Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Now that you have completed the end of month posting procedure, you are required to prepare a bank reconciliation as at June 30, 2020.

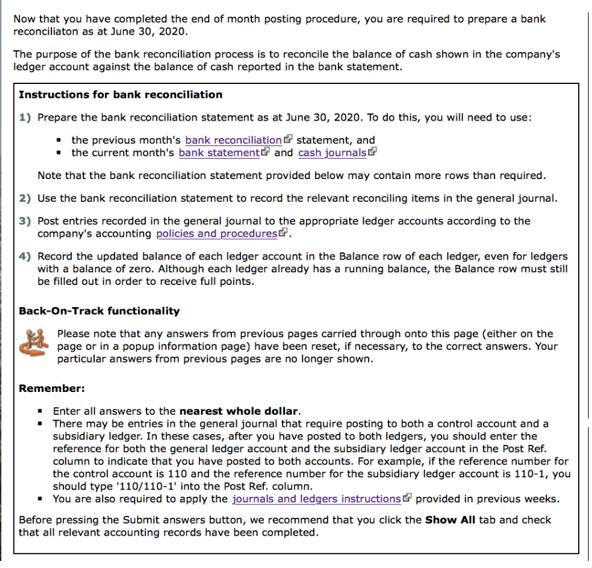

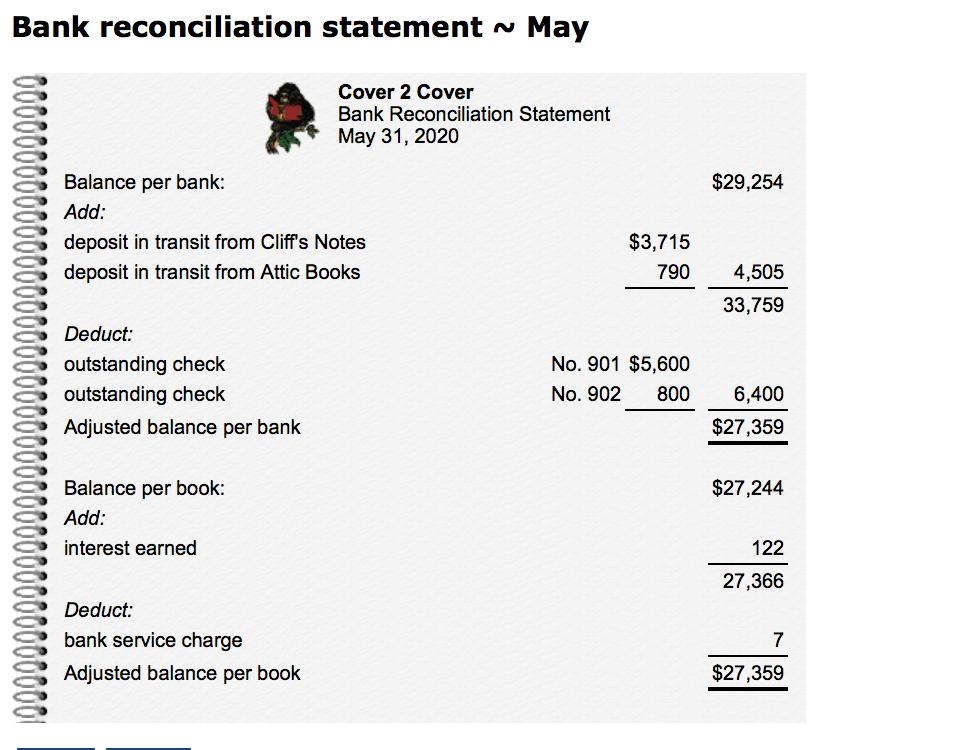

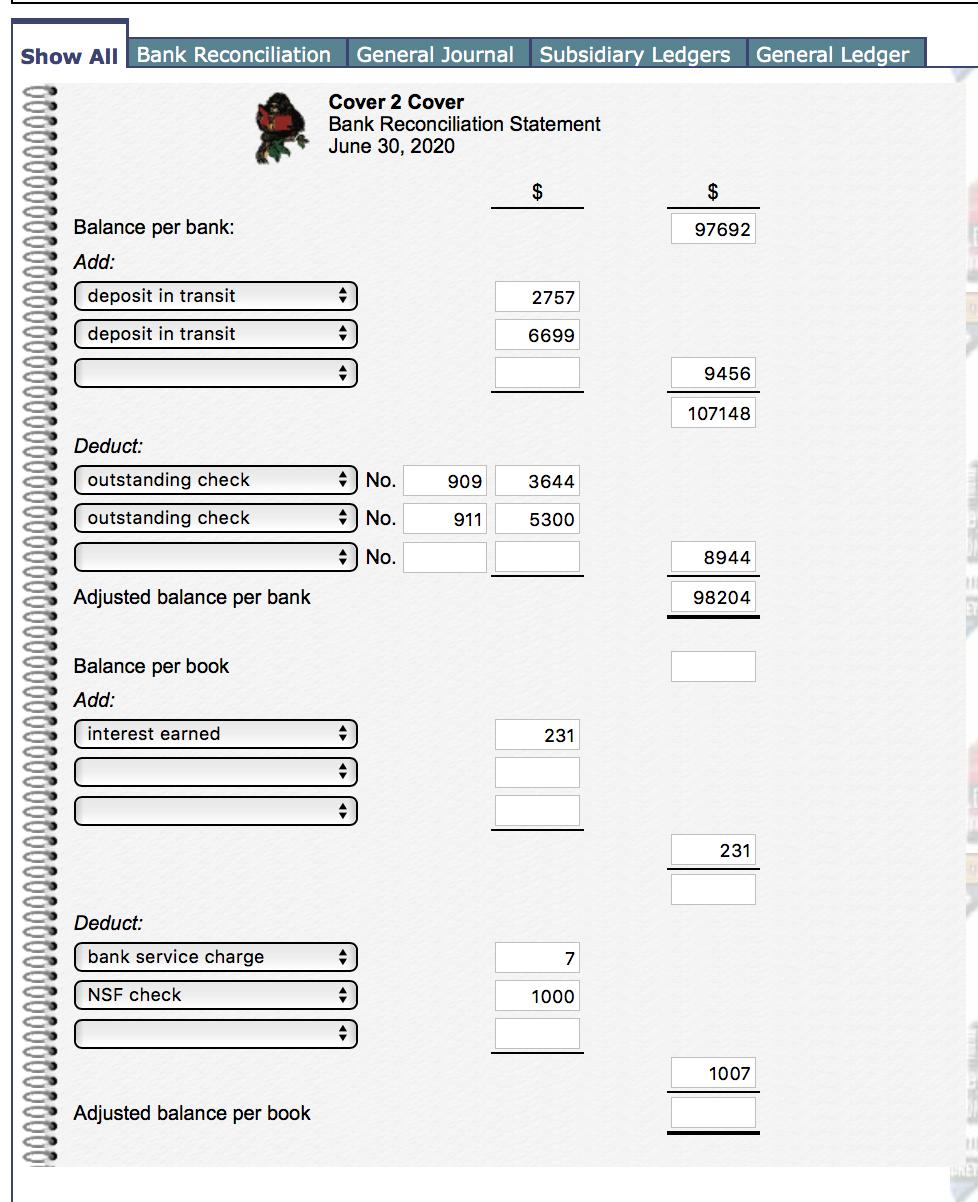

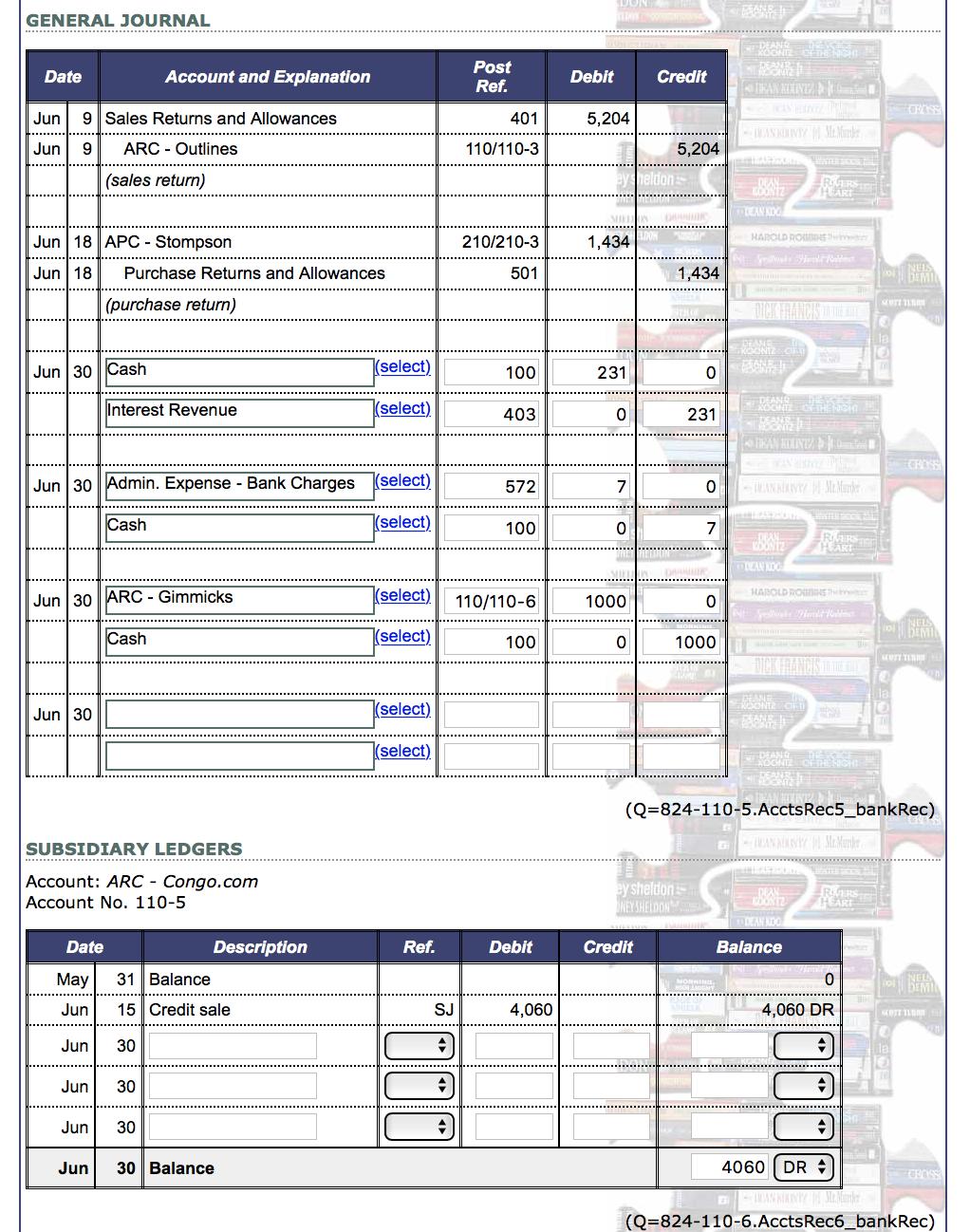

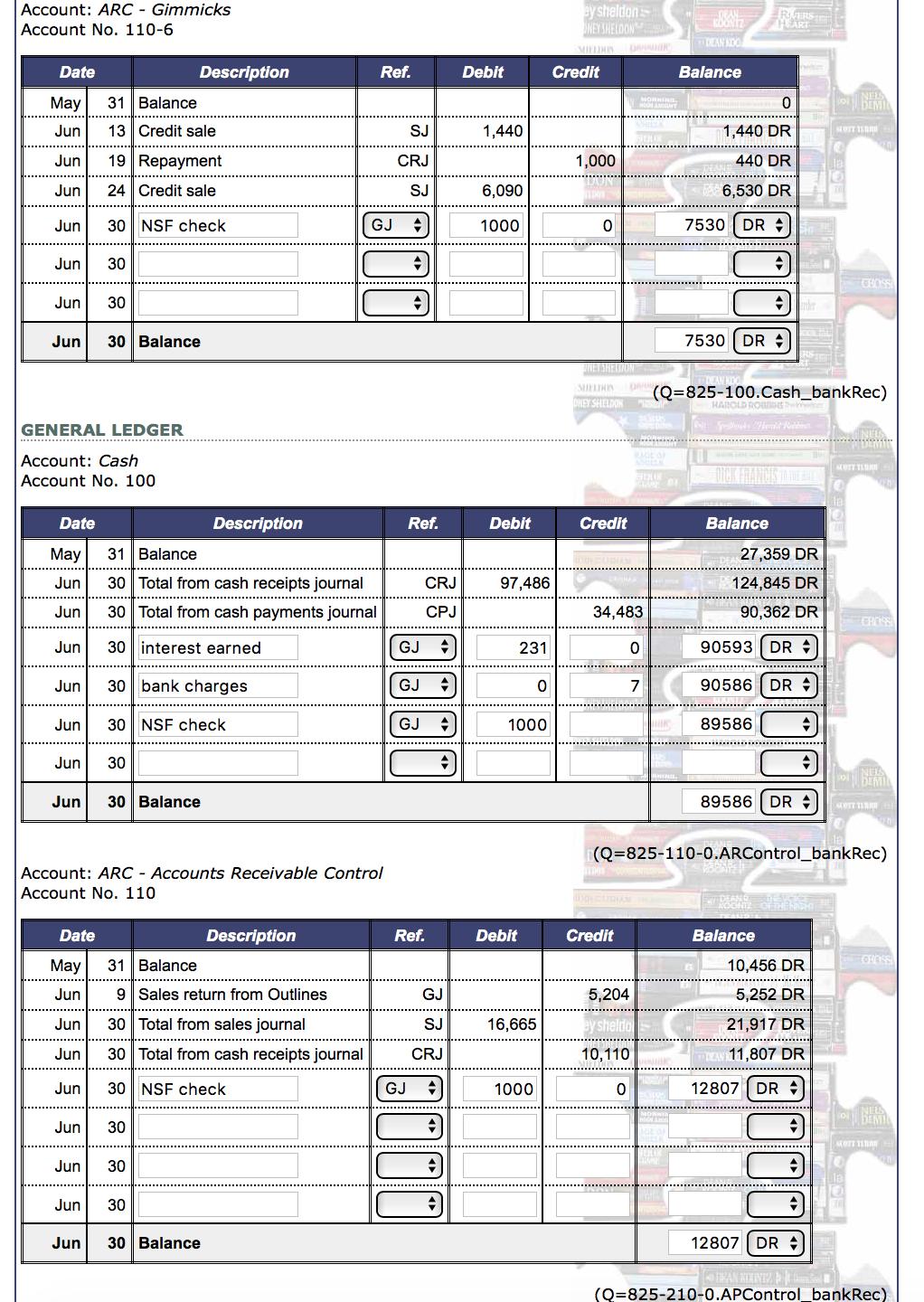

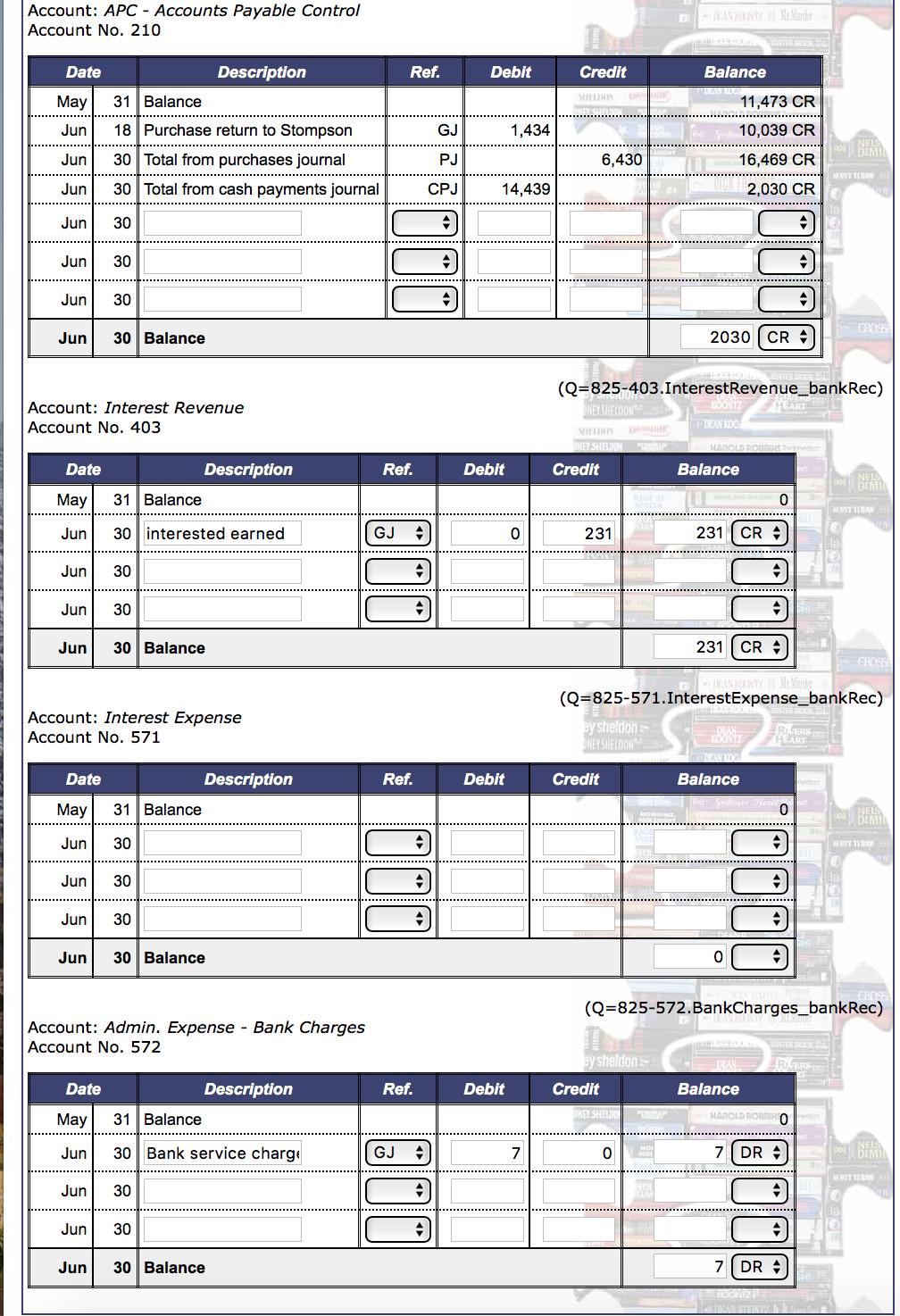

Now that you have completed the end of month posting procedure, you are required to prepare a bank reconciliation as at June 30, 2020. The purpose of the bank reconciliation process is to reconcile the balance of cash shown in the company's ledger account against the balance of cash reported in the bank statement. Instructions for bank reconciliation 1) Prepare the bank reconciliation statement as at June 30, 2020. To do this, you will need to use: the previous month's bank reconciliation statement, and the current month's bank statement and cash journals Note that the bank reconciliation statement provided below may contain more rows than required. 2) Use the bank reconciliation statement to record the relevant reconciling items in the general journal. 3) Post entries recorded in the general journal to the appropriate ledger accounts according to the company's accounting policies and procedures. 4) Record the updated balance of each ledger account in the Balance row of each ledger, even for ledgers with a balance of zero. Although each ledger already has a running balance, the Balance row must still be filled out in order to receive full points. Back-On-Track functionality Please note that any answers from previous pages carried through onto this page (either on the page or in a popup information page) have been reset, if necessary, to the correct answers. Your particular answers from previous pages are no longer shown. Remember: Enter all answers to the nearest whole dollar. There may be entries in the general journal that require posting to both a control account and a subsidiary ledger. In these cases, after you have posted to both ledgers, you should enter the reference for both the general ledger account and the subsidiary ledger account in the Post Ref. column to indicate that you have posted to both accounts. For example, if the reference number for the control account is 110 and the reference number for the subsidiary ledger account is 110-1, you should type '110/110-1' into the Post Ref. column. You are also required to apply the journals and ledgers instructions provided in previous weeks. Before pressing the Submit answers button, we recommend that you click the Show All tab and check that all relevant accounting records have been completed. Bank reconciliation statement ~ May 10000000 Balance per bank: Add: deposit in transit from Cliff's Notes deposit in transit from Attic Books Deduct: outstanding check outstanding check Adjusted balance per bank Balance per book: Add: interest earned Cover 2 Cover Bank Reconciliation Statement May 31, 2020 Deduct: bank service charge Adjusted balance per book $3,715 790 No. 901 $5,600 No. 902 800 $29,254 4,505 33,759 6,400 $27,359 $27,244 122 27,366 7 $27,359 Bank statement ~ June Neville Cooper 827 McGee Avenue Miami, FL 33109 Cover 2 Cover Date Particulars JUN 1 BALANCE BROUGHT FORWARD JUN 4 JUN 5 JUN 6 JUN 6 JUN 6 LOAN 902 DEPOSIT - Cliff's Notes DEPOSIT - Attic Books 901 903 DEPOSIT - Cash sales JUN 7 JUN 9 JUN 10 904 JUN 13 JUN 14 905 JUN 17 JUN 19 907 JUN 20 DEPOSIT - Cash sales DEPOSIT - Attic Books DEPOSIT - Cash sales DEPOSIT - Gimmicks NSF CHECK- Gimmicks DEPOSIT - Cash sales 908 DEPOSIT - Cliff's Notes DEPOSIT - Cash sales JUN 21 JUN 24 JUN 27 JUN 28 JUN 30 JUN 30 JUN 30 JUN 30 INTEREST JUN 30 SERVICE CHARGE 910 Last statement to This statement to 05/31/20 06/30/20 Debit $800 $5,600 $1,787 $2,787 $3,750 $5,746 $1,000 $4,227 $5,323 $7 Total debits $31,027 Credit $43,000 $3,715 $790 $7,830 $11,394 $2,993 $9,191 $1,000 $9,595 $3,027 $6,699 $231 Total credits $99,465 EASTPAC Miami branch Account No. 27900920 1 Page No. Balance $29,254 CR $72,254 CR $71,454 CR $75,169 CR $75,959 CR $70,359 CR $68,572 CR $76,402 CR $73,615 CR $85,009 CR $81,259 CR $84,252 CR $78,506 CR $87,697 CR $88,697 CR $87,697 CR $97,292 CR $93,065 CR $96,092 CR $102,791 CR $97,468 CR $97,699 CR $97,692 CR Final balance $97,692 CR Proceeds of checks will not be available until cleared. All entries for the last business day are subject to verification and authorization. Any items not paid, or withdrawn, will be adjusted by reversal entry on a later statement. NSF means Not-Sufficient-Funds. CASH RECEIPTS JOURNAL Date Jun 1 Bank Loan Payable Jun 5 Sales Revenue Jun 11 ARC-Attic Books Jun 12 Sales Revenue Jun 19 ARC - Gimmicks Jun 19 Sales Revenue Jun 20 ARC Outlines Jun 26 Sales Revenue Jun 30 ARC- Cliff's Notes Jun 30 Sales Revenue Total Post reference Account CASH PAYMENTS JOURNAL Date Total Post reference Account Jun 2 APC-Albatross Jun 4 APC-Booked Inn Jun 7 Purchases Jun 13 APC Books R Us Jun 15 Wages Expense Jun 26 APC Stompson Jun 28 APC - Noir Novels Jun 29 Wages Expense Jun 30 Salary Expense Post Ref. 250 X 110-1 X 110-6 X 110-3 X 110-4 X Check No. 903 904 905 906 907 908 909 910 911 Cash Debit 43,000 7,830 2,993 11,394 1,000 9,191 2,757 9,595 