Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Suppose an investor want to purchase 100 ABC stocks. Stock ABC is currently traded at $150 per share. The investor has only $10,000 and

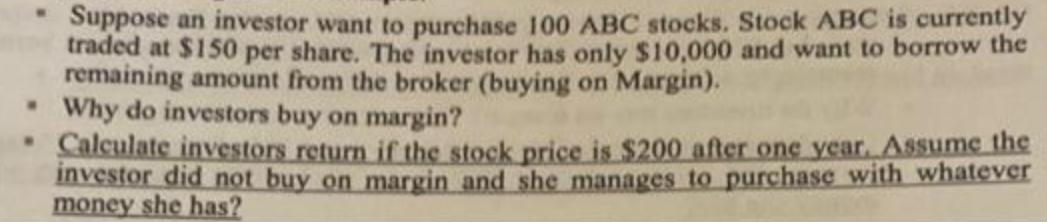

Suppose an investor want to purchase 100 ABC stocks. Stock ABC is currently traded at $150 per share. The investor has only $10,000 and want to borrow the remaining amount from the broker (buying on Margin). . Why do investors buy on margin? Calculate investors return if the stock price is $200 after one year. Assume the investor did not buy on margin and she manages to purchase with whatever money she has? Suppose an investor want to purchase 100 ABC stocks. Stock ABC is currently traded at $150 per share. The investor has only $10,000 and want to borrow the remaining amount from the broker (buying on Margin). . Why do investors buy on margin? Calculate investors return if the stock price is $200 after one year. Assume the investor did not buy on margin and she manages to purchase with whatever money she has?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

We can solve the above question as illustrated below STEP 1 NB No of shares purc...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started