Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Accounting for personal income taxes Saralisa City, which operates on a calendar year basis, obtains 40 percent of its revenues from personal income taxes.

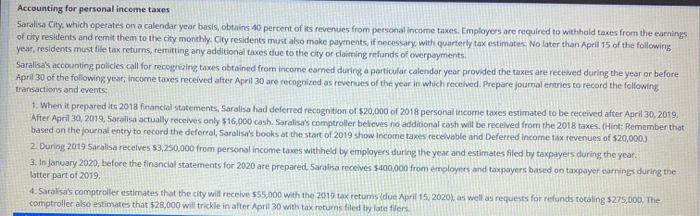

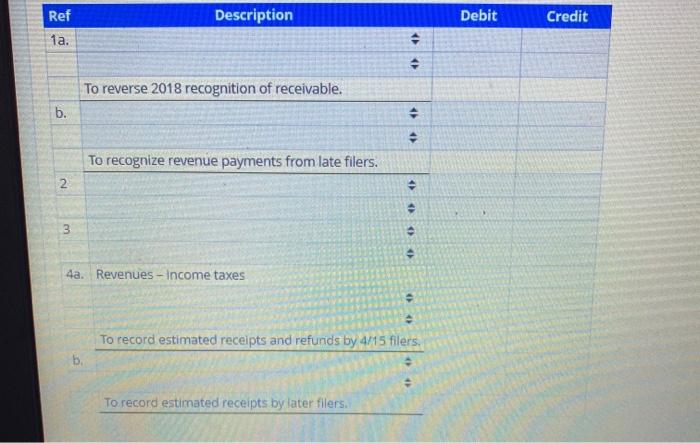

Accounting for personal income taxes Saralisa City, which operates on a calendar year basis, obtains 40 percent of its revenues from personal income taxes. Employers are required to withhold taxes from the earnings of city residents and remit them to the city monthly. City residents must also moke payments, if necessary, with quarterly tax estimates No later than April 15 of the following year, residents must file tax returns, remitting any additional taxes due to the city or claitming refunds of overpayments. Saralisa's accounting policies call for recognzing taxes obtained from income earned during a particular calendar year provided the taxes are receved during the year or before April 30 of the following year; income taxes received after April 30 are recognized as revenues of the year in which received. Prepare journal entries to record the following transactions and events 1. When it prepared its 2018 financial statements, Saralisa had deferred recognition of $20.000 of 2018 personal income taxes estimated to be received after April 30, 2019. After April 30, 2019, Saralisa actualy receives only $16,000 cash. Saralisa's comptroller beleves no additional cash will be recelved from the 2018 taxes. (Hint: Remember that based on the journal entry to record the deferral, Saralisa's books at the start of 2019 show Income taxes receivable and Deferred income tax revenues of $20,000.) 2. During 2019 Saralisa recelves $3,250.000 from personal income taxes withheld by employers during the year and estimates filed by taxpayers during the year. 3. In January 2020, before the financial statements for 2020 are prepared. Saralisa receives $400,000 from employers and taxpayers based on taxpayer earnings during the latter part of 2019, 4. Saralisa's comptroller estimates that the city will receive $55,000 with the 2019 tax retums (due April 15, 2020), as well as requests for refunds totaling $275,000, The comptroller also estimates that $28,000 will trickle in after April 30 with tax returns filed by late filers Ref Description Debit Credit 1a. To reverse 2018 recognition of receivable. b. To recognize revenue payments from late filers. 2. 4a. Revenues - Income taxes To record estimated receipts and refunds by 4/15 filers. b. To record estimated receipts by later filers. 3.

Step by Step Solution

★★★★★

3.37 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

1 Cash 3250000 Revenues personal income taxes 3250000 To record c...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started