Question

A company has a coupon bond as a liability. The bond has a par value of 1000, pays 8% coupons annually, and redeems at

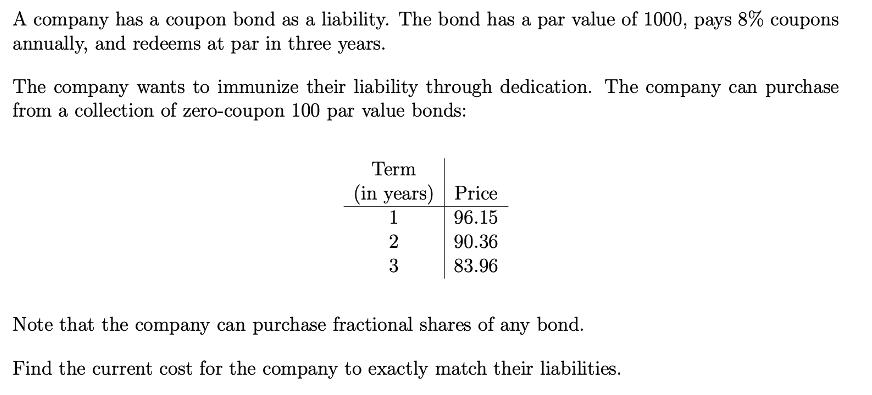

A company has a coupon bond as a liability. The bond has a par value of 1000, pays 8% coupons annually, and redeems at par in three years. The company wants to immunize their liability through dedication. The company can purchase from a collection of zero-coupon 100 par value bonds: Term (in years) 1 2 3 Price 96.15 90.36 83.96 Note that the company can purchase fractional shares of any bond. Find the current cost for the company to exactly match their liabilities.

Step by Step Solution

3.48 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

ANS WER The current cost for the company to exac...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Applied Equity Analysis and Portfolio Management Tools to Analyze and Manage Your Stock Portfolio

Authors: Robert A.Weigand

1st edition

978-111863091, 1118630912, 978-1118630914

Students also viewed these Law questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App