Prepare the Journal Entries in the General Journal Journai Entries Post Journal Entries to the General Ledger General Ledger Prepare a Trial Balance Trial

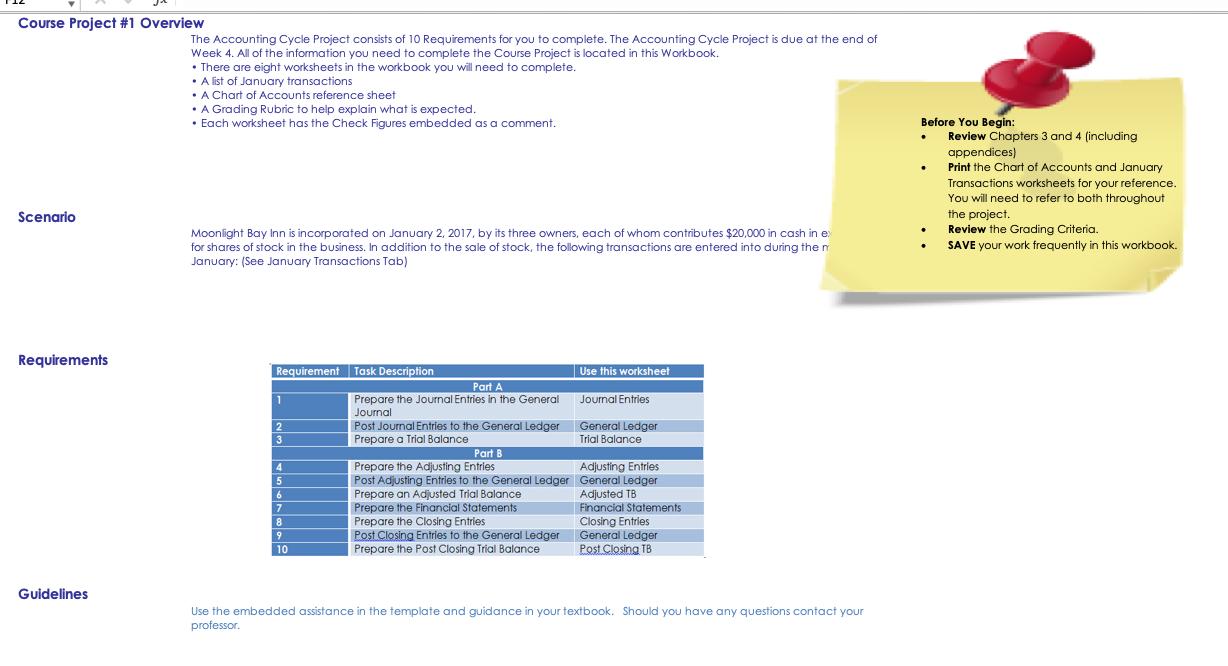

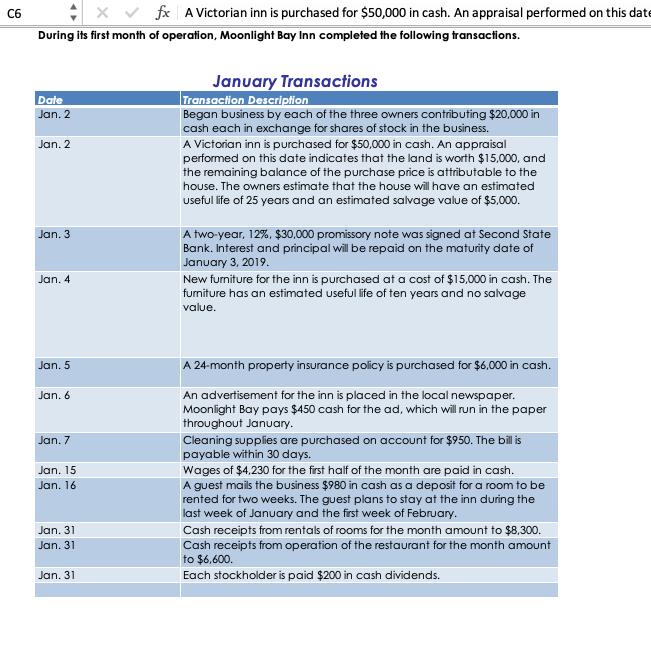

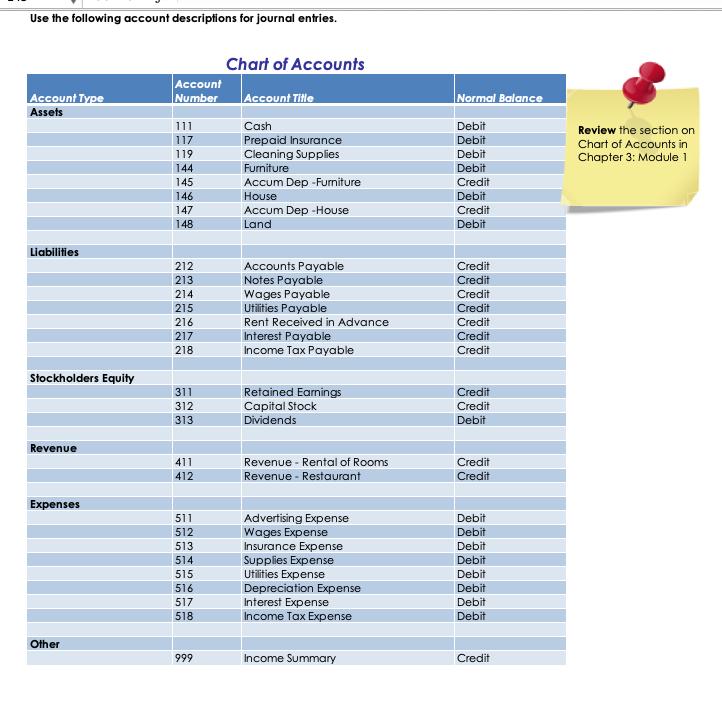

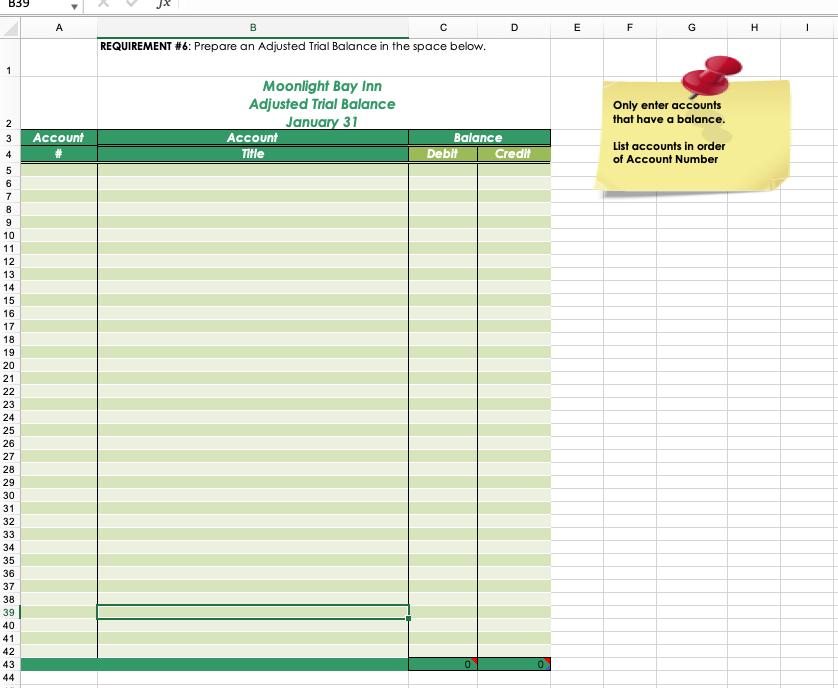

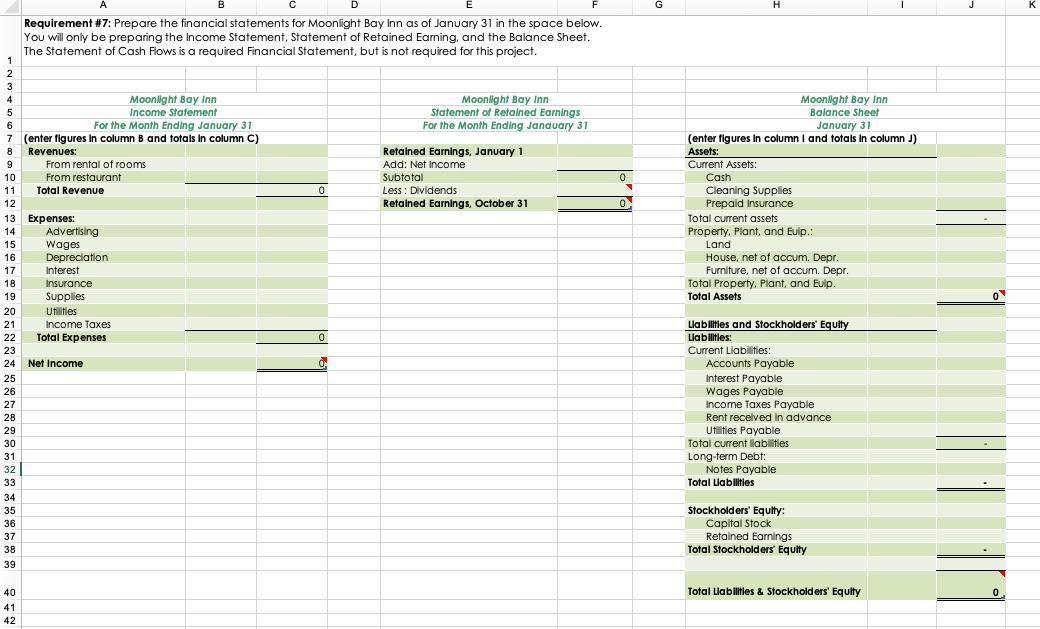

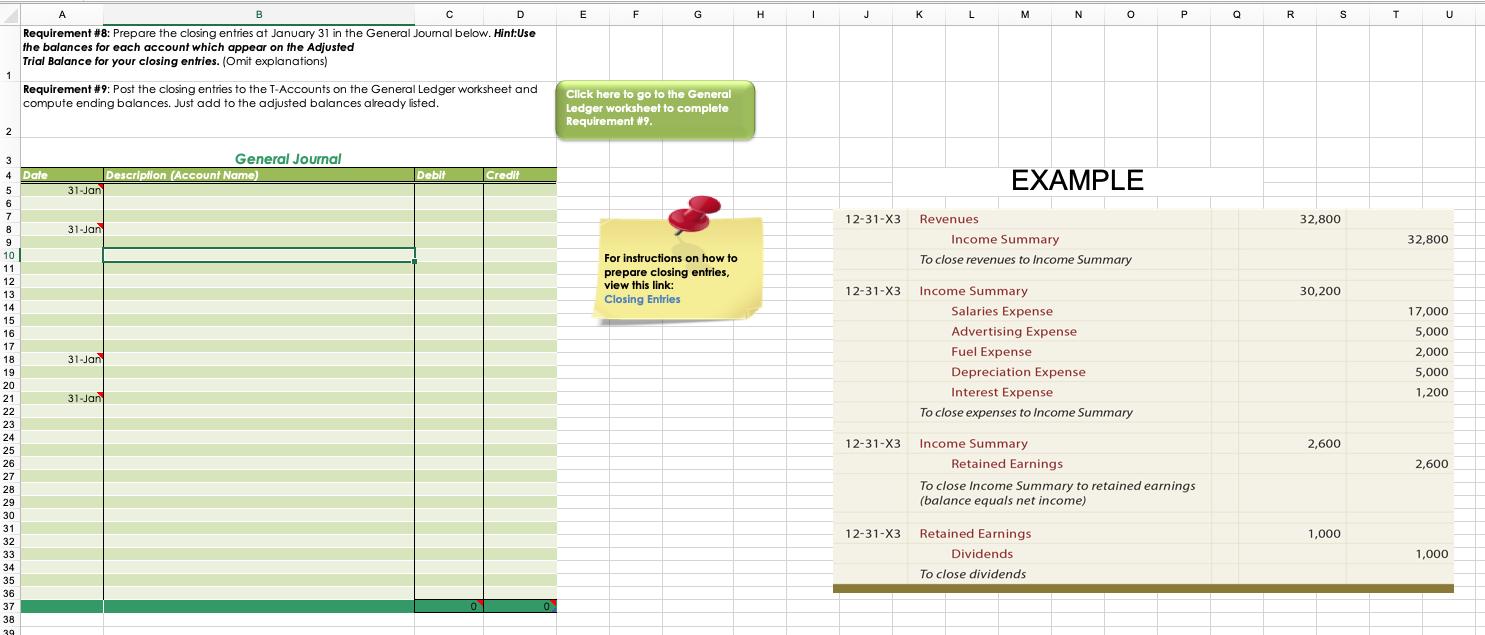

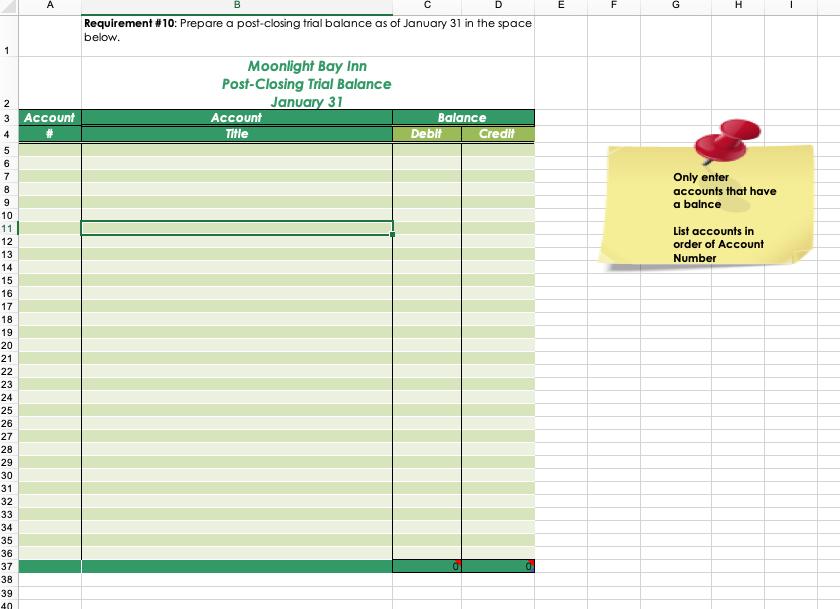

Prepare the Journal Entries in the General Journal Journai Entries Post Journal Entries to the General Ledger General Ledger Prepare a Trial Balance Trial Balance Prepare the Adjusting Entries Adjusting Entries Post Adjusting Entries to the General Ledger General Ledger Prepare an Adjusted Trial Balance Adjusted TB Prepare the Financial Statements Financial Statements Prepare the Closing Entries Closing Entries Post Closing Entries to the General Ledger General Ledger Prepare the Post Closing Trial Balance Post Closing TB Course Project #1 Overview The Accounting Cycle Project consists of 10 Requirements for you to complete. The Accounting Cycle Project is due at the end of Week 4. All of the information you need to complete the Course Project is located in this workbook. There are eight worksheets in the workbook you will need to complete. A list of January transactions A Chart of Accounts reference sheet A Grading Rubric to help explain what is expected. Each worksheet has the Check Figures embedded as a comment. Before You Begin: Review Chapters 3 and 4 (including appendices) Print the Chart of Accounts and January