Question

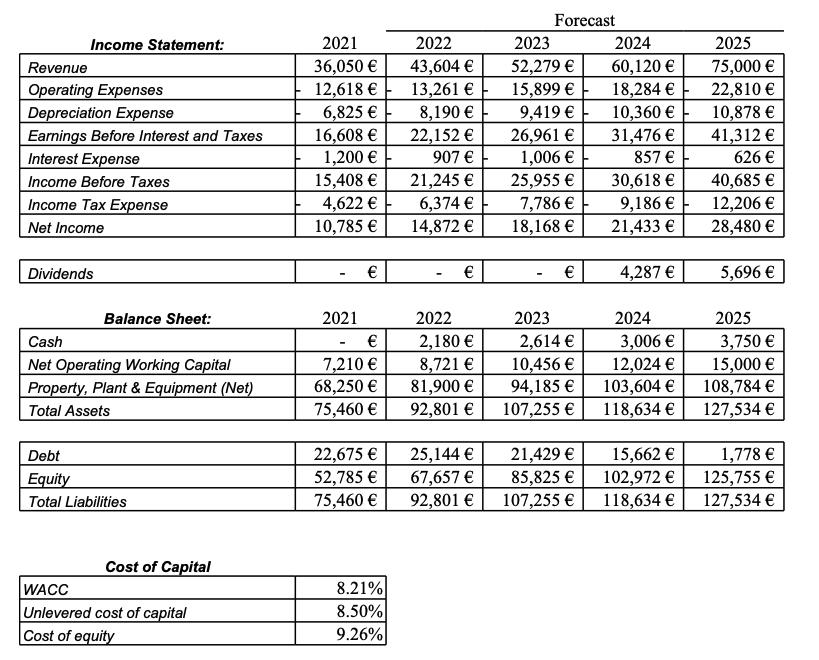

1. Compute the enterprise value and the value of the equity of the company using the APV method. To do so, use your projections of

1. Compute the enterprise value and the value of the equity of the company using the APV method. To do so, use your projections of free cash flows in the first three years and the one of the fourth year to estimate the terminal value. You can assume cash flows will grow at a 1% constant rate from 2025 onwards. The cost of debt is 4%. The tax rate is 30%. Assume the interest tax shields can be discounted at the unlevered cost of capital.

2. Compute the enterprise value and the value of the equity of the comapany using the WACC method, based on the assumption of a constant target Debt/Assets of 20%

Income Statement: Revenue Operating Expenses Depreciation Expense Earnings Before Interest and Taxes Interest Expense Income Before Taxes Income Tax Expense Net Income Dividends Balance Sheet: Cash Net Operating Working Capital Property, Plant & Equipment (Net) Total Assets Debt Equity Total Liabilities Cost of Capital WACC Unlevered cost of capital Cost of equity 2021 36,050 12,618 6,825 16,608 1,200 15,408 4,622 10,785 2021 7,210 68,250 75,460 - 22,675 52,785 75,460 8.21% 8.50% 9.26% 2022 43,604 13,261 8,190 22,152 907 21,245 6,374 14,872 - 2022 2,180 8,721 81,900 92,801 25,144 67,657 92,801 Forecast 2023 52,279 15,899 9,419 26,961 1,006 25,955 7,786 18,168 2023 2,614 10,456 94,185 107,255 21,429 85,825 107,255 2024 60,120 18,284 10,360 31,476 857 30,618 9,186 21,433 4,287 2024 3,006 12,024 103,604 118,634 15,662 102,972 118,634 2025 75,000 22,810 10,878 41,312 626 40,685 12,206 28,480 5,696 2025 3,750 15,000 108,784 127,534 1,778 125,755 127,534

Step by Step Solution

3.41 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

Answer Question 1 The enterprise value and the value of the equity of the company can be computed using the APV method To compute the value we need to ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started