Assume that the Service company provided services to Smith Company on October 1, 2021, accepting a $500,000, three-year note in payment for the services,

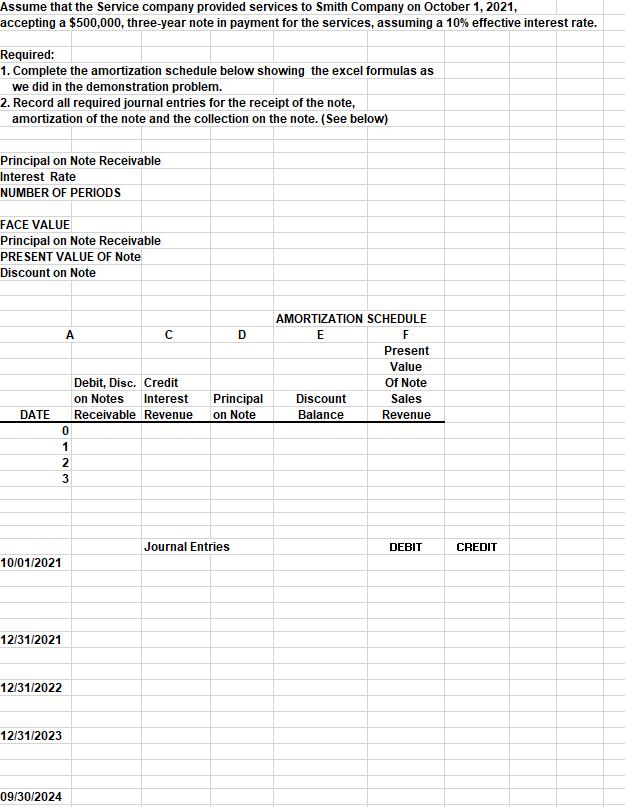

Assume that the Service company provided services to Smith Company on October 1, 2021, accepting a $500,000, three-year note in payment for the services, assuming a 10% effective interest rate. Required: 1. Complete the amortization schedule below showing the excel formulas as we did in the demonstration problem. 2. Record all required journal entries for the receipt of the note, amortization of the note and the collection on the note. (See below) Principal on Note Receivable Interest Rate NUMBER OF PERIODS FACE VALUE Principal on Note Receivable PRESENT VALUE OF Note Discount on Note AMORTIZATION SCHEDULE A D E F Present Value Of Note Debit, Disc. Credit on Notes Interest Principal on Note Discount Sales DATE Receivable Revenue Balance Revenue Journal Entries DEBIT CREDIT 10/01/2021 12/31/2021 12131/2022 12/31/2023 09/30/2024 123

Step by Step Solution

3.53 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

some numbers are missing in question As per questi...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started