Answered step by step

Verified Expert Solution

Question

1 Approved Answer

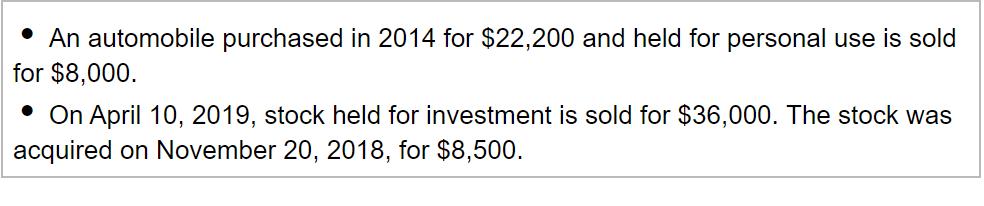

An automobile purchased in 2014 for $22,200 and held for personal use is sold for $8,000. On April 10, 2019, stock held for investment

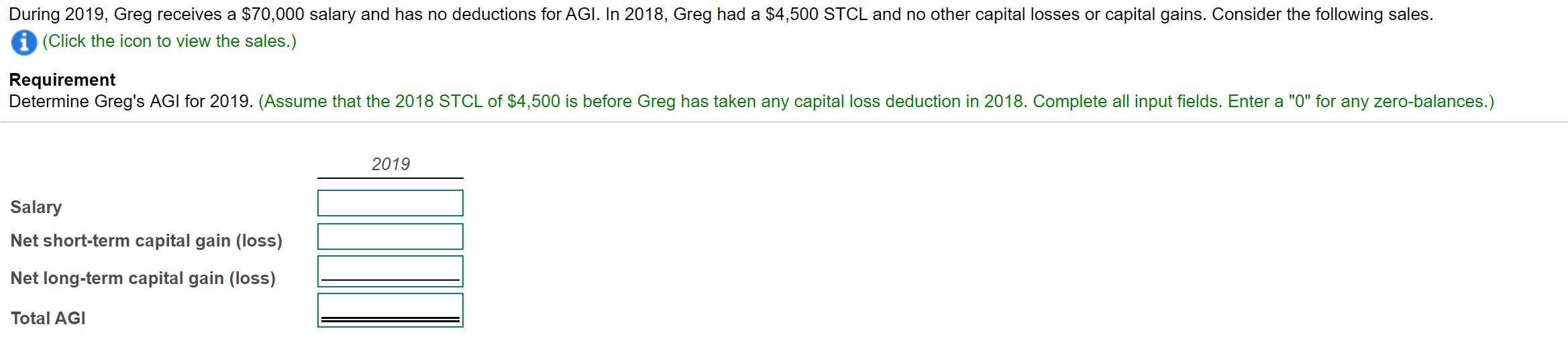

An automobile purchased in 2014 for $22,200 and held for personal use is sold for $8,000. On April 10, 2019, stock held for investment is sold for $36,000. The stock was acquired on November 20, 2018, for $8,500. During 2019, Greg receives a $70,000 salary and has no deductions for AGI. In 2018, Greg had a $4,500 STCL and no other capital losses or capital gains. Consider the following sales. i (Click the icon to view the sales.) Requirement Determine Greg's AGI for 2019. (Assume that the 2018 STCL of $4,500 is before Greg has taken any capital loss deduction in 2018. Complete all input fields. Enter a "0" for any zero-balances.) 2019 Salary Net short-term capital gain (loss) Net long-term capital gain (loss) Total AGI

Step by Step Solution

★★★★★

3.52 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Answer Note Maxlmum capltal loss Allowed In the Year Is 3000 The...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started