Answered step by step

Verified Expert Solution

Question

1 Approved Answer

As part of the overall discussion concerning the da Vinci surgical system, management is contemplating the new technological advances in the system as well

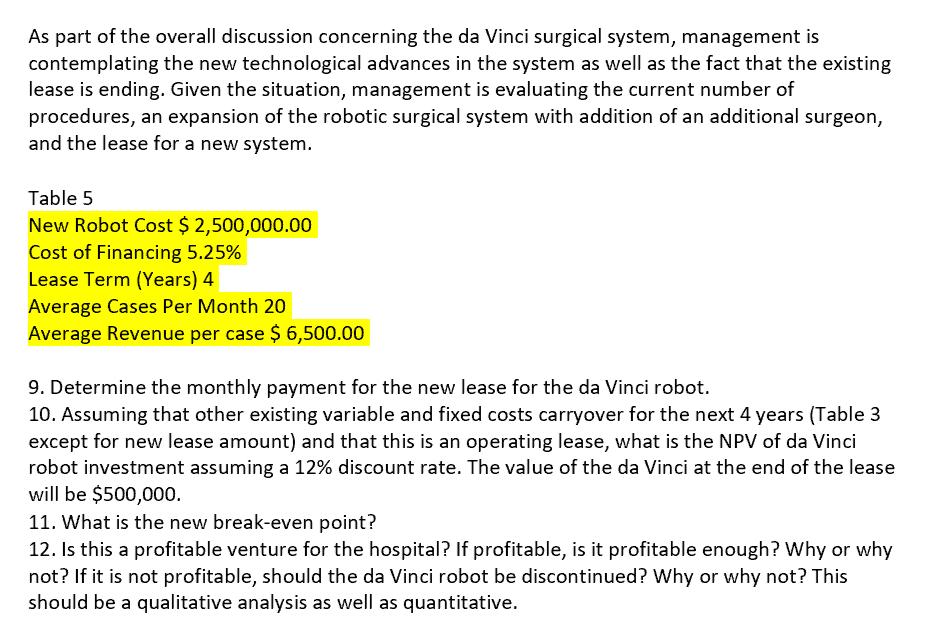

As part of the overall discussion concerning the da Vinci surgical system, management is contemplating the new technological advances in the system as well as the fact that the existing lease is ending. Given the situation, management is evaluating the current number of procedures, an expansion of the robotic surgical system with addition of an additional surgeon, and the lease for a new system. Table 5 New Robot Cost $ 2,500,000.00 Cost of Financing 5.25% Lease Term (Years) 4 Average Cases Per Month 20 Average Revenue per case $ 6,500.00 9. Determine the monthly payment for the new lease for the da Vinci robot. 10. Assuming that other existing variable and fixed costs carryover for the next 4 years (Table 3 except for new lease amount) and that this is an operating lease, what is the NPV of da Vinci robot investment assuming a 12% discount rate. The value of the da Vinci at the end of the lease will be $500,000. 11. What is the new break-even point? 12. Is this a profitable venture for the hospital? If profitable, is it profitable enough? Why or why not? If it is not profitable, should the da Vinci robot be discontinued? Why or why not? This should be a qualitative analysis as well as quantitative.

Step by Step Solution

★★★★★

3.51 Rating (171 Votes )

There are 3 Steps involved in it

Step: 1

9 The monthly payment for the new lease for the da Vinci robot would be 62500 10 The NPV of da Vinci ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started