Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Decide if each transaction requires the journal entry or not. If needed, please show the journal entry in detail. August 2020 transactions: Aug 3 3

Decide if each transaction requires the journal entry or not. If needed, please show the journal entry in detail.

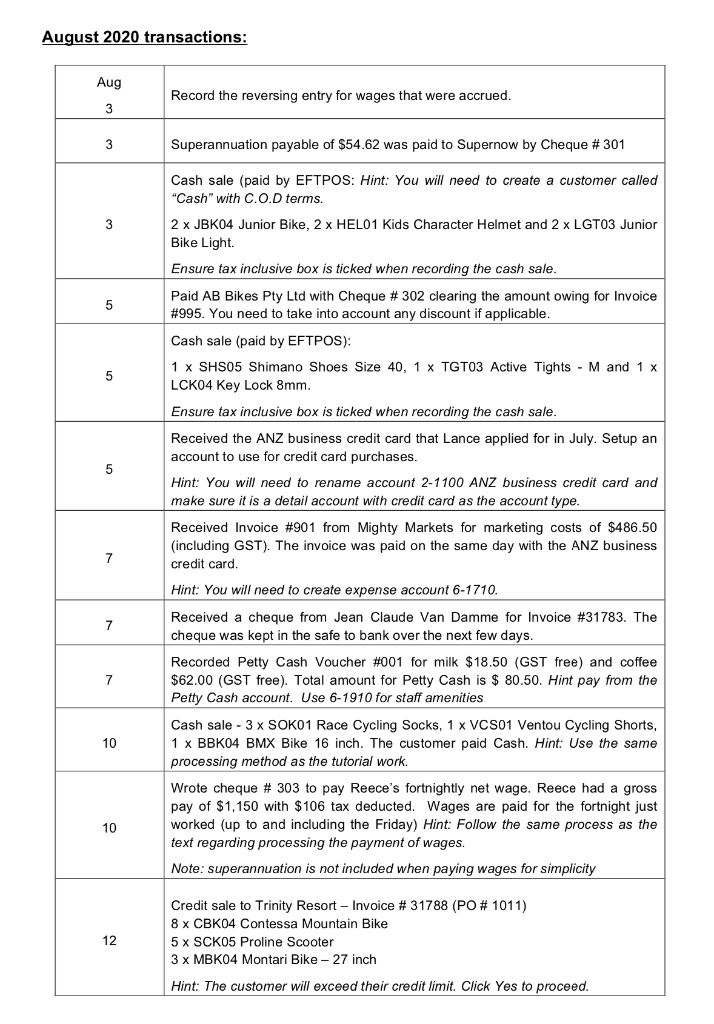

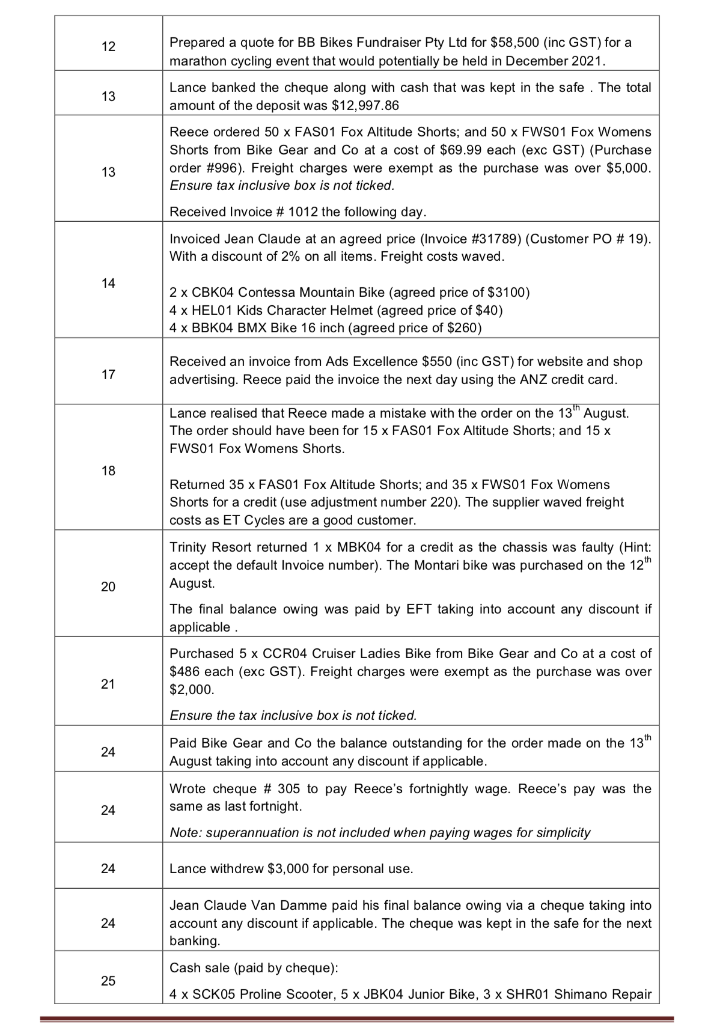

August 2020 transactions: Aug 3 3 3 5 5 5 7 7 7 10 10 12 Record the reversing entry for wages that were accrued. Superannuation payable of $54.62 was paid to Supernow by Cheque # 301 Cash sale (paid by EFTPOS: Hint: You will need to create a customer called "Cash" with C.O.D terms. 2 x JBK04 Junior Bike, 2 x HEL01 Kids Character Helmet and 2 x LGT03 Junior Bike Light. Ensure tax inclusive box is ticked when recording the cash sale. Paid AB Bikes Pty Ltd with Cheque # 302 clearing the amount owing for Invoice # 995. You need to take into account any discount if applicable. Cash sale (paid by EFTPOS): 1 x SHS05 Shimano Shoes Size 40, 1 x TGT03 Active Tights - M and 1 x LCK04 Key Lock 8mm. Ensure tax inclusive box is ticked when recording the cash sale. Received the ANZ business credit card that Lance applied for in July. Setup an account to use for credit card purchases. Hint: You will need to rename account 2-1100 ANZ business credit card and make sure it is a detail account with credit card as the account type. Received Invoice # 901 from Mighty Markets for marketing costs of $486.50 (including GST). The invoice was paid on the same day with the ANZ business credit card. Hint: You will need to create expense account 6-1710. Received a cheque from Jean Claude Van Damme for Invoice # 31783. The cheque was kept in the safe to bank over the next few days. Recorded Petty Cash Voucher # 001 for milk $18.50 (GST free) and coffee $62.00 (GST free). Total amount for Petty Cash is $ 80.50. Hint pay from the Petty Cash account. Use 6-1910 for staff amenities Cash sale - 3 x SOK01 Race Cycling Socks, 1 x VCS01 Ventou Cycling Shorts, 1 x BBK04 BMX Bike 16 inch. The customer paid Cash. Hint: Use the same processing method as the tutorial work. Wrote cheque # 303 to pay Reece's fortnightly net wage. Reece had a gross pay of $1,150 with $106 tax deducted. Wages are paid for the fortnight just worked (up to and including the Friday) Hint: Follow the same process as the text regarding processing the payment of wages. Note: superannuation is not included when paying wages for simplicity Credit sale to Trinity Resort - Invoice # 31788 (PO # 1011) 8 x CBK04 Contessa Mountain Bike 5 x SCK05 Proline Scooter 3 x MBK04 Montari Bike - 27 inch Hint: The customer will exceed their credit limit. Click Yes to proceed. 