Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Southwest Airlines wants to borrow pounds, and BBA Aviation wants to borrow dollars. Because Southwest is better known in the U.S., it can borrow

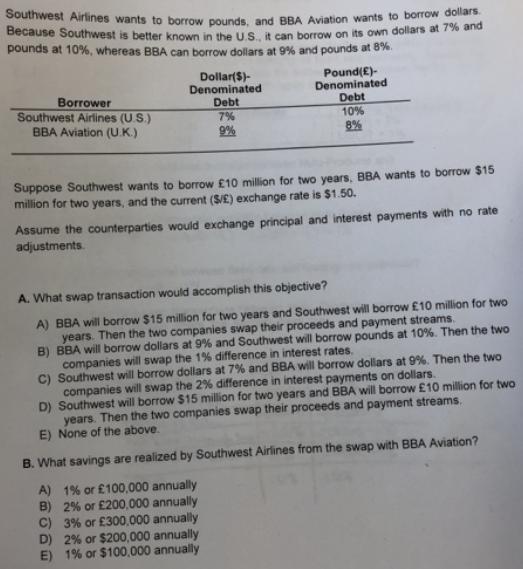

Southwest Airlines wants to borrow pounds, and BBA Aviation wants to borrow dollars. Because Southwest is better known in the U.S., it can borrow on its own dollars at 7% and pounds at 10%, whereas BBA can borrow dollars at 9% and pounds at 8%. Borrower Southwest Airlines (U.S.) BBA Aviation (U.K.) Dollar ($)- Denominated Debt 7% 9% Pound ()- Denominated Debt 10% 8% Suppose Southwest wants to borrow 10 million for two years, BBA wants to borrow $15 million for two years, and the current (S/E) exchange rate is $1.50. Assume the counterparties would exchange principal and interest payments with no rate adjustments. A. What swap transaction would accomplish this objective? A) BBA will borrow $15 million for two years and Southwest will borrow 10 million for two years. Then the two companies swap their proceeds and payment streams. B) BBA will borrow dollars at 9% and Southwest will borrow pounds at 10%. Then the two companies will swap the 1% difference in interest rates. C) Southwest will borrow dollars at 7% and BBA will borrow dollars at 9%. Then the two companies will swap the 2% difference in interest payments on dollars. D) Southwest will borrow $15 million for two years and BBA will borrow 10 million for two years. Then the two companies swap their proceeds and payment streams. E) None of the above. B. What savings are realized by Southwest Airlines from the swap with BBA Aviation? A) 1% or 100,000 annually B) 2% or 200,000 annually C) 3% or 300,000 annually D) 2% or $200,000 annually E) 1% or $100,000 annually

Step by Step Solution

★★★★★

3.41 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

SOLUTION We can solve the above questions as follows PART A ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started