Question

A graduate in financial planning on average, earns about $55,000 a year, you can assume that this amount is your starting salary package (i.e. it

A graduate in financial planning on average, earns about $55,000 a year, you can assume that this amount is your starting salary package (i.e. it includes the superannuation guarantee contribution).

• Your salary itself is expected to increase by 3% per year that accounts for increases due to the CPI and any promotions throughout your lifetime.

• You can assume the tax rates to remain constant, and that inflation (CPI) is 2% per annum.

• Your superannuation funds are invested in a growth option. The growth option is expected to generate a net return of 6.0% per annum (net of fees) for the foreseeable future.

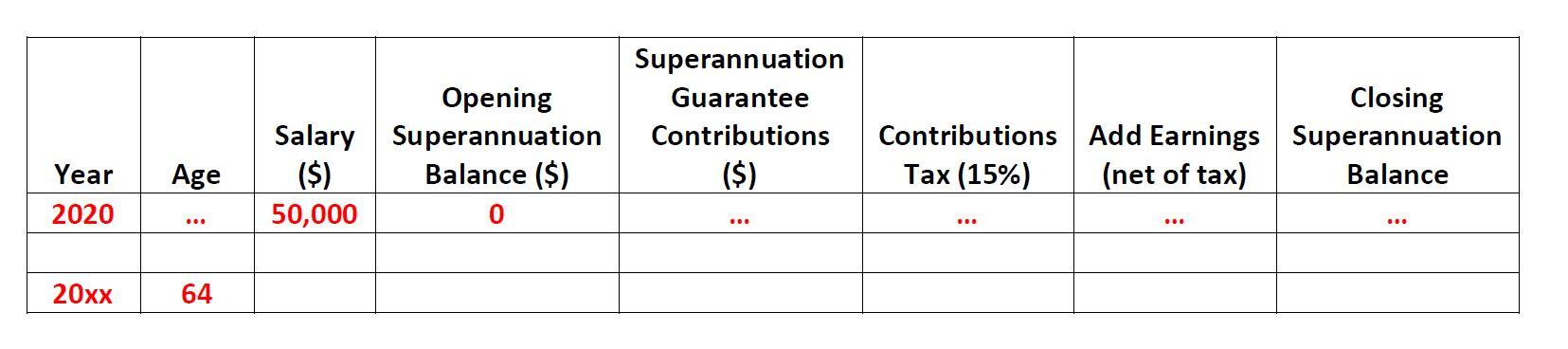

You aim at building wealth between now and when you retire within your superannuation fund. One of your goals is to retire on your 65th birthday. Show the amount of accumulated superannuation for each year through till retirement. You should use the table below as a sample to illustrate the accumulation of your superannuation fund to retirement. You can assume the tax rates remain constant and that you make no further contributions or savings towards retirement.

Superannuation Closing Opening Superannuation Balance ($) Guarantee Salary ($) 50,000 Contributions Add Earnings Superannuation (net of tax) Contributions Year Age ($) ax (15%) Balance 2020 ... 20 64

Step by Step Solution

3.53 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

Assuming that you are starting at age 25 and retiring at age 65 your accumulated superannuation bala...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started