Transactions worksheets for your reference. You will need to refer to both throughout the project. Review the Grading Criteria. Scenario Moonlight Bay Inn is incorporated on January 2, 2017, by its three owners, each of whom contributes $20,000 in cash in e for shares of stock in the business. In addition to the sale of stock, the following transactions are entered into during the January: (See January Transactions Tab) SAVE your work frequently in this workbook. Requirements Requirement Task Description Use this worksheet Part A Prepare the Journal Entries in the General Journal Entries Journal Post Journal Entries to the General Ledger Prepare a Trial Balance General Ledger Trial Balance 3 Part B Adjusting Entries Prepare the Adjusting Entries Post Adjusting Entries to the General Ledger General Ledger Prepare an Adjusted Trial Balance Prepare the Financial Statements Prepare the Closing Entries Post Closing Entries to the General Ledger General Ledger Prepare the Post Closing Trial Balance 4. Adjusted TB Financial Statements 8 Closing Entries 9. 10 Post Closing TB Guidelines Use the embedded assistance in the template and guidance in your textbook. Should you have any questions contact your professor. X v fx A Victorian inn is purchased for $50,000 in cash. An appraisal performed on this date During its first month of operation, Moonlight Bay Inn completed the following transactions. C6 January Transactions Transaction Description Began business by each of the three owners contributing $20.000 in cash each in exchange for shares of stock in the business. A