Answered step by step

Verified Expert Solution

Question

1 Approved Answer

7 Complete the assignment using the Illini Tap Financial Statements excel file provided, and submit on Compass by 5 pm Friday October 2nd. For questions

7

7

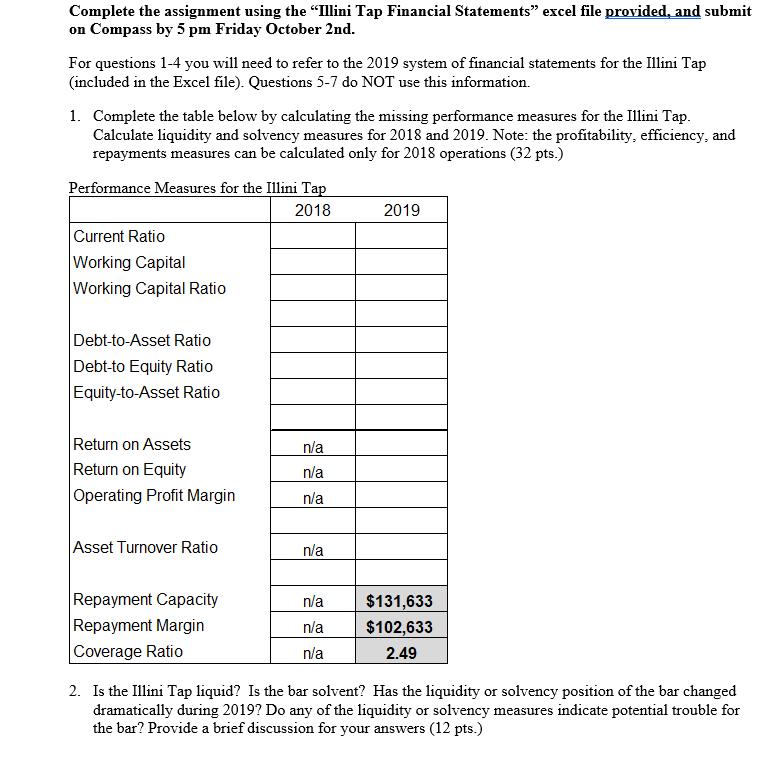

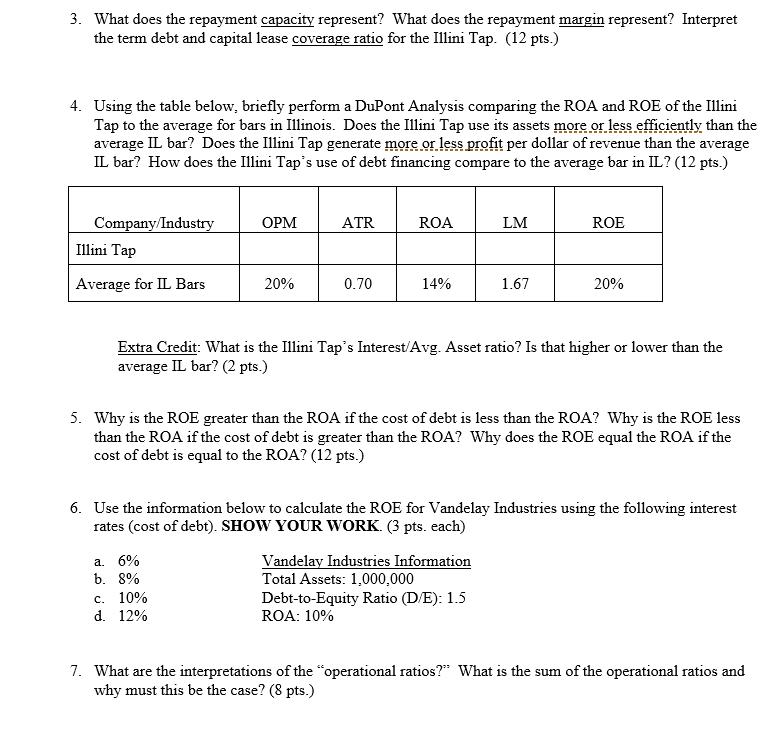

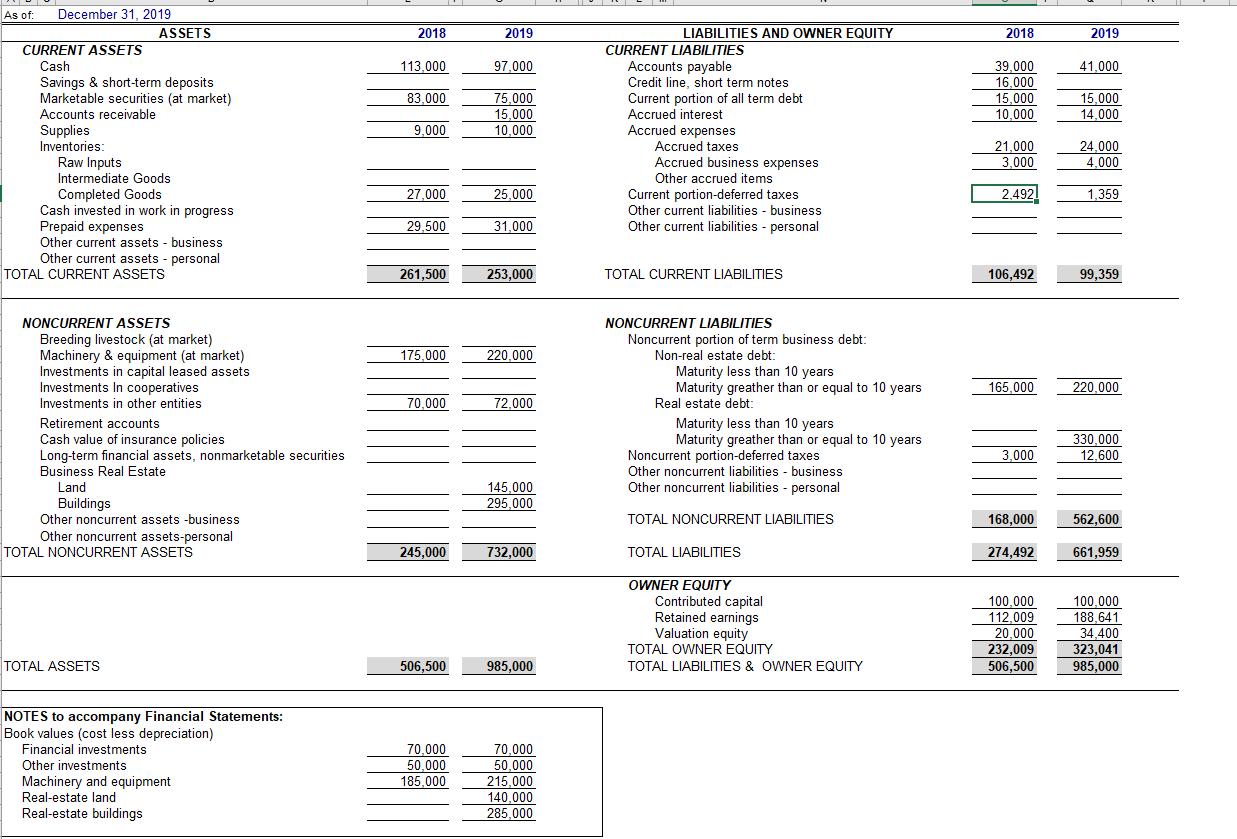

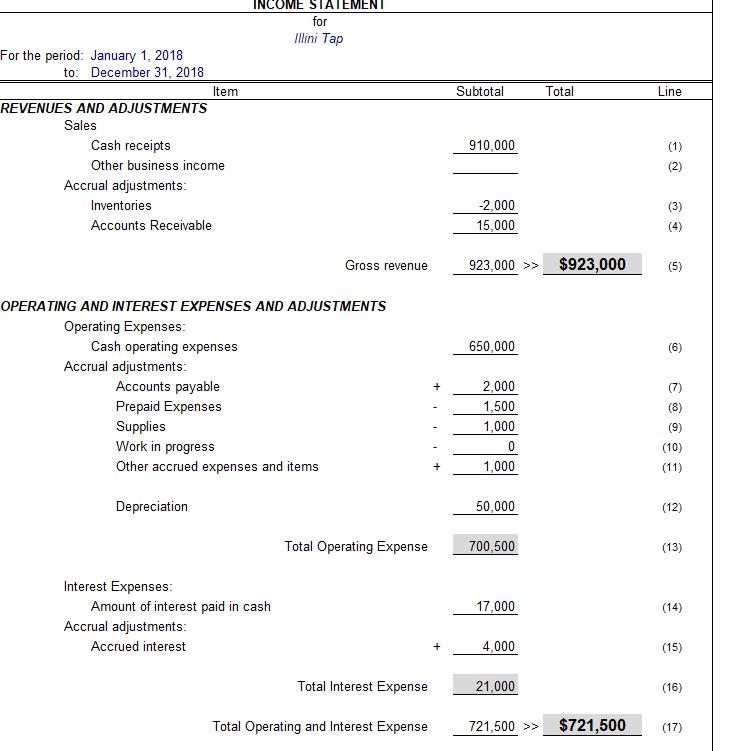

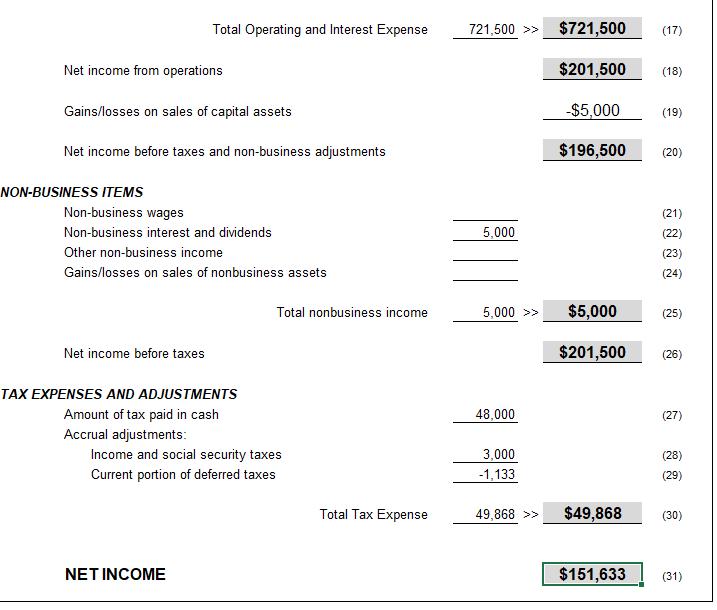

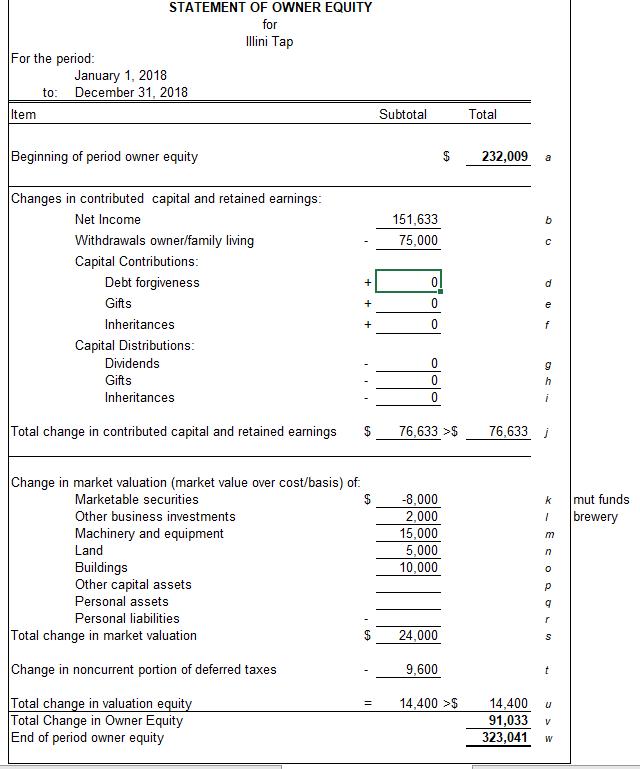

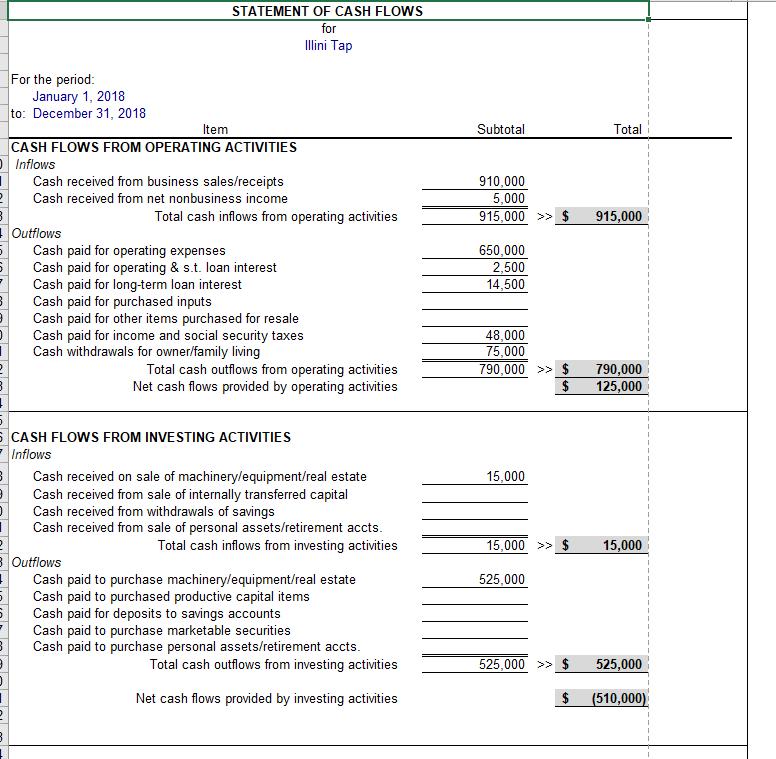

