Question

AGN Corporation uses the systems development life cycle to develop/select new forms of information technology for its operations; its technology acquisition process is considered managed

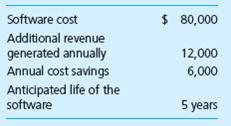

AGN Corporation uses the systems development life cycle to develop/select new forms of information technology for its operations; its technology acquisition process is considered “managed” based on the capability maturity model. AGN is considering purchasing new software to track its sales and marketing function. Relevant data about the software appear below:

AGN uses a discount rate of 3% in decisions of this type. Additional revenue and cost savings are “net of tax.”

a. Use Excel’s NPV and IRR functions to calculate the net present value and internal rate of return on the software. (Check figure: NPV is between $2,000 and $2,500.)

b. Should AGN buy the software? Why, or why not?

Software cost $ 80,000 Additional revenue generated annually Annual cost savings Anticipated life of the software 12,000 6,000 5 years

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started