3,027 6,699 97,486 (100) Post Ref. Credit Sales Sales Accounts Other Discounts Revenue Receivable Accounts 43,000 210-2 210-4 X 210-5 516 210-3 210-1 516 545 333 333 (402) 1,805 2,844 1,919 4,227 3,644 7,830 14,439 (210) 11,394 Debit Accounts Purchases Payable 9,191 9,595 6,699 44,709 (400) 3,750 3,750 (500) 3,326 1,000 2,757 3,027 10,110 (110) Other Accounts 5,746 5,323 5,300 16,369 (X) 43,000 (X) Cash Credit 1,787 2.787 3,750 1,919 5,746 4,227 3,644 5,323 5,300 34,483 (100) Purchase Discounts 18 57 75 (502) Show All Bank Reconciliation 0000000000001 Balance per bank: Add: deposit in transit deposit in transit Deduct: outstanding check outstanding check Adjusted balance per bank Balance per book Add: interest earned Deduct: bank service charge NSF check General Journal Subsidiary Ledgers General Ledger Cover 2 Cover Bank Reconciliation Statement June 30, 2020 Adjusted balance per book + + + + No. No. + No. + + + + 909 911 $ 2757 6699 3644 5300 231 7 1000 $ 97692 9456 107148 8944 98204 231 1007 GENERAL JOURNAL Date Jun 9 Sales Returns and Allowances Jun 9 ARC Outlines (sales return) Jun 18 APC - Stompson Jun 18 Purchase Returns and Allowances (purchase return) Jun 30 Cash Jun 30 Jun 30 Admin. Expense - Bank Charges (select) Cash (select) Jun 30 ARC - Gimmicks Date Account and Explanation Interest Revenue SUBSIDIARY LEDGERS Account: ARC - Congo.com Account No. 110-5 Jun Cash Jun May 31 Balance Jun 15 Credit sale Jun 30 30 30 Description (select) (select) Jun 30 Balance (select) (select) (select) (select) Ref. Post Ref. SJ + + 401 110/110-3 210/210-3 501 100 403 572 100 110/110-6 100 Debit 4,060 Debit 5,204 ay sheldon 1,434 231 0 7 0 1000 0 Credit Credit 5,204 DANC ey sheldon ONEY SHELDON 1,434 STROF 0 231 0 7 0 1000 Account: ARC - Gimmicks Account No. 110-6 Date Jun May Jun Jun 19 Repayment Jun 24 Credit sale Jun 30 NSF check Jun Jun 30 Date GENERAL LEDGER Account: Cash Account No. 100. May Jun Jun Jun Jun 31 Balance 13 Credit sale 30 31 Balance 30 Total from cash receipts journal 30 Total from cash payments journal 30 interest earned Jun 30 bank charges Jun 30 NSF check Date 30 Balance Jun 30 Balance Description 30 Jun Jun Jun 30 Account: ARC - Accounts Receivable Control Account No. 110 Jun 30 May 31 Balance Jun 9 Sales return from Outlines Jun 30 Total from sales journal Jun 30 Total from cash receipts journal Jun 30 NSF check Description 30 30 Balance Description Ref. GJ SJ CRJ SJ + + + Ref. GJ GJ GJ GJ CRJ CPJ Ref. GJ SJ CRJ Debit 1,440 6,090 1000 Debit 97,486 231 1000 Debit 16,665 0 1000 By sheldon NEY SHELDON MIDDHIS DARAINER Credit 1,000 0 NETSHELDON SHELDRIS DNEY SELELDON Credit 34,483 Credit 20 RACE OF 0 0 7 5,204 ey sheldo 10,110 TH RAN OCEAN NOO O Balance 7530 0 1,440 DR 440 DR 6,530 DR DR 7530 DR Balance VERS HEART (Q-825-100.Cash_bankRec) HAROLD ROS SpePads Ferdit Relmes + 27,359 DR 124,845 DR 90,362 DR 90593 DR 90586 DR = 89586 EU DIANG 89586 DR Balance 10,456 DR 5,252 DR 21,917 DR 11,807 DR 12807 DR + 12807 DR + DEMIA SOTT TERRE (Q=825-110-0.ARControl_bankRec) CROSS MUTT TU CROSS DEMIN SOTT TER Lla SITE OFFISS DEMI AKOTT TE (Q=825-210-0.APControl_bankRec). Account: APC - Accounts Payable Control Account No. 210 Date May 31 Balance Jun 18 Purchase return to Stompson Jun 30 Total from purchases journal Jun Jun 30 Jun 30 Jun Jun Date 30 Total from cash payments journal Account: Interest Revenue Account No. 403 Jun 30 30 Balance Jun 30 Date May 31 Balance Jun 30 interested earned Jun 30 May Jun 30 Balance Account: Interest Expense Account No. 571 31 Balance 30 Description Jun 30 Jun 30 Description Jun 30 Balance Jun 30 Description Account: Admin. Expense - Bank Charges Account No. 572 Jun 30 Date May 31 Balance Jun 30 Bank service charg Description Jun 30 Balance Ref. Ref. GJ + Ref. Ref. GJ + + # GJ PJ CPJ Debit 14,439 Debit Debit 1,434 Debit 0 7 Credit SHELIHIN NG SHELDHES DA DNEY SHELDON SAN Credit 6,430 231 Credit (Q-825-403. InterestRevenue_bankRec) ONEY SHELDON HEART By sheldon NEYSHELDON RAGE OF Credit By sheldon OKEY SHELDON 0 Balance REA NOT 11,473 CR 10,039 CR 16,469 CR 2,030 CR 2030 CR + COONTZ DEAN NOG HABOLD Balance 231 CR 231 SEDUNTY Mt. Minder (Q=825-571. Interest Expense_bankRec) 0 DMAN BOO Balance CRE DRAN Balance 0 7 DR 7 DR recelia RIVERS (Q=825-572.BankCharges_bankRec) HEART 0 + HAROLD ROO WANTED DEMO MUTT TLUE RIVERS SCOTT TER COROSS DEMI SKOTT TEMAN MOTT TER Now that you have completed the end of month posting procedure, you are required to prepare a bank reconciliation as at June 30, 2020. The purpose of the bank reconciliation process is to reconcile the balance of cash shown in the company's ledger account against the balance of cash reported in the bank statement. Instructions for bank reconciliation 1) Prepare the bank reconciliation statement as at June 30, 2020. To do this, you will need to use: the previous month's bank reconciliation statement, and the current month's bank statement and cash journals Note that the bank reconciliation statement provided below may contain more rows than required. 2) Use the bank reconciliation statement to record the relevant reconciling items in the general journal. 3) Post entries recorded in the general journal to the appropriate ledger accounts according to the company's accounting policies and procedures. 