Answered step by step

Verified Expert Solution

Question

1 Approved Answer

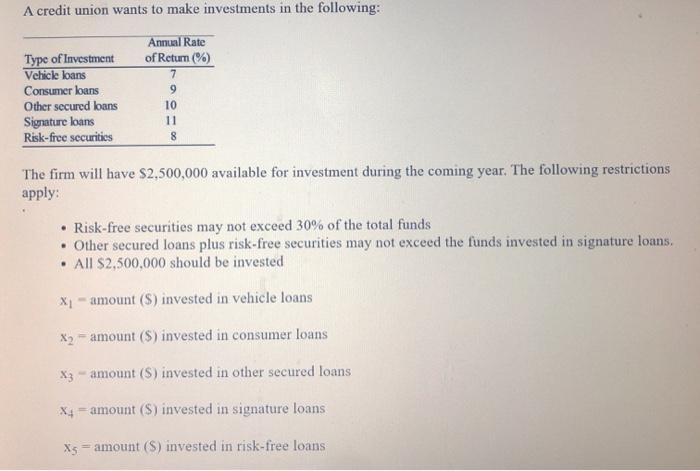

A credit union wants to make investments in the following: Type of Investment Vehicle loans Consumer loans Other secured loans Signature loans Risk-free securities

A credit union wants to make investments in the following: Type of Investment Vehicle loans Consumer loans Other secured loans Signature loans Risk-free securities Annual Rate of Return (%) 7 9 10 11 8 The firm will have $2,500,000 available for investment during the coming year. The following restrictions apply: Risk-free securities may not exceed 30% of the total funds . Other secured loans plus risk-free securities may not exceed the funds invested in signature loans. All $2,500,000 should be invested X - amount (S) invested in vehicle loans X2 - amount (S) invested in consumer loans X3 - amount (S) invested in other secured loans. X4 amount (S) invested in signature loans X5 = amount (S) invested in risk-free loans Formulate a model and solve it using computer. How should the $2,500,000 be allocated to each alternative to maximize annual return? What is the annual return?

Step by Step Solution

★★★★★

3.57 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

This problem can be solved using the the concept Linear Progamming Problem The objective function in ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started