Answered step by step

Verified Expert Solution

Question

1 Approved Answer

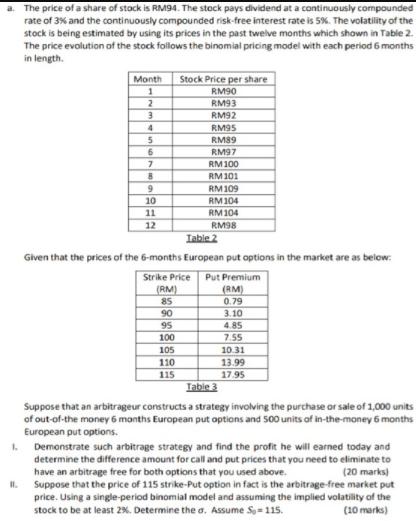

a. The price of a share of stock is RM94. The stock pays dividend at a continuously compounded rate of 3% and the continuously

a. The price of a share of stock is RM94. The stock pays dividend at a continuously compounded rate of 3% and the continuously compounded risk-free interest rate is 5%. The volatility of the stock is being estimated by using its prices in the past twelve months which shown in Table 2. The price evolution of the stock follows the binomial pricing model with each period 6 months in length. Month Stock Price per share RM90 RM93 RM92 4. RM95 RM89 RM97 RM100 RM101 RM109 10 RM104 11 RM104 12 RM98 Tabie 2 Given that the prices of the 6-months European put options in the market are as below: Strike Price Put Premium (RM) (RM) 85 0.79 90 3.10 95 4.85 100 7.55 105 10.31 13.99 17.95 Tabie 3 110 115 Suppose that an arbitrageur constructs a strategy involving the purchase or sale of 1,000 units of out-of-the money 6 months European put options and 500 units of in-the-money 6 months European put options. 1. Demonstrate such arbitrage strategy and find the profit he will earned today and determine the difference amount for call and put prices that you need to eliminate to have an arbitrage free for both options that you used above. Suppose that the price of 115 strike-Put option in fact is the arbitrage-free market put price. Using a single-period binomial model and assuming the implied volatility of the stock to be at least 2%. Determine the a. Assume S= 115. (20 marks) II. (10 marks)

Step by Step Solution

★★★★★

3.60 Rating (146 Votes )

There are 3 Steps involved in it

Step: 1

Answer Given data A stock is cussently piced at so 85 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started