ABC corporation has the following balances on 1 January 2019: Equipment $ 1000 Accumulated Depreciation, Equipment $ 400 During 2019, the following transactions took

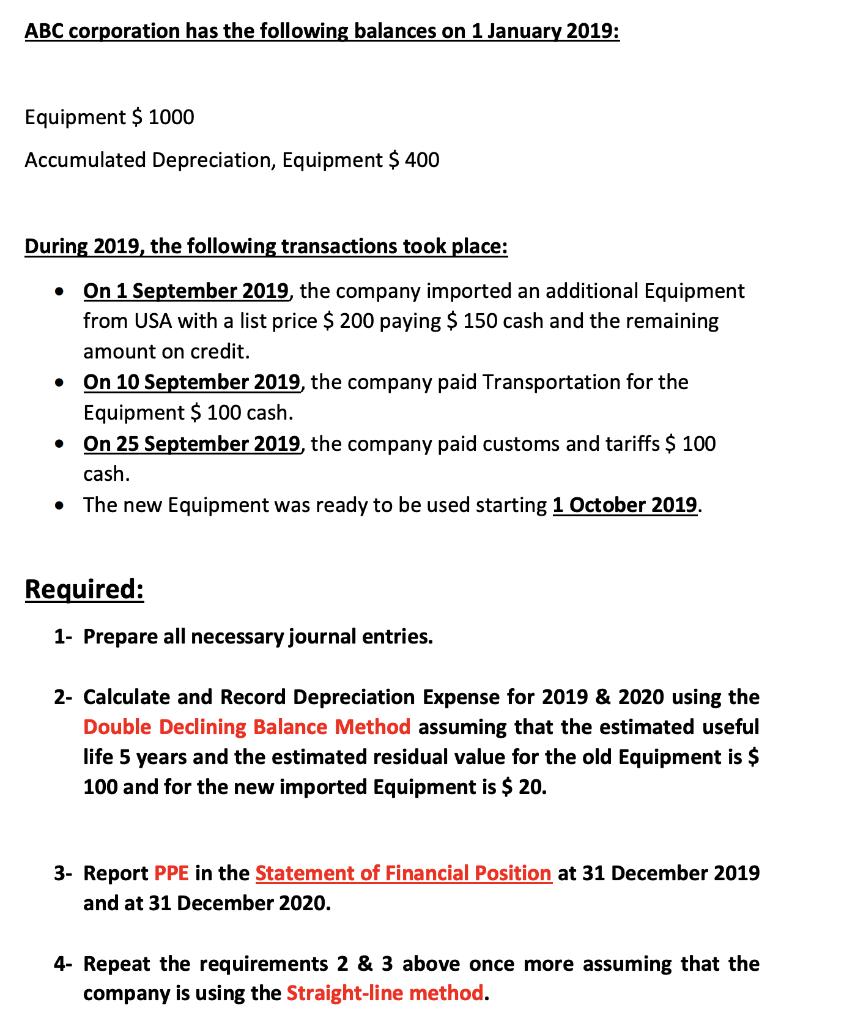

ABC corporation has the following balances on 1 January 2019: Equipment $ 1000 Accumulated Depreciation, Equipment $ 400 During 2019, the following transactions took place: On 1 September 2019, the company imported an additional Equipment from USA with a list price $ 200 paying $ 150 cash and the remaining amount on credit. On 10 September 2019, the company paid Transportation for the Equipment $ 100 cash. On 25 September 2019, the company paid customs and tariffs $ 100 cash. The new Equipment was ready to be used starting 1 October 2019. Required: 1- Prepare all necessary journal entries. 2- Calculate and Record Depreciation Expense for 2019 & 2020 using the Double Declining Balance Method assuming that the estimated useful life 5 years and the estimated residual value for the old Equipment is $ 100 and for the new imported Equipment is $ 20o. 3- Report PPE in the Statement of Financial Position at 31 December 2019 and at 31 December 2020. 4- Repeat the requirements 2 & 3 above once more assuming that the company is using the Straight-line method.

Step by Step Solution

3.41 Rating (145 Votes )

There are 3 Steps involved in it

Step: 1

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started