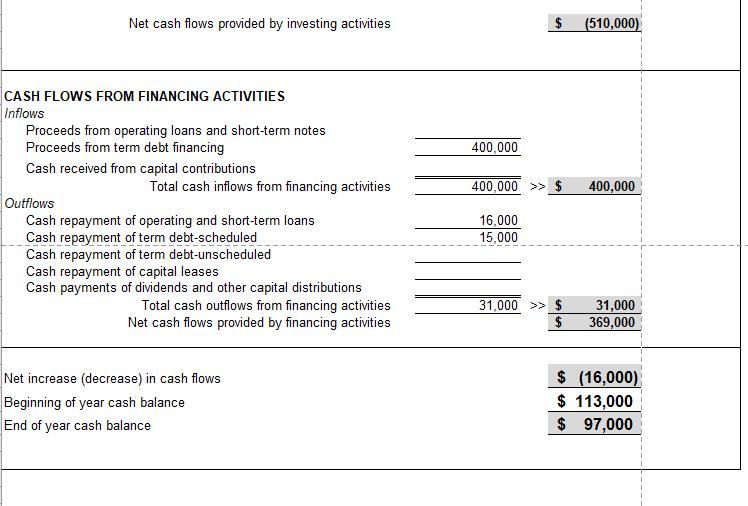

Complete the assignment using the "Illini Tap Financial Statements" excel file provided, and submit on Compass by 5 pm Friday October 2nd. For questions 1-4 you will need to refer to the 2019 system of financial statements for the Illini Tap (included in the Excel file). Questions 5-7 do NOT use this information. 1. Complete the table below by calculating the missing performance measures for the Illini Tap. Calculate liquidity and solvency measures for 2018 and 2019. Note: the profitability, efficiency, and repayments measures can be calculated only for 2018 operations (32 pts.) Performance Measures for the Illini Tap 2018 Current Ratio Working Capital Working Capital Ratio Debt-to-Asset Ratio Debt-to Equity Ratio Equity-to-Asset Ratio Return on Assets Return on Equity Operating Profit Margin Asset Turnover Ratio Repayment Capacity Repayment Margin Coverage Ratio n/a n/a n/a n/a n/a n/a n/a 2019 $131,633 $102,633 2.49 2. Is the Illini Tap liquid? Is the bar solvent? Has the liquidity or solvency position of the bar changed dramatically during 2019? Do any of the liquidity or solvency measures indicate potential trouble for the bar? Provide a brief discussion for your answers (12 pts.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

1 Complete the table below by calculating the missing performance measures for the Illini Tap Calculate liquidity and solvency measures for 2018 and 2019 2 Is the Illini Tap liquid Is the bar solvent ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started