Question

(b) What is the actual return on the pension and other postretirement benefits plan investments in 2018?Use a negative sign to indicate the actual return

(b) What is the actual return on the pension and other postretirement benefits plan investments in 2018?Use a negative sign to indicate the actual return was a loss, if applicable.

(b) What is the actual return on the pension and other postretirement benefits plan investments in 2018?Use a negative sign to indicate the actual return was a loss, if applicable.

Answer: ______ million

(e) How much cash did Norfolk Southern contribute to its pension and other postretirement benefits plans in 2018?

Pension = $_____ million

Postretirement benefits = $_____ million

(f) How much cash did retirees receive in 2018 from the pension plan and other postretirement benefits plans?

Pension = $_____ million

Postretirement benefits = $_____ million

How much cash did Norfolk Southern pay these retirees in 2018?

$______ million

(g) Show the computation of the funded status for the pension and other postretirement benefits plans in 2018.

Do not use negative signs with your answers.

Pension : $2,371 million - $_____ million = $_____million Answer: underfunded/overfunded

Postretirement benefits: $466 million - $_____ million = $_____ million. Answer: underfunded/overfunded

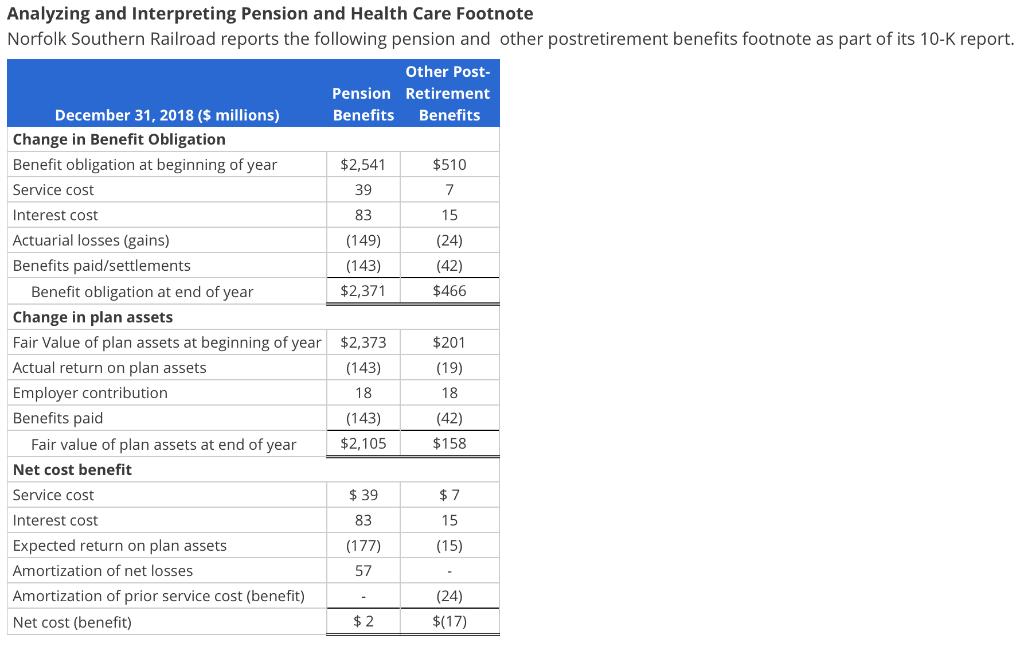

Analyzing and Interpreting Pension and Health Care Footnote Norfolk Southern Railroad reports the following pension and other postretirement benefits footnote as part of its 10-K report. Other Post- Pension Retirement December 31, 2018 ($ millions) Benefits Benefits Change in Benefit Obligation Benefit obligation at beginning of year $2,541 $510 Service cost 39 7 Interest cost 83 15 Actuarial losses (gains) (149) (24) Benefits paid/settlements (143) (42) Benefit obligation at end of year $2,371 $466 Change in plan assets Fair Value of plan assets at beginning of year $2,373 $201 Actual return on plan assets (143) (19) Employer contribution 18 18 Benefits paid (143) (42) Fair value of plan assets at end of year $2,105 $158 Net cost benefit Service cost $ 39 $ 7 Interest cost 83 15 Expected return on plan assets (177) (15) Amortization of net losses 57 Amortization of prior service cost (benefit) (24) Net cost (benefit) $ 2 $(17)

Step by Step Solution

3.36 Rating (165 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started