4) Record the updated balance of each ledger account in the Balance row of each ledger, even for ledgers with a balance of zero. Although each ledger already has a running balance, the Balance row must still be filled out in order to receive full points. Back-On-Track functionality Please note that any answers from previous pages carried through onto this page (either on the page or in a popup information page) have been reset, if necessary, to the correct answers. Your particular answers from previous pages are no longer shown. Remember: Enter all answers to the nearest whole dollar. There may be entries in the general journal that require posting to both a control account and a subsidiary ledger. In these cases, after you have posted to both ledgers, you should enter the reference for both the general ledger account and the subsidiary ledger account in the Post Ref. column to indicate that you have posted to both accounts. For example, if the reference number for the control account is 110 and the reference number for the subsidiary ledger account is 110-1, you should type '110/110-1' into the Post Ref. column. You are also required to apply the journals and ledgers instructions provided in previous weeks. Before pressing the Submit answers button, we recommend that you click the Show All tab and check that all relevant accounting records have been completed. Bank reconciliation statement ~ May 10000000 Balance per bank: Add: deposit in transit from Cliff's Notes deposit in transit from Attic Books Deduct: outstanding check outstanding check Adjusted balance per bank Balance per book: Add: interest earned Cover 2 Cover Bank Reconciliation Statement May 31, 2020 Deduct: bank service charge Adjusted balance per book $3,715 790 No. 901 $5,600 No. 902 800 $29,254 4,505 33,759 6,400 $27,359 $27,244 122 27,366 7 $27,359 Bank statement ~ June Neville Cooper 827 McGee Avenue Miami, FL 33109 Cover 2 Cover Date Particulars JUN 1 BALANCE BROUGHT FORWARD JUN 4 JUN 5 JUN 6 JUN 6 JUN 6 LOAN 902 DEPOSIT - Cliff's Notes DEPOSIT - Attic Books 901 903 DEPOSIT - Cash sales JUN 7 JUN 9 JUN 10 904 JUN 13 JUN 14 905 JUN 17 JUN 19 907 JUN 20 DEPOSIT - Cash sales DEPOSIT - Attic Books DEPOSIT - Cash sales DEPOSIT - Gimmicks NSF CHECK- Gimmicks DEPOSIT - Cash sales 908 DEPOSIT - Cliff's Notes DEPOSIT - Cash sales JUN 21 JUN 24 JUN 27 JUN 28 JUN 30 JUN 30 JUN 30 JUN 30 INTEREST JUN 30 SERVICE CHARGE 910 Last statement to This statement to 05/31/20 06/30/20 Debit $800 $5,600 $1,787 $2,787 $3,750 $5,746 $1,000 $4,227 $5,323 $7 Total debits $31,027 Credit $43,000 $3,715 $790 $7,830 $11,394 $2,993 $9,191 $1,000 $9,595 $3,027 $6,699 $231 Total credits $99,465 EASTPAC Miami branch Account No. 27900920 1 Page No. Balance $29,254 CR $72,254 CR $71,454 CR $75,169 CR $75,959 CR $70,359 CR $68,572 CR $76,402 CR $73,615 CR $85,009 CR $81,259 CR $84,252 CR $78,506 CR $87,697 CR $88,697 CR $87,697 CR $97,292 CR $93,065 CR $96,092 CR $102,791 CR $97,468 CR $97,699 CR $97,692 CR Final balance $97,692 CR Proceeds of checks will not be available until cleared. All entries for the last business day are subject to verification and authorization. Any items not paid, or withdrawn, will be adjusted by reversal entry on a later statement. NSF means Not-Sufficient-Funds. CASH RECEIPTS JOURNAL Date Jun 1 Bank Loan Payable Jun 5 Sales Revenue Jun 11 ARC-Attic Books Jun 12 Sales Revenue Jun 19 ARC - Gimmicks Jun 19 Sales Revenue Jun 20 ARC Outlines Jun 26 Sales Revenue Jun 30 ARC- Cliff's Notes Jun 30 Sales Revenue Total Post reference Account CASH PAYMENTS JOURNAL Date Total Post reference Account Jun 2 APC-Albatross Jun 4 APC-Booked Inn Jun 7 Purchases Jun 13 APC Books R Us Jun 15 Wages Expense Jun 26 APC Stompson Jun 28 APC - Noir Novels Jun 29 Wages Expense Jun 30 Salary Expense Post Ref. 250 X 110-1 X 110-6 X 110-3 X 110-4 X Check No. 903 904 905 906 907 908 909 910 911 Cash Debit 43,000 7,830 2,993 11,394 1,000 9,191 2,757 9,595 3,027 6,699 97,486 (100) Post Ref. Credit Sales Sales Accounts Other Discounts Revenue Receivable Accounts 43,000 210-2 210-4 X 210-5 516 210-3 210-1 516 545 333 333 (402) 1,805 2,844 1,919 4,227 3,644 7,830 14,439 (210) 11,394 Debit Accounts Purchases Payable 9,191 9,595 6,699 44,709 (400) 3,750 3,750 (500) 3,326 1,000 2,757 3,027 10,110 (110) Other Accounts 5,746 5,323 5,300 16,369 (X) 43,000 (X) Cash Credit 1,787 2.787 3,750 1,919 5,746 4,227 3,644 5,323 5,300 34,483 (100) Purchase Discounts 18 57 75 (502) Show All Bank Reconciliation 0000000000001 Balance per bank: Add: deposit in transit deposit in transit Deduct: outstanding check outstanding check Adjusted balance per bank Balance per book Add: interest earned Deduct: bank service charge NSF check General Journal Subsidiary Ledgers General Ledger Cover 2 Cover Bank Reconciliation Statement June 30, 2020 Adjusted balance per book + + + + No. No. + No. + + + + 909 911 $ 2757 6699 3644 5300 231 7 1000 $ 97692 9456 107148 8944 98204 231 1007 GENERAL JOURNAL Date Jun 9 Sales Returns and Allowances Jun 9 ARC Outlines (sales return) Jun 18 APC - Stompson Jun 18 Purchase Returns and Allowances (purchase return) Jun 30 Cash Jun 30 Jun 30 Admin. Expense - Bank Charges (select) Cash (select) Jun 30 ARC - Gimmicks Date Account and Explanation Interest Revenue SUBSIDIARY LEDGERS Account: ARC - Congo.com Account No. 