Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Your father needs financial guidance on saving for a house and he decides to hire you as his financial advisor. Your family annual income

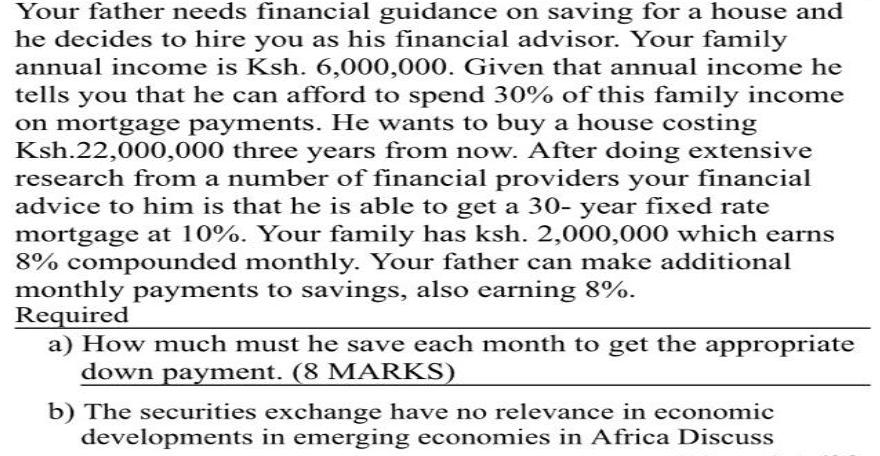

Your father needs financial guidance on saving for a house and he decides to hire you as his financial advisor. Your family annual income is Ksh. 6,000,000. Given that annual income he tells you that he can afford to spend 30% of this family income on mortgage payments. He wants to buy a house costing Ksh.22,000,000 three years from now. After doing extensive research from a number of financial providers your financial advice to him is that he is able to get a 30- year fixed rate mortgage at 10%. Your family has ksh. 2,000,000 which earns 8% compounded monthly. Your father can make additional monthly payments to savings, also earning 8%. Required a) How much must he save each month to get the appropriate down payment. (8 MARKS) b) The securities exchange have no relevance in economic developments in emerging economies in Africa Discuss

Step by Step Solution

★★★★★

3.54 Rating (168 Votes )

There are 3 Steps involved in it

Step: 1

a Let the mortgage payments be annual So maximum mortgage payments annual 30 Ksh 6000000 Ksh 1800000 Present Value of mortgage payments for 30 years 1...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started