12 13 13 14 17 18 20 21 24 24 24 24 25 Prepared a quote for BB Bikes Fundraiser Pty Ltd for $58,500 (inc GST) for a marathon cycling event that would potentially be held in December 2021. Lance banked the cheque along with cash that was kept in the safe. The total amount of the deposit was $12,997.86 Reece ordered 50 x FAS01 Fox Altitude Shorts; and 50 x FWS01 Fox Womens Shorts from Bike Gear and Co at a cost of $69.99 each (exc GST) (Purchase order # 996). Freight charges were exempt as the purchase was over $5,000. Ensure tax inclusive box is not ticked. Received Invoice # 1012 the following day. Invoiced Jean Claude at an agreed price (Invoice # 31789) (Customer PO # 19). With a discount of 2% on all items. Freight costs waved. 2 x CBK04 Contessa Mountain Bike (agreed price of $3100) 4 x HEL01 Kids Character Helmet (agreed price of $40) 4 x BBK04 BMX Bike 16 inch (agreed price of $260) Received an invoice from Ads Excellence $550 (inc GST) for website and shop advertising. Reece paid the invoice the next day using the ANZ credit card. Lance realised that Reece made a mistake with the order on the 13th August. The order should have been for 15 x FAS01 Fox Altitude Shorts; and 15 x FWS01 Fox Womens Shorts. Returned 35 x FAS01 Fox Altitude Shorts; and 35 x FWS01 Fox Womens Shorts for a credit (use adjustment number 220). The supplier waved freight costs as ET Cycles are a good customer. Trinity Resort returned 1 x MBK04 for a credit as the chassis was faulty (Hint: accept the default Invoice number). The Montari bike was purchased on the 12th August. The final balance owing was paid by EFT taking into account any discount if applicable Purchased 5 x CCR04 Cruiser Ladies Bike from Bike Gear and Co at a cost of $486 each (exc GST). Freight charges were exempt as the purchase was over $2,000. Ensure the tax inclusive box is not ticked. Paid Bike Gear and Co the balance outstanding for the order made on the 13th August taking into account any discount if applicable. Wrote cheque # 305 to pay Reece's fortnightly wage. Reece's pay was the same as last fortnight. Note: superannuation is not included when paying wages for simplicity Lance withdrew $3,000 for personal use. Jean Claude Van Damme paid his final balance owing via a cheque taking into account any discount if applicable. The cheque was kept in the safe for the next banking. Cash sale (paid by cheque): 4 x SCK05 Proline Scooter, 5 x JBK04 Junior Bike, 3 x SHR01 Shimano Repair

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Trial Balance Accounts Debit Credit Bank Overdraft 1381...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started