Question

ASC Enterprise, is a manufacturer of dairy products that was formed three years ago by three brothers who, as directors, retain sole ownership of its

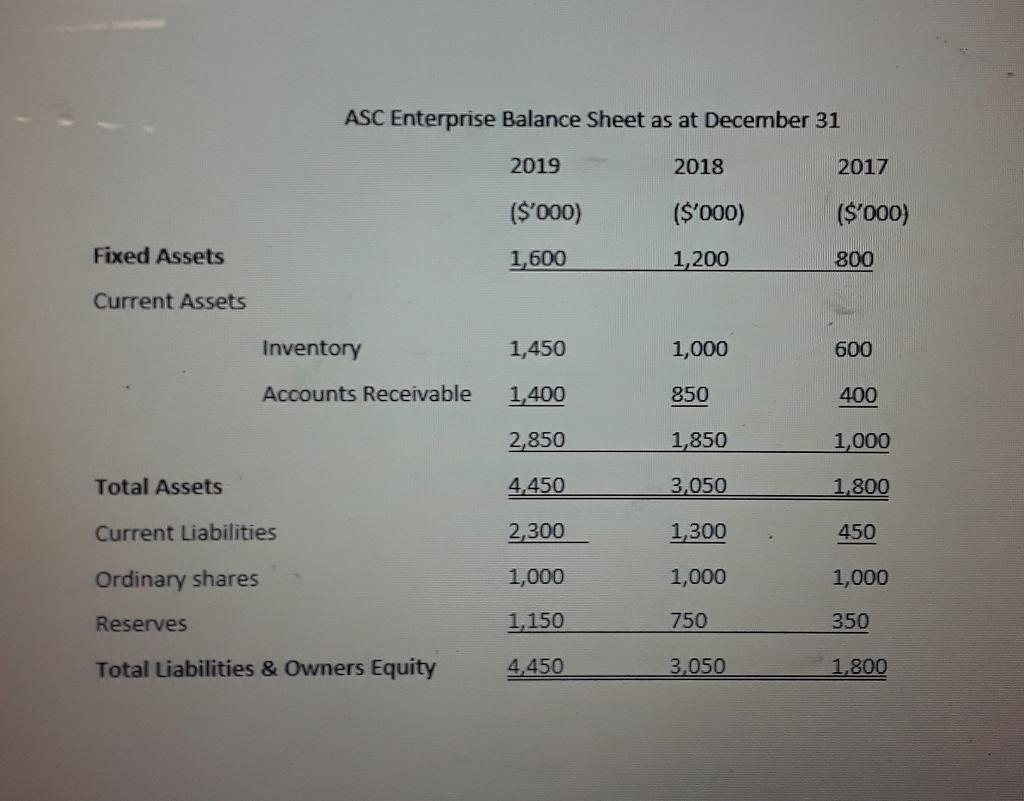

ASC Enterprise, is a manufacturer of dairy products that was formed three years ago by three brothers who, as directors, retain sole ownership of its ordinary share capital. One-third of the initial share capital was provided by each brother. However, the company has managed to return a profit in each year of operation as shown in the financial statements. ASC Enterprise has an overdraft limit of $3.2 million and pays interest on its overdraft at a rate of 6 percent (6%) per year. The company currently has no long-term debt. Current liabilities consist of trade creditors and overdraft finance in each of the three years as follows:

| Year | 2017 | 2018 | 2019 |

| Overdraft ($'000) | 50 | 567 | 1,167 |

| Trade Creditors ($'000) | 400 | 733 | 1,133 |

| Interest | ? | ? | ? |

The Industry averages for firms similar to ASC Enterprise are

Net Profit Margin | 9% | Creditors days | 70 days | |

Interest Cover | 15 Times | Current ratio | 2.1 times | |

| Stock days | 85 days | Quick ratio | 0.8 times | |

| Debtor days | 75 days | DEBT/Equity ratio | 40% (using Book value) |

Required:

As the newly-appointed Chief Financial Officer of ASC Enterprise. write a report to discuss whether the company is likely to be successful if it approaches its bank FCIB for a loan to undertake a project at a cost of $2.5 million. Your discussion should include an analysis of the current financial position and recent financial performance of the company. Comment on whether the bank should provide ASC Enterprise with the finance and on what basis. Annual Interest should be clearly calculated as part of the leverage analysis.

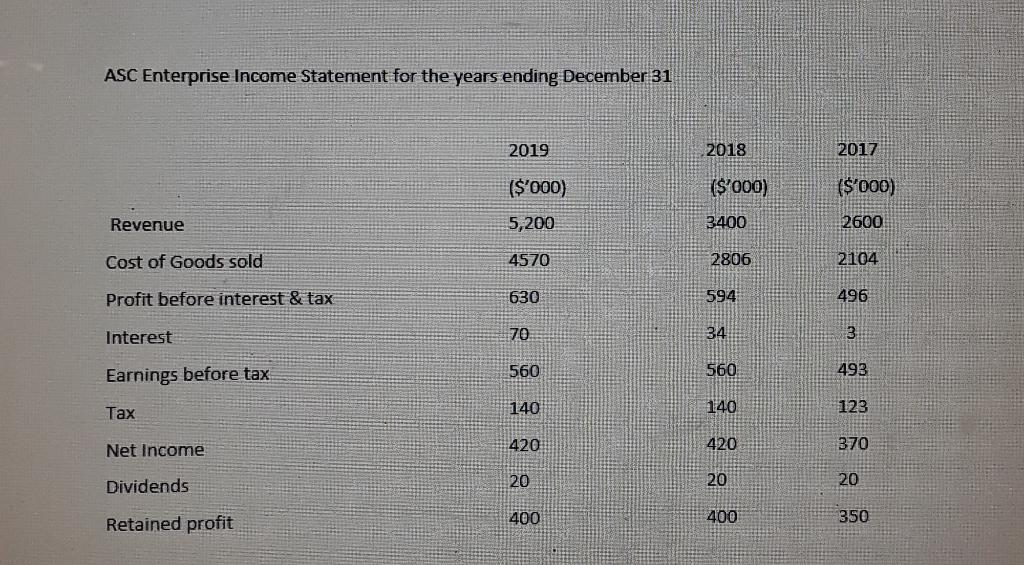

ASC Enterprise Income Statement for the years ending December 31 2019 2018 2017 ($'000) (S'000) (S'000) Revenue 5,200 3400 2600 Cost of Goods sold 4570 2806 2104 Profit before interest & tax 630 594 496 Interest 70 34 3 Earnings before tax 560 560 493 140 140 123 Tax Net Income 420 420 370 20 20 20 Dividends Retained profit 400 400 350

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Key ratio of ASC Enterprise based on current financial performance and position With current financi...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started