110-5 Jun Cash Jun May 31 Balance Jun 15 Credit sale Jun 30 30 30 Description (select) (select) Jun 30 Balance (select) (select) (select) (select) Ref. Post Ref. SJ + + 401 110/110-3 210/210-3 501 100 403 572 100 110/110-6 100 Debit 4,060 Debit 5,204 ay sheldon 1,434 231 0 7 0 1000 0 Credit Credit 5,204 DANC ey sheldon ONEY SHELDON 1,434 STROF 0 231 0 7 0 1000 Account: ARC - Gimmicks Account No. 110-6 Date Jun May Jun Jun 19 Repayment Jun 24 Credit sale Jun 30 NSF check Jun Jun 30 Date GENERAL LEDGER Account: Cash Account No. 100. May Jun Jun Jun Jun 31 Balance 13 Credit sale 30 31 Balance 30 Total from cash receipts journal 30 Total from cash payments journal 30 interest earned Jun 30 bank charges Jun 30 NSF check Date 30 Balance Jun 30 Balance Description 30 Jun Jun Jun 30 Account: ARC - Accounts Receivable Control Account No. 110 Jun 30 May 31 Balance Jun 9 Sales return from Outlines Jun 30 Total from sales journal Jun 30 Total from cash receipts journal Jun 30 NSF check Description 30 30 Balance Description Ref. GJ SJ CRJ SJ + + + Ref. GJ GJ GJ GJ CRJ CPJ Ref. GJ SJ CRJ Debit 1,440 6,090 1000 Debit 97,486 231 1000 Debit 16,665 0 1000 By sheldon NEY SHELDON MIDDHIS DARAINER Credit 1,000 0 NETSHELDON SHELDRIS DNEY SELELDON Credit 34,483 Credit 20 RACE OF 0 0 7 5,204 ey sheldo 10,110 TH RAN OCEAN NOO O Balance 7530 0 1,440 DR 440 DR 6,530 DR DR 7530 DR Balance VERS HEART (Q-825-100.Cash_bankRec) HAROLD ROS SpePads Ferdit Relmes + 27,359 DR 124,845 DR 90,362 DR 90593 DR 90586 DR = 89586 EU DIANG 89586 DR Balance 10,456 DR 5,252 DR 21,917 DR 11,807 DR 12807 DR + 12807 DR + DEMIA SOTT TERRE (Q=825-110-0.ARControl_bankRec) CROSS MUTT TU CROSS DEMIN SOTT TER Lla SITE OFFISS DEMI AKOTT TE (Q=825-210-0.APControl_bankRec). Account: APC - Accounts Payable Control Account No. 210 Date May 31 Balance Jun 18 Purchase return to Stompson Jun 30 Total from purchases journal Jun Jun 30 Jun 30 Jun Jun Date 30 Total from cash payments journal Account: Interest Revenue Account No. 403 Jun 30 30 Balance Jun 30 Date May 31 Balance Jun 30 interested earned Jun 30 May Jun 30 Balance Account: Interest Expense Account No. 571 31 Balance 30 Description Jun 30 Jun 30 Description Jun 30 Balance Jun 30 Description Account: Admin. Expense - Bank Charges Account No. 572 Jun 30 Date May 31 Balance Jun 30 Bank service charg Description Jun 30 Balance Ref. Ref. GJ + Ref. Ref. GJ + + # GJ PJ CPJ Debit 14,439 Debit Debit 1,434 Debit 0 7 Credit SHELIHIN NG SHELDHES DA DNEY SHELDON SAN Credit 6,430 231 Credit (Q-825-403. InterestRevenue_bankRec) ONEY SHELDON HEART By sheldon NEYSHELDON RAGE OF Credit By sheldon OKEY SHELDON 0 Balance REA NOT 11,473 CR 10,039 CR 16,469 CR 2,030 CR 2030 CR + COONTZ DEAN NOG HABOLD Balance 231 CR 231 SEDUNTY Mt. Minder (Q=825-571. Interest Expense_bankRec) 0 DMAN BOO Balance CRE DRAN Balance 0 7 DR 7 DR recelia RIVERS (Q=825-572.BankCharges_bankRec) HEART 0 + HAROLD ROO WANTED DEMO MUTT TLUE RIVERS SCOTT TER COROSS DEMI SKOTT TEMAN MOTT TER Now that you have completed the end of month posting procedure, you are required to prepare a bank reconciliation as at June 30, 2020. The purpose of the bank reconciliation process is to reconcile the balance of cash shown in the company's ledger account against the balance of cash reported in the bank statement. Instructions for bank reconciliation 1) Prepare the bank reconciliation statement as at June 30, 2020. To do this, you will need to use: the previous month's bank reconciliation statement, and the current month's bank statement and cash journals Note that the bank reconciliation statement provided below may contain more rows than required. 2) Use the bank reconciliation statement to record the relevant reconciling items in the general journal. 3) Post entries recorded in the general journal to the appropriate ledger accounts according to the company's accounting policies and procedures. 4) Record the updated balance of each ledger account in the Balance row of each ledger, even for ledgers with a balance of zero. Although each ledger already has a running balance, the Balance row must still be filled out in order to receive full points. Back-On-Track functionality Please note that any answers from previous pages carried through onto this page (either on the page or in a popup information page) have been reset, if necessary, to the correct answers. Your particular answers from previous pages are no longer shown. Remember: Enter all answers to the nearest whole dollar. There may be entries in the general journal that require posting to both a control account and a subsidiary ledger. In these cases, after you have posted to both ledgers, you should enter the reference for both the general ledger account and the subsidiary ledger account in the Post Ref. column to indicate that you have posted to both accounts. For example, if the reference number for the control account is 110 and the reference number for the subsidiary ledger account is 110-1, you should type '110/110-1' into the Post Ref. column. You are also required to apply the journals and ledgers instructions provided in previous weeks. Before pressing the Submit answers button, we recommend that you click the Show All tab and check that all relevant accounting records have been completed. Bank reconciliation statement ~ May 10000000 Balance per bank: Add: deposit in transit from Cliff's Notes deposit in transit from Attic Books Deduct: outstanding check outstanding check Adjusted balance per bank Balance per book: Add: interest earned Cover 2 Cover Bank Reconciliation Statement May 31, 2020 Deduct: bank service charge Adjusted balance per book $3,715 790 No. 901 $5,600 No. 902 800 $29,254 4,505 33,759 6,400 $27,359 $27,244 122 27,366 7 $27,359 Bank statement ~ June Neville Cooper 827 McGee Avenue Miami, FL 33109 Cover 2 Cover Date Particulars JUN 1 BALANCE BROUGHT FORWARD JUN 4 JUN 5 JUN 6 JUN 6 JUN 6 LOAN 902 DEPOSIT - Cliff's Notes DEPOSIT - Attic Books 901 903 DEPOSIT - Cash sales JUN 7 JUN 9 JUN 10 904 JUN 13 JUN 14 905 JUN 17 JUN 19 907 JUN 20 DEPOSIT - Cash sales DEPOSIT - Attic Books DEPOSIT - Cash sales DEPOSIT - Gimmicks NSF CHECK- Gimmicks DEPOSIT - Cash sales 908 DEPOSIT - Cliff's Notes DEPOSIT - Cash sales JUN 21 JUN 24 JUN 27 JUN 28 JUN 30 JUN 30 JUN 30 JUN 30 INTEREST JUN 30 SERVICE CHARGE 910 Last statement to This statement to 05/31/20 06/30/20 Debit $800 $5,600 $1,787 $2,787 $3,750 $5,746 $1,000 $4,227 $5,323 $7 Total debits $31,027 Credit $43,000 $3,715 $790 $7,830 $11,394 $2,993 $9,191 $1,000 $9,595 $3,027 $6,699 $231 Total credits $99,465 EASTPAC Miami branch Account No. 27900920 1 Page No. Balance $29,254 CR $72,254 CR $71,454 CR $75,169 CR $75,959 CR $70,359 CR $68,572 CR $76,402 CR $73,615 CR $85,009 CR $81,259 CR $84,252 CR $78,506 CR $87,697 CR $88,697 CR $87,697 CR $97,292 CR $93,065 CR $96,092 CR $102,791 CR $97,468 CR $97,699 CR $97,692 CR Final balance $97,692 CR Proceeds of checks will not be available until cleared. All entries for the last business day are subject to verification and authorization. Any items not paid, or withdrawn, will be adjusted by reversal entry on a later statement. NSF means Not-Sufficient-Funds. CASH RECEIPTS JOURNAL Date Jun 1 Bank Loan Payable Jun 5 Sales Revenue Jun 11 ARC-Attic Books Jun 12 Sales Revenue Jun 19 ARC - Gimmicks Jun 19 Sales Revenue Jun 20 ARC Outlines Jun 26 Sales Revenue Jun 30 ARC- Cliff's Notes Jun 30 Sales Revenue Total Post reference Account CASH PAYMENTS JOURNAL Date Total Post reference Account Jun 2 APC-Albatross Jun 4 APC-Booked Inn Jun 7 Purchases Jun 13 APC Books R Us Jun 15 Wages Expense Jun 26 APC Stompson Jun 28 APC - Noir Novels Jun 29 Wages Expense Jun 30 Salary Expense Post Ref. 250 X 110-1 X 110-6 X 110-3 X 110-4 X Check No. 903 904 905 906 907 908 909 910 911 Cash Debit 43,000 7,830 2,993 11,394 1,000 9,191 2,757 9,595 3,027 6,699 97,486 (100) Post Ref. Credit Sales Sales Accounts Other Discounts Revenue Receivable Accounts 43,000 210-2 210-4 X 210-5 516 210-3 210-1 516 545 333 333 (402) 1,805 2,844 1,919 4,227 3,644 7,830 14,439 (210) 11,394 Debit Accounts Purchases Payable 9,191 9,595 6,699 44,709 (400) 3,750 3,750 (500) 3,326 1,000 2,757 3,027 10,110 (110) Other Accounts 5,746 5,323 5,300 16,369 (X) 43,000 (X) Cash Credit 1,787 2.787 3,750 1,919 5,746 4,227 3,644 5,323 5,300 34,483 (100) Purchase Discounts 18 57 75 (502) Show All Bank Reconciliation 0000000000001 Balance per bank: Add: deposit in transit deposit in transit Deduct: outstanding check outstanding check Adjusted balance per bank Balance per book Add: interest earned Deduct: bank service charge NSF check General Journal Subsidiary Ledgers General Ledger Cover 2 Cover Bank Reconciliation Statement June 30, 2020 Adjusted balance per book + + + + No. No. + No. + + + + 909 911 $ 2757 6699 3644 5300 231 7 1000 $ 97692 9456 107148 8944 98204 231 1007 GENERAL JOURNAL Date Jun 9 Sales Returns and Allowances Jun 9 ARC Outlines (sales return) Jun 18 APC - Stompson Jun 18 Purchase Returns and Allowances (purchase return) Jun 30 Cash Jun 30 Jun 30 Admin. Expense - Bank Charges (select) Cash (select) Jun 30 ARC - Gimmicks Date Account and Explanation Interest Revenue SUBSIDIARY LEDGERS Account: ARC - Congo.com Account No. 110-5 Jun Cash Jun May 31 Balance Jun 15 Credit sale Jun 30 30 30 Description (select) (select) Jun 30 Balance (select) (select) (select) (select) Ref. Post Ref. SJ + + 401 110/110-3 210/210-3 501 100 403 572 100 110/110-6 100 Debit 4,060 Debit 5,204 ay sheldon 1,434 231 0 7 0 1000 0 Credit Credit 5,204 DANC ey sheldon ONEY SHELDON 1,434 STROF 0 231 0 7 0 1000 Account: ARC - Gimmicks Account No. 110-6 Date Jun May Jun Jun 19 Repayment Jun 24 Credit sale Jun 30 NSF check Jun Jun 30 Date GENERAL LEDGER Account: Cash Account No. 100. May Jun Jun Jun Jun 31 Balance 13 Credit sale 30 31 Balance 30 Total from cash receipts journal 30 Total from cash payments journal 30 interest earned Jun 30 bank charges Jun 30 NSF check Date 30 Balance Jun 30 Balance Description 30 Jun Jun Jun 30 Account: ARC - Accounts Receivable Control Account No. 110 Jun 30 May 31 Balance Jun 9 Sales return from Outlines Jun 30 Total from sales journal Jun 30 Total from cash receipts journal Jun 30 NSF check Description 30 30 Balance Description Ref. GJ SJ CRJ SJ + + + Ref. GJ GJ GJ GJ CRJ CPJ Ref. GJ SJ CRJ Debit 1,440 6,090 1000 Debit 97,486 231 1000 Debit 16,665 0 1000 By sheldon NEY SHELDON MIDDHIS DARAINER Credit 1,000 0 NETSHELDON SHELDRIS DNEY SELELDON Credit 34,483 Credit 20 RACE OF 0 0 7 5,204 ey sheldo 10,110 TH RAN OCEAN NOO O Balance 7530 0 1,440 DR 440 DR 6,530 DR DR 7530 DR Balance