Victorian inn is purchased for $50,000 in cash. An appraisal performed on this date indicates that the land is worth $15,000, and the remaining balance of the purchase price is attributable to the house. The owners estimate that the house will have an estimated Date Jan. 2 Jan. 2 useful life of 25 years and an estimated salvage value of $5,000. A two-year, 12%, $30,000 promissory note was signed at Second State Bank. Interest and principal will be repaid on the maturity date of January 3, 2019. New furniture for the inn is purchased at a cost of $15,000 in cash. The fumiture has an estimated useful ife of ten years and no salvage Jan. 3 Jan. 4 value. Jan. 5 A 24-month property insurance policy is purchased for $6.000 in cash. Jan. 6 An advertisement for the inn is placed in the local newspaper. Moonlight Bay pays $450 cash for the ad, which will run in the paper throughout January. Cleaning supplies are purchased on account for $950. The bil is payable within 30 days. Jan. 7 Wages of $4.230 for the frst half of the month are paid in cash. A guest mails the business $980 in cash as a deposit for a room to be rented for two weeks. The guest plans to stay at the inn during the last week of January and the frst week of February. Jan. 15 Jan. 16 Cash receipts from rentals of rooms for the month amount to $8,300. Cash receipts from operation of the restaurant for the month amount to $6,600. Each stockholder is paid $200 in cash dividends. Jan. 31 Jan. 31 Jan. 31 Use the following account descriptions for journal entries. Chart of Accounts Account Type Assets