Question

A broker writes an American call option with strike E = 95 and expiry date T = 3 years. The risk-free interest rate is

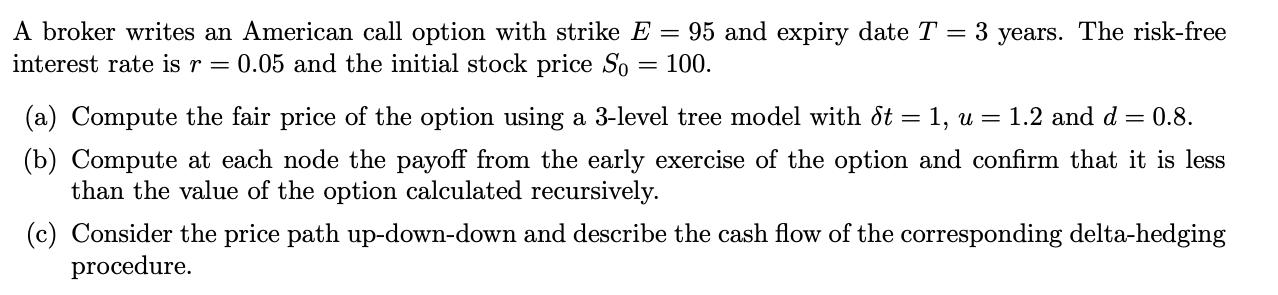

A broker writes an American call option with strike E = 95 and expiry date T = 3 years. The risk-free interest rate is r = 0.05 and the initial stock price So 100. (a) Compute the fair price of the option using a 3-level tree model with dt = 1, u = 1.2 and d = 0.8. (b) Compute at each node the payoff from the early exercise of the option and confirm that it is less than the value of the option calculated recursively. (c) Consider the price path up-down-down and describe the cash flow of the corresponding delta-hedging procedure.

Step by Step Solution

3.45 Rating (168 Votes )

There are 3 Steps involved in it

Step: 1

a The stock price at time t0 is S0100 The stock price at time t1 is S11S0112 The stock prices at tim...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Options Futures and Other Derivatives

Authors: John C. Hull

10th edition

013447208X, 978-0134472089

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App