Question

1). Which of the following portfolios is suitable for immunizing this liability against a shift in interest rates today: A). Portfolio (i) B). Portfolio (ii)

1). Which of the following portfolios is suitable for immunizing this liability against a shift in interest rates today:

A). Portfolio (i)

B). Portfolio (ii)

C). Portfolio (iii)

D). Portfolio (iv)

E). Portfolio (v)

2). You consider immunizing against the liability by investing in 66,075.54 bonds of Type D. This portfolio has a present value, today, equal to the present value of the liability. If the yield curve increases to 7.9%, what is the new present value of this immunizing portfolio?

A). 4,813,754.96

B). 4,806,248.87

C). 4,544,469.09

D). 4,531,608.71

E). None of the above

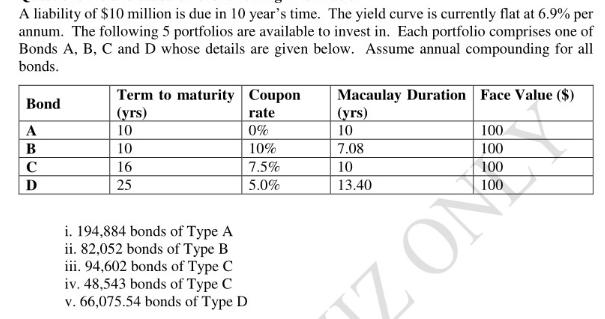

A liability of $10 million is due in 10 year's time. The yield curve is currently flat at 6.9% per annum. The following 5 portfolios are available to invest in. Each portfolio comprises one of Bonds A, B, C and D whose details are given below. Assume annual compounding for all bonds. Term to maturity Coupon (yrs) Macaulay Duration Face Value ($) (yrs) 10 Bond rate A 10 0% 100 B 10 10% 7.08 100 C 16 7.5% 10 100 D 25 5.0% 13.40 100 i. 194,884 bonds of Type A ii. 82,052 bonds of Type B iii. 94,602 bonds of Type C iv. 48,543 bonds of Type C v. 66,075.54 bonds of Type D Z ON

Step by Step Solution

3.44 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started