Account Number Account Title Normal Balance 111 Cash Debit Review the section on 117 Prepaid Insurance Cleaning Supplies Furniture Debit Chart of Accounts in 119 Debit Chapter 3: Module 1 Debit Credit Debit Credit 144 145 Accum Dep -Fumiture House 146 147 Accum Dep -House 148 Land Debit Liabilities 212 Accounts Payable Notes Payable Wages Payable Utities Payable Rent Received in Advance Interest Payable Income Tax Payable Credit 213 Credit 214 Credit 215 Credit 216 Credit 217 Credit 218 Credit Stockholders Equity Retained Earnings Capital Stock 311 Credit 312 Credit 313 Dividends Debit Revenue 411 Revenue - Rental of Rooms Credit 412 Revenue - Restaurant Credit Expenses Advertising Expense Wages Expense Insurance Expense Supplies Expense Utilities Expense Depreciation Expense Interest Expense Income Tax Expense 511 Debit 512 Debit 513 Debit 514 Debit 515 Debit 516 Debit 517 Debit 518 Debit Other 999 Income Summary Credit B39 A B D G H REQUIREMENT #6: Prepare an Adjusted Trial Balance in the space below. 1 Moonlight Bay Inn Adjusted Trial Balance January 31 Only enter accounts that have a balance. 2 Account Account Balance List accounts in order of Account Number Debit 4 Title Credit 6 7 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 A B. G H. Requirement #7: Prepare the financial statements for Moonlight Bay Inn as of January 31 in the space below. You will only be preparing the Income Statement, Statement of Retained Eaming, and the Balance Sheet. The Statement of Cash Flows is a required Financial Statement, but is not required for this project. 