VERS HEART (Q-825-100.Cash_bankRec) HAROLD ROS SpePads Ferdit Relmes + 27,359 DR 124,845 DR 90,362 DR 90593 DR 90586 DR = 89586 EU DIANG 89586 DR Balance 10,456 DR 5,252 DR 21,917 DR 11,807 DR 12807 DR + 12807 DR + DEMIA SOTT TERRE (Q=825-110-0.ARControl_bankRec) CROSS MUTT TU CROSS DEMIN SOTT TER Lla SITE OFFISS DEMI AKOTT TE (Q=825-210-0.APControl_bankRec). Account: APC - Accounts Payable Control Account No. 210 Date May 31 Balance Jun 18 Purchase return to Stompson Jun 30 Total from purchases journal Jun Jun 30 Jun 30 Jun Jun Date 30 Total from cash payments journal Account: Interest Revenue Account No. 403 Jun 30 30 Balance Jun 30 Date May 31 Balance Jun 30 interested earned Jun 30 May Jun 30 Balance Account: Interest Expense Account No. 571 31 Balance 30 Description Jun 30 Jun 30 Description Jun 30 Balance Jun 30 Description Account: Admin. Expense - Bank Charges Account No. 572 Jun 30 Date May 31 Balance Jun 30 Bank service charg Description Jun 30 Balance Ref. Ref. GJ + Ref. Ref. GJ + + # GJ PJ CPJ Debit 14,439 Debit Debit 1,434 Debit 0 7 Credit SHELIHIN NG SHELDHES DA DNEY SHELDON SAN Credit 6,430 231 Credit (Q-825-403. InterestRevenue_bankRec) ONEY SHELDON HEART By sheldon NEYSHELDON RAGE OF Credit By sheldon OKEY SHELDON 0 Balance REA NOT 11,473 CR 10,039 CR 16,469 CR 2,030 CR 2030 CR + COONTZ DEAN NOG HABOLD Balance 231 CR 231 SEDUNTY Mt. Minder (Q=825-571. Interest Expense_bankRec) 0 DMAN BOO Balance CRE DRAN Balance 0 7 DR 7 DR recelia RIVERS (Q=825-572.BankCharges_bankRec) HEART 0 + HAROLD ROO WANTED DEMO MUTT TLUE RIVERS SCOTT TER COROSS DEMI SKOTT TEMAN MOTT TER Now that you have completed the end of month posting procedure, you are required to prepare a bank reconciliation as at June 30, 2020. The purpose of the bank reconciliation process is to reconcile the balance of cash shown in the company's ledger account against the balance of cash reported in the bank statement. Instructions for bank reconciliation 1) Prepare the bank reconciliation statement as at June 30, 2020. To do this, you will need to use: the previous month's bank reconciliation statement, and the current month's bank statement and cash journals Note that the bank reconciliation statement provided below may contain more rows than required. 2) Use the bank reconciliation statement to record the relevant reconciling items in the general journal. 3) Post entries recorded in the general journal to the appropriate ledger accounts according to the company's accounting policies and procedures. 4) Record the updated balance of each ledger account in the Balance row of each ledger, even for ledgers with a balance of zero. Although each ledger already has a running balance, the Balance row must still be filled out in order to receive full points. Back-On-Track functionality Please note that any answers from previous pages carried through onto this page (either on the page or in a popup information page) have been reset, if necessary, to the correct answers. Your particular answers from previous pages are no longer shown. Remember: Enter all answers to the nearest whole dollar. There may be entries in the general journal that require posting to both a control account and a subsidiary ledger. In these cases, after you have posted to both ledgers, you should enter the reference for both the general ledger account and the subsidiary ledger account in the Post Ref. column to indicate that you have posted to both accounts. For example, if the reference number for the control account is 110 and the reference number for the subsidiary ledger account is 110-1, you should type '110/110-1' into the Post Ref. column. You are also required to apply the journals and ledgers instructions provided in previous weeks. Before pressing the Submit answers button, we recommend that you click the Show All tab and check that all relevant accounting records have been completed. Bank reconciliation statement ~ May 10000000 Balance per bank: Add: deposit in transit from Cliff's Notes deposit in transit from Attic Books Deduct: outstanding check outstanding check Adjusted balance per bank Balance per book: Add: interest earned Cover 2 Cover Bank Reconciliation Statement May 31, 2020 Deduct: bank service charge Adjusted balance per book $3,715 790 No. 901 $5,600 No. 902 800 $29,254 4,505 33,759 6,400 $27,359 $27,244 122 27,366 7 $27,359 Bank statement ~ June Neville Cooper 827 McGee Avenue Miami, FL 33109 Cover 2 Cover Date Particulars JUN 1 BALANCE BROUGHT FORWARD JUN 4 JUN 5 JUN 6 JUN 6 JUN 6 LOAN 902 DEPOSIT - Cliff's Notes DEPOSIT - Attic Books 901 903 DEPOSIT - Cash sales JUN 7 JUN 9 JUN 10 904 JUN 13 JUN 14 905 JUN 17 JUN 19 907 JUN 20 DEPOSIT - Cash sales DEPOSIT - Attic Books DEPOSIT - Cash sales DEPOSIT - Gimmicks NSF CHECK- Gimmicks DEPOSIT - Cash sales 908 DEPOSIT - Cliff's Notes DEPOSIT - Cash sales JUN 21 JUN 24 JUN 27 JUN 28 JUN 30 JUN 30 JUN 30 JUN 30 INTEREST JUN 30 SERVICE CHARGE 910 Last statement to This statement to 05/31/20 06/30/20 Debit $800 $5,600 $1,787 $2,787 $3,750 $5,746 $1,000 $4,227 $5,323 $7 Total debits $31,027 Credit $43,000 $3,715 $790 $7,830 $11,394 $2,993 $9,191 $1,000 $9,595 $3,027 $6,699 $231 Total credits $99,465 EASTPAC Miami branch Account No. 27900920 1 Page No. Balance $29,254 CR $72,254 CR $71,454 CR $75,169 CR $75,959 