Answered step by step

Verified Expert Solution

Question

1 Approved Answer

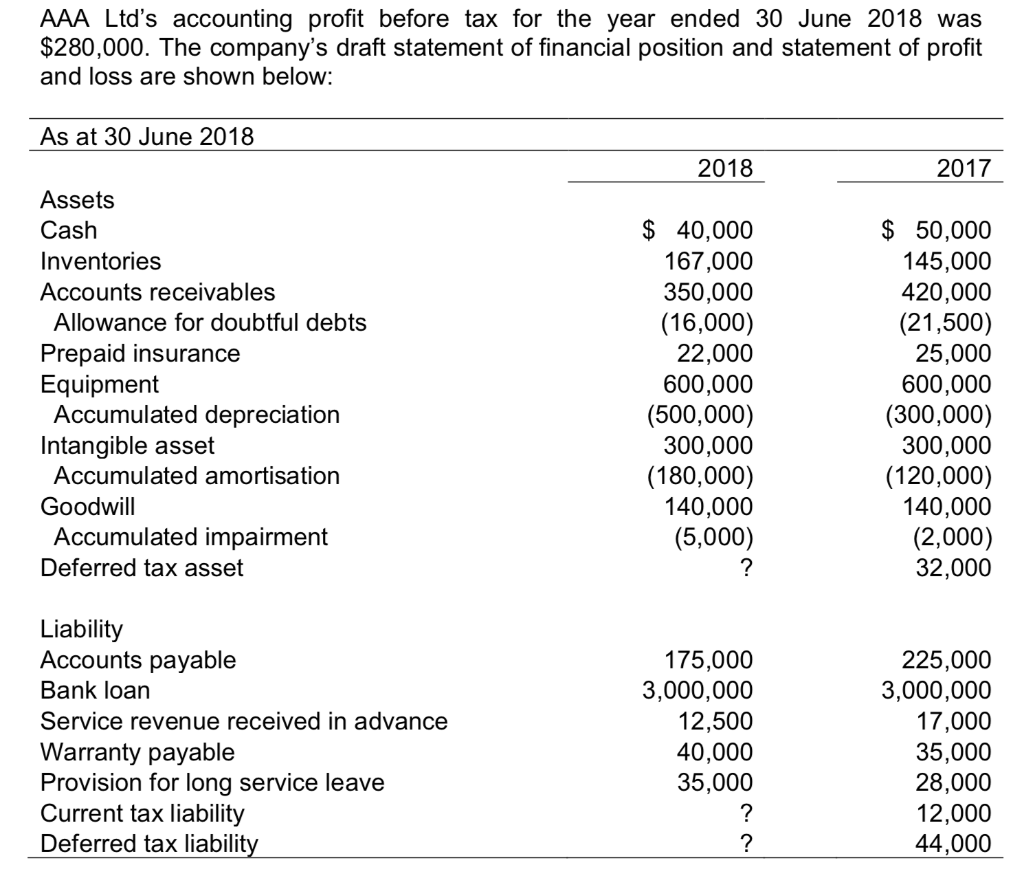

AAA Ltd's accounting profit before tax for the year ended 30 June 2018 was $280,000. The company's draft statement of financial position and statement