2 3 Moonlight Bay In Income Statement For the Month Ending January 31 Moonlight Bay Inn Statement of Retained Earnings For the Month Ending Janauary 31 Moonlight Bay Inn Balance Sheet 4 5 6 January 31 7 (enter figures in column B and totals in column C) (enter figures in column I and totals in column J) Revenues: From rental of rooms Retalned Earnings, January 1 Add: Net Income 8 Assets: Subtotal Less : Dividends Retalned Earnings, October 31 Current Assets: Cash Cleaning Supples Prepald Insurance 10 From restaurant 11 Total Revenue 12 13 Expenses: Advertising Total current assets 14 Property, Plant, and Eulp.: Wages Depreclation Interest Insurance Supplies 15 Land House, net of accum. Depr. Furniture, net of accum. Depr. Total Property, Plant, and Euip. Total Assets 16 17 18 19 20 Utilifles Income Taxes Total Expenses Llablities and Stockholders' Equity 21 22 Liabilitles: 23 Current Liabilities: 24 Net Income Accounts Payable 25 Interest Payable Wages Payable Income Taxes Payable Rent recelved in advance Utilties Payable Total current labilitles 26 27 28 29 30 Long-term Debt: Notes Payable Total Llabilities 31 32 33 34 Stockholders' Equity: Capital Stock Retained Earnings Total Stockholders' Equity 35 36 37 38 39 40 Total Llabilities & Stockholders' Equity 41 42 A B D E F G H J. K M N R U Requirement #8: Prepare the closing entries at January 31 in the General Jounal below. Hint:Use the balances for each account which appear on the Adjusted Trial Balance for your closing entries. (Omit explanations) 1 Requirement #9: Post the closing entries to the T-Accounts on the General Ledger worksheet and compute ending balances. Just add to the adjusted balances already listed. Click here to go to the General Ledger worksheet to complete Requirement #9. 