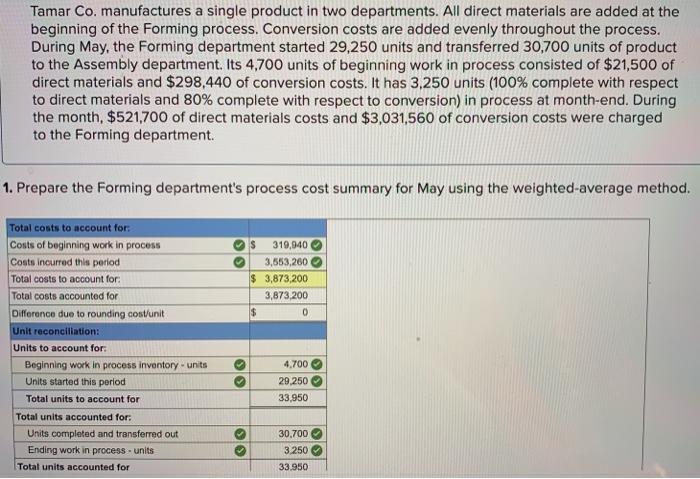

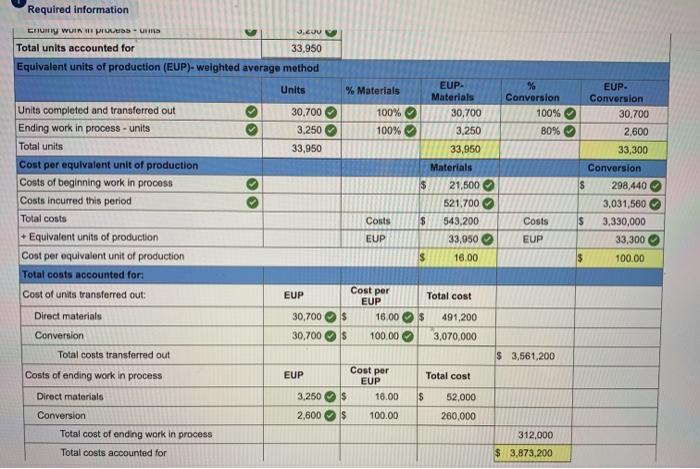

Tamar Co. manufactures a single product in two departments. All direct materials are added at the beginning of the Forming process. Conversion costs are added evenly throughout the process. During May, the Forming department started 29,250 units and transferred 30,700 units of product to the Assembly department. Its 4,700 units of beginning work in process consisted of $21,500 of direct materials and $298,440 of conversion costs. It has 3,250 units (100% complete with respect to direct materials and 80% complete with respect to conversion) in process at month-end. During the month, $521,700 of direct materials costs and $3,031,560 of conversion costs were charged to the Forming department. 1. Prepare the Forming department's process cost summary for May using the weighted-average method. Total costs to account for: Costs of beginning work in process Costs incurred this period Total costs to account for: Total costs accounted for Difference due to rounding cost/unit Unit reconciliation: Units to account for: Beginning work in process inventory- units Units started this period Total units to account for Total units accounted for: Units completed and transferred out Ending work in process units Total units accounted for >> 33 $ 319,940 3,553,260 $ 3,873,200 3,873,200 $ 0 4,700 29,250 33,950 30,700 3,250 33.950 Required information Ending work in pr Total units accounted for Equivalent units of production (EUP)-weighted average method Units Units completed and transferred out Ending work in process-units Total units Cost per equivalent unit of production Costs of beginning work in process Costs incurred this period Total costs +Equivalent units of production Cost per equivalent unit of production Total costs accounted for: Cost of units transferred out: Direct materials Conversion Total costs transferred out Costs of ending work in process Direct materials Conversion Total cost of ending work in process Total costs accounted for 3,200 33,950 30,700 3,250 33,950 EUP 30,700 30,700 EUP % Materials $ S 3,250 $ 2,600 $ 100% 100% Costs EUP Cost per EUP 16.00 100.00 Cost per EUP 16.00 100.00 $ $ $ EUP- Materials $ 30,700 3,250 33,950 Materials 21.500 521,700 543,200 33,950 16.00 Total cost $ 491,200 3,070,000 Total cost 52,000 260,000 % Conversion 100% 80% Costs EUP $ 3,561,200 312,000 $ 3,873,200 $ $ $ EUP. Conversion 30,700 2,600 33,300 Conversion 298,440 3,031,560 3,330,000 33,300 100.00

Step by Step Solution

3.29 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

WIP FORMING DEPT AC PARTICULARS BAL BD RAW MATERIAL WAGES CONTROL FACTORY OVERHEADS RAW ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started