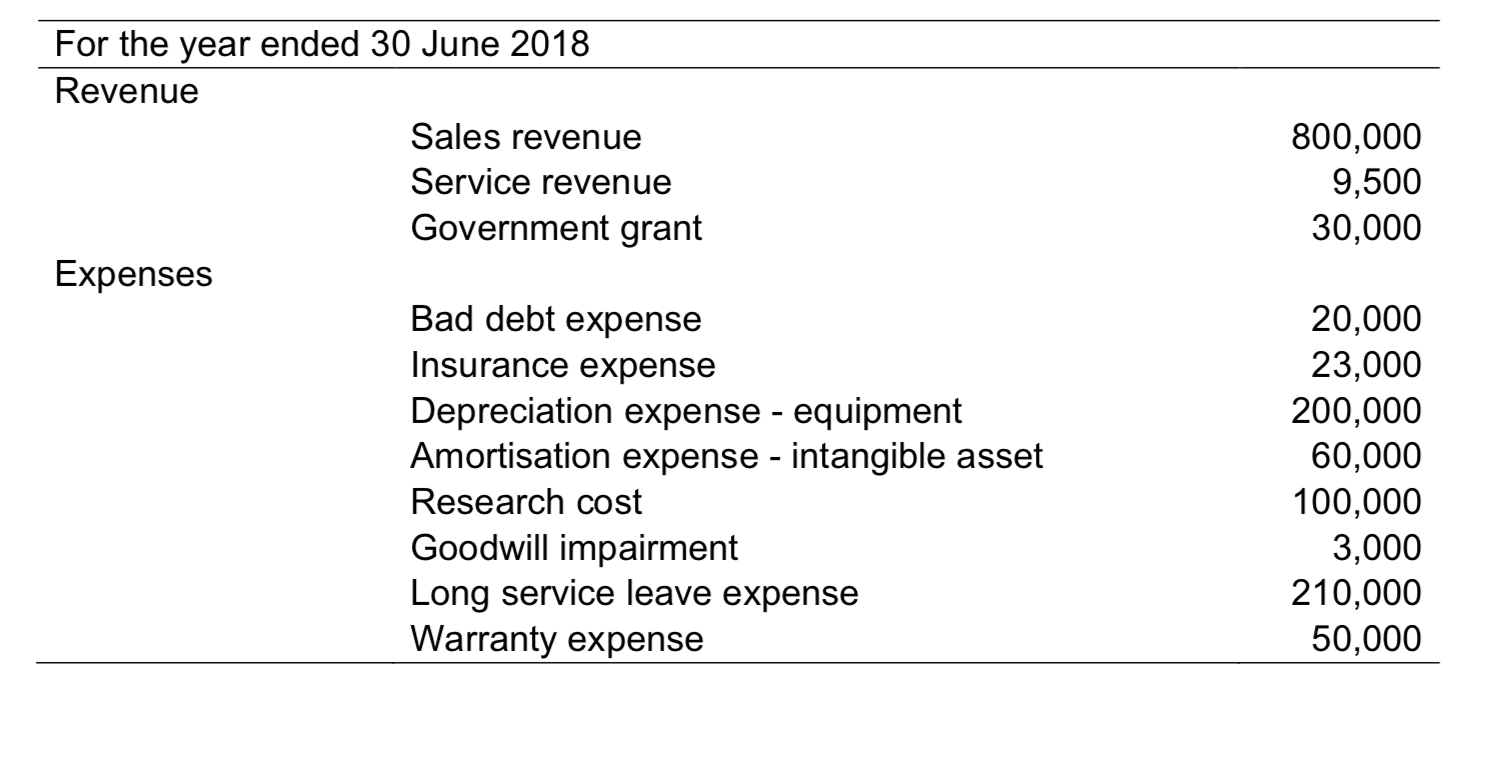

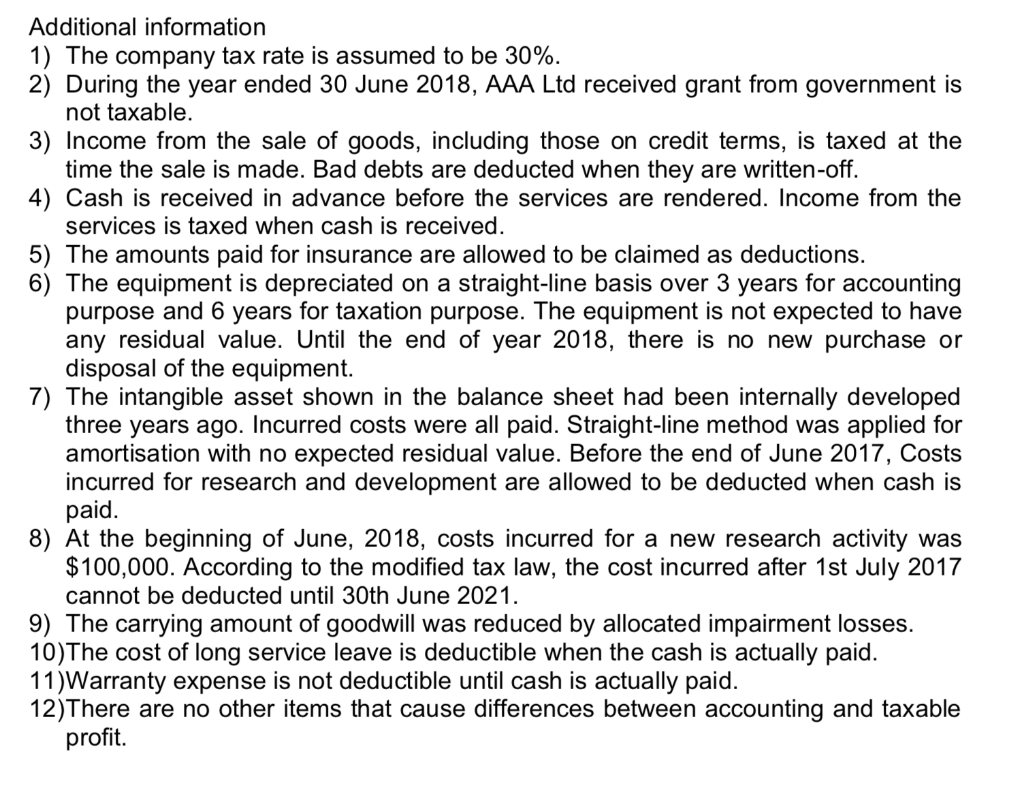

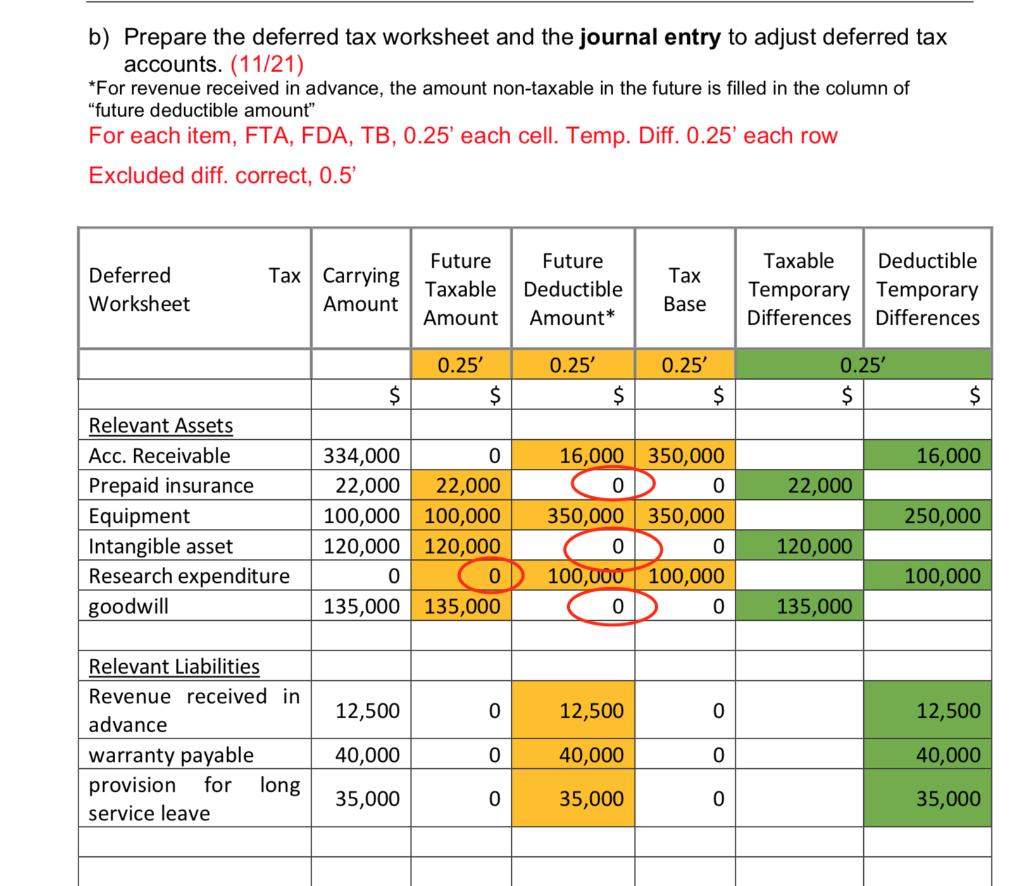

AAA Ltd's accounting profit before tax for the year ended 30 June 2018 was $280,000. The company's draft statement of financial position and statement of profit and loss are shown below: As at 30 June 2018 Assets Cash Inventories Accounts receivables Allowance for doubtful debts Prepaid insurance Equipment Accumulated depreciation Intangible asset Accumulated amortisation Goodwill Accumulated impairment Deferred tax asset Liability Accounts payable Bank loan Service revenue received in advance Warranty payable Provision for long service leave Current tax liability Deferred tax liability 2018 $ 40,000 167,000 350,000 (16,000) 22,000 600,000 (500,000) 300,000 (180,000) 140,000 (5,000) ? 175,000 3,000,000 12,500 40,000 35,000 ? ? 2017 $ 50,000 145,000 420,000 (21,500) 25,000 600,000 (300,000) 300,000 (120,000) 140,000 (2,000) 32,000 225,000 3,000,000 17,000 35,000 28,000 12,000 44,000 For the year ended 30 June 2018 Revenue Expenses Sales revenue Service revenue Government grant Bad debt expense Insurance expense Depreciation expense - equipment Amortisation expense - intangible asset Research cost Goodwill impairment Long service leave expense Warranty expense 800,000 9,500 30,000 20,000 23,000 200,000 60,000 100,000 3,000 210,000 50,000 Additional information 1) The company tax rate is assumed to be 30%. 