3 General Journal 4 Date Credit EXAMPLE Description (Account Name) Debit 5 31-Jan 6 7 12-31-X3 Revenues 32,800 8 31-Jan 9 Income Summary 32,800 10 For instructions on how to To close revenues to Income Summary 11 prepare closing entries, view this link: Closing Entries 12 12-31-X3 Income Summary 30,200 13 14 Salaries Expense 17,000 15 16 Advertising Expense 5,000 17 Fuel Expense 2,000 18 31-Jan 19 Depreciation Expense 5,000 20 31-Jan Interest Expense 1,200 21 22 To close expenses to Income Summary 23 24 12-31-X3 Income Summary 2,600 25 26 Retained Earnings 2,600 27 To close Income Summary to retained earnings (balance equals net income) 28 29 30 31 12-31-X3 Retained Earnings 1,000 32 33 Dividends 1,000 34 To close dividends 35 36 37 38 39 A B. E G Requirement #10: Prepare a post-closing trial balance as of January 31 in the space below. 1 Moonlight Bay Inn Post-Closing Trial Balance January 31 3 Account Account Balance Credit Title Deblt 6 Only enter 8 accounts that have a balnce 10 List accou 11 12 order of Account 13 Number 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40

Step by Step Solution

3.43 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

02Jan Cash 60000 To Capital Stock 60000 Being capital contribution made 02Jan Land 15000 House 35000 To Cash 50000 Being Land building purchased 03Jan ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started