Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The Smith's take out 5-year $240,000 mortgage with Bank of Quebec in which the balance is to be financed by equal monthly payments over

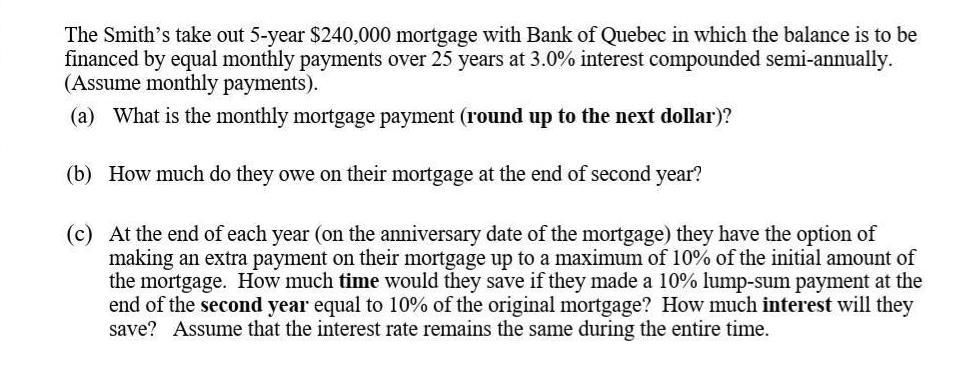

The Smith's take out 5-year $240,000 mortgage with Bank of Quebec in which the balance is to be financed by equal monthly payments over 25 years at 3.0% interest compounded semi-annually. (Assume monthly payments). (a) What is the monthly mortgage payment (round up to the next dollar)? (b) How much do they owe on their mortgage at the end of second year? (c) At the end of each year (on the anniversary date of the mortgage) they have the option of making an extra payment on their mortgage up to a maximum of 10% of the initial amount of the mortgage. How much time would they save if they made a 10% lump-sum payment at the end of the second year equal to 10% of the original mortgage? How much interest will they save? Assume that the interest rate remains the same during the entire time.

Step by Step Solution

★★★★★

3.46 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

Yearly InstallmentPMTD200D201D199 Monthly ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started