2) During the year ended 30 June 2018, AAA Ltd received grant from government is not taxable. 3) Income from the sale of goods, including those on credit terms, is taxed at the time the sale is made. Bad debts are deducted when they are written-off. 4) Cash is received in advance before the services are rendered. Income from the services is taxed when cash is received. 5) The amounts paid for insurance are allowed to be claimed as deductions. 6) The equipment is depreciated on a straight-line basis over 3 years for accounting purpose and 6 years for taxation purpose. The equipment is not expected to have any residual value. Until the end of year 2018, there is no new purchase or disposal of the equipment. 7) The intangible asset shown in the balance sheet had been internally developed three years ago. Incurred costs were all paid. Straight-line method was applied for amortisation with no expected residual value. Before the end of June 2017, Costs incurred for research and development are allowed to be deducted when cash is paid. 8) At the beginning of June, 2018, costs incurred for a new research activity was $100,000. According to the modified tax law, the cost incurred after 1st July 2017 cannot be deducted until 30th June 2021. 9) The carrying amount of goodwill was reduced by allocated impairment losses. 10) The cost of long service leave is deductible when the cash is actually paid. 11)Warranty expense is not deductible until cash is actually paid. 12)There are no other items that cause differences between accounting and taxable profit. b) Prepare the deferred tax worksheet and the journal entry to adjust deferred tax accounts. (11/21) *For revenue received in advance, the amount non-taxable in the future is filled in the column of "future deductible amount" For each item, FTA, FDA, TB, 0.25' each cell. Temp. Diff. 0.25' each row Excluded diff. correct, 0.5' Deferred Worksheet Tax Carrying Amount Relevant Assets Acc. Receivable Prepaid insurance Equipment Intangible asset Research expenditure goodwill Relevant Liabilities Revenue received in advance warranty payable provision for long service leave $ Future Taxable Amount 12,500 40,000 35,000 0.25' $ 334,000 0 22,000 22,000 100,000 100,000 120,000 120,000 0 0 135,000 135,000 0 0 0 Future Deductible Amount* 0.25' $ Tax Base 12,500 40,000 35,000 0.25' $ 16,000 | 350,000 0 0 350,000 350,000 0 0 100,000 100,000 0 0 0 O 0 Taxable Deductible Temporary Temporary Differences Differences 0.25' $ 22,000 120,000 135,000 $ 16,000 250,000 100,000 12,500 40,000 35,000

Step by Step Solution

★★★★★

3.60 Rating (171 Votes )

There are 3 Steps involved in it

Step: 1

To prepare the deferred tax worksheet and the journal entry to adjust deferred tax accounts for AAA Ltd we need to analyze the temporary differences between the carrying amounts and tax bases of the a...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started