CR $70,359 CR $68,572 CR $76,402 CR $73,615 CR $85,009 CR $81,259 CR $84,252 CR $78,506 CR $87,697 CR $88,697 CR $87,697 CR $97,292 CR $93,065 CR $96,092 CR $102,791 CR $97,468 CR $97,699 CR $97,692 CR Final balance $97,692 CR Proceeds of checks will not be available until cleared. All entries for the last business day are subject to verification and authorization. Any items not paid, or withdrawn, will be adjusted by reversal entry on a later statement. NSF means Not-Sufficient-Funds. CASH RECEIPTS JOURNAL Date Jun 1 Bank Loan Payable Jun 5 Sales Revenue Jun 11 ARC-Attic Books Jun 12 Sales Revenue Jun 19 ARC - Gimmicks Jun 19 Sales Revenue Jun 20 ARC Outlines Jun 26 Sales Revenue Jun 30 ARC- Cliff's Notes Jun 30 Sales Revenue Total Post reference Account CASH PAYMENTS JOURNAL Date Total Post reference Account Jun 2 APC-Albatross Jun 4 APC-Booked Inn Jun 7 Purchases Jun 13 APC Books R Us Jun 15 Wages Expense Jun 26 APC Stompson Jun 28 APC - Noir Novels Jun 29 Wages Expense Jun 30 Salary Expense Post Ref. 250 X 110-1 X 110-6 X 110-3 X 110-4 X Check No. 903 904 905 906 907 908 909 910 911 Cash Debit 43,000 7,830 2,993 11,394 1,000 9,191 2,757 9,595 3,027 6,699 97,486 (100) Post Ref. Credit Sales Sales Accounts Other Discounts Revenue Receivable Accounts 43,000 210-2 210-4 X 210-5 516 210-3 210-1 516 545 333 333 (402) 1,805 2,844 1,919 4,227 3,644 7,830 14,439 (210) 11,394 Debit Accounts Purchases Payable 9,191 9,595 6,699 44,709 (400) 3,750 3,750 (500) 3,326 1,000 2,757 3,027 10,110 (110) Other Accounts 5,746 5,323 5,300 16,369 (X) 43,000 (X) Cash Credit 1,787 2.787 3,750 1,919 5,746 4,227 3,644 5,323 5,300 34,483 (100) Purchase Discounts 18 57 75 (502) Show All Bank Reconciliation 0000000000001 Balance per bank: Add: deposit in transit deposit in transit Deduct: outstanding check outstanding check Adjusted balance per bank Balance per book Add: interest earned Deduct: bank service charge NSF check General Journal Subsidiary Ledgers General Ledger Cover 2 Cover Bank Reconciliation Statement June 30, 2020 Adjusted balance per book + + + + No. No. + No. + + + + 909 911 $ 2757 6699 3644 5300 231 7 1000 $ 97692 9456 107148 8944 98204 231 1007 GENERAL JOURNAL Date Jun 9 Sales Returns and Allowances Jun 9 ARC Outlines (sales return) Jun 18 APC - Stompson Jun 18 Purchase Returns and Allowances (purchase return) Jun 30 Cash Jun 30 Jun 30 Admin. Expense - Bank Charges (select) Cash (select) Jun 30 ARC - Gimmicks Date Account and Explanation Interest Revenue SUBSIDIARY LEDGERS Account: ARC - Congo.com Account No. 110-5 Jun Cash Jun May 31 Balance Jun 15 Credit sale Jun 30 30 30 Description (select) (select) Jun 30 Balance (select) (select) (select) (select) Ref. Post Ref. SJ + + 401 110/110-3 210/210-3 501 100 403 572 100 110/110-6 100 Debit 4,060 Debit 5,204 ay sheldon 1,434 231 0 7 0 1000 0 Credit Credit 5,204 DANC ey sheldon ONEY SHELDON 1,434 STROF 0 231 0 7 0 1000 Account: ARC - Gimmicks Account No. 110-6 Date Jun May Jun Jun 19 Repayment Jun 24 Credit sale Jun 30 NSF check Jun Jun 30 Date GENERAL LEDGER Account: Cash Account No. 100. May Jun Jun Jun Jun 31 Balance 13 Credit sale 30 31 Balance 30 Total from cash receipts journal 30 Total from cash payments journal 30 interest earned Jun 30 bank charges Jun 30 NSF check Date 30 Balance Jun 30 Balance Description 30 Jun Jun Jun 30 Account: ARC - Accounts Receivable Control Account No. 110 Jun 30 May 31 Balance Jun 9 Sales return from Outlines Jun 30 Total from sales journal Jun 30 Total from cash receipts journal Jun 30 NSF check Description 30 30 Balance Description Ref. GJ SJ CRJ SJ + + + Ref. GJ GJ GJ GJ CRJ CPJ Ref. GJ SJ CRJ Debit 1,440 6,090 1000 Debit 97,486 231 1000 Debit 16,665 0 1000 By sheldon NEY SHELDON MIDDHIS DARAINER Credit 1,000 0 NETSHELDON SHELDRIS DNEY SELELDON Credit 34,483 Credit 20 RACE OF 0 0 7 5,204 ey sheldo 10,110 TH RAN OCEAN NOO O Balance 7530 0 1,440 DR 440 DR 6,530 DR DR 7530 DR Balance VERS HEART (Q-825-100.Cash_bankRec) HAROLD ROS SpePads Ferdit Relmes + 27,359 DR 124,845 DR 90,362 DR 90593 DR 90586 DR = 89586 EU DIANG 89586 DR Balance 10,456 DR 5,252 DR 21,917 DR 11,807 DR 12807 DR + 12807 DR + DEMIA SOTT TERRE (Q=825-110-0.ARControl_bankRec) CROSS MUTT TU CROSS DEMIN SOTT TER Lla SITE OFFISS DEMI AKOTT TE (Q=825-210-0.APControl_bankRec). Account: APC - Accounts Payable Control Account No. 210 Date May 31 Balance Jun 18 Purchase return to Stompson Jun 30 Total from purchases journal Jun Jun 30 Jun 30 Jun Jun Date 30 Total from cash payments journal Account: Interest Revenue Account No. 403 Jun 30 30 Balance Jun 30 Date May 31 Balance Jun 30 interested earned Jun 30 May Jun 30 Balance Account: Interest Expense Account No. 571 31 Balance 30 Description Jun 30 Jun 30 Description Jun 30 Balance Jun 30 Description Account: Admin. Expense - Bank Charges Account No. 572 Jun 30 Date May 31 Balance Jun 30 Bank service charg Description Jun 30 Balance Ref. Ref. GJ + Ref. Ref. GJ + + # GJ PJ CPJ Debit 14,439 Debit Debit 1,434 Debit 0 7 Credit SHELIHIN NG SHELDHES DA DNEY SHELDON SAN Credit 6,430 231 Credit (Q-825-403. InterestRevenue_bankRec) ONEY SHELDON HEART By sheldon NEYSHELDON RAGE OF Credit By sheldon OKEY SHELDON 0 Balance REA NOT 11,473 CR 10,039 CR 16,469 CR 2,030 CR 2030 CR + COONTZ DEAN NOG HABOLD Balance 231 CR 231 SEDUNTY Mt. Minder (Q=825-571. Interest Expense_bankRec) 0 DMAN BOO Balance CRE DRAN Balance 0 7 DR 7 DR recelia RIVERS (Q=825-572.BankCharges_bankRec) HEART 0 + HAROLD ROO WANTED DEMO MUTT TLUE RIVERS SCOTT TER COROSS DEMI SKOTT TEMAN MOTT TER Now that you have completed the end of month posting procedure, you are required to prepare a bank reconciliation as at June 30, 2020. The purpose of the bank reconciliation process is to reconcile the balance of cash shown in the company's ledger account against the balance of cash reported in the bank statement. Instructions for bank reconciliation 1) Prepare the bank reconciliation statement as at June 30, 2020. To do this, you will need to use: the previous month's bank reconciliation statement, and the current month's bank statement and cash journals Note that the bank reconciliation statement provided below may contain more rows than required. 2) Use the bank reconciliation statement to record the relevant reconciling items in the general journal. 3) Post entries recorded in the general journal to the appropriate ledger accounts according to the company's accounting policies and procedures. 4) Record the updated balance of each ledger account in the Balance row of each ledger, even for ledgers with a balance of zero. Although each ledger already has a running balance, the Balance row must still be filled out in order to receive full points. Back-On-Track functionality Please note that any answers from previous pages carried through onto this page (either on the page or in a popup information page) have been reset, if necessary, to the correct answers. Your particular answers from previous pages are no longer shown. Remember: Enter all answers to the nearest whole dollar. There may be entries in the general journal that require posting to both a control account and a subsidiary ledger. In these cases, after you have posted to both ledgers, you should enter the reference for both the general ledger account and the subsidiary ledger account in the Post Ref. column to indicate that you have posted to both accounts. For example, if the reference number for the control account is 110 and the reference number for the subsidiary ledger account is 110-1, you should type '110/110-1' into the Post Ref. column. You are also required to apply the journals and ledgers instructions provided in previous weeks. Before pressing the Submit answers button, we recommend that you click the Show All tab and check that all relevant accounting records have been completed. Bank reconciliation statement ~ May 10000000 Balance per bank: Add: deposit in transit from Cliff's Notes deposit in transit from Attic Books Deduct: outstanding check outstanding check Adjusted balance per bank Balance per book: Add: interest earned Cover 2 Cover Bank Reconciliation Statement May 31, 2020 Deduct: bank service charge Adjusted balance per book $3,715 790 No. 901 $5,600 No. 902 800 $29,254 4,505 33,759 6,400 $27,359 $27,244 122 27,366 7 $27,359 Bank statement ~ June Neville Cooper 827 McGee Avenue Miami, FL 33109 Cover 2 Cover Date Particulars JUN 1 BALANCE BROUGHT FORWARD JUN 4 JUN 5 JUN 6 JUN 6 JUN 6 LOAN 902 DEPOSIT - Cliff's Notes DEPOSIT - Attic Books 901 903 DEPOSIT - Cash sales JUN 7 JUN 9 JUN 10 904 JUN 13 JUN 14 905 JUN 17 JUN 19 907 JUN 20 DEPOSIT - Cash sales DEPOSIT - Attic Books DEPOSIT - Cash sales DEPOSIT - Gimmicks NSF CHECK- Gimmicks DEPOSIT - Cash sales 908 DEPOSIT - Cliff's Notes DEPOSIT - Cash sales JUN 21 JUN 24 JUN 27 JUN 28 JUN 30 JUN 30 JUN 30 JUN 30 INTEREST JUN 30 SERVICE CHARGE 910 Last statement to This statement to 05/31/20 06/30/20 Debit $800 $5,600 $1,787 $2,787 $3,750 $5,746 $1,000 $4,227 $5,323 $7 Total debits $31,027 Credit $43,000 $3,715 $790 $7,830 $11,394 $2,993 $9,191 $1,000 $9,595 $3,027 $6,699 $231 Total credits $99,465 EASTPAC Miami branch Account No. 27900920 1 Page No. Balance $29,254 CR $72,254 CR $71,454 CR $75,169 CR $75,959 CR $70,359 CR $68,572 CR $76,402 CR $73,615 CR $85,009 CR $81,259 CR $84,252 CR $78,506 CR $87,697 CR $88,697 CR $87,697 CR $97,292 CR $93,065 CR $96,092 CR $102,791 CR $97,468 CR $97,699 CR $97,692 CR Final balance $97,692 CR Proceeds of checks will not be available until cleared. All entries for the last business day are subject to verification and authorization. Any items not paid, or withdrawn, will be adjusted by reversal entry on a later statement. NSF means Not-Sufficient-Funds. CASH RECEIPTS JOURNAL Date Jun 1 Bank Loan Payable Jun 5 Sales Revenue Jun 11 ARC-Attic Books Jun 12 Sales Revenue Jun 19 ARC - Gimmicks Jun 19 Sales Revenue Jun 20 ARC Outlines Jun 26 Sales Revenue Jun 30 ARC- Cliff's Notes Jun 30 Sales Revenue Total Post reference Account CASH PAYMENTS JOURNAL Date Total Post reference Account Jun 2 APC-Albatross Jun 4 APC-Booked Inn Jun 7 Purchases Jun 13 APC Books R Us Jun 15 Wages Expense Jun 26 APC Stompson Jun 28 APC - Noir Novels Jun 29 Wages Expense Jun 30 Salary Expense Post Ref. 250 X 110-1 X 110-6 X 110-3 X 110-4 X Check No. 903 904 905 906 907 908 909 910 911 Cash Debit 43,000 7,830 2,993 11,394 1,000 9,191 2,757 9,595 3,027 6,699 97,486 (100) Post Ref. Credit Sales Sales Accounts Other Discounts Revenue Receivable Accounts 43,000 210-2 210-4 X 210-5 516 210-3 210-1 516 545 333 333 (402) 1,805 2,844 1,919 4,227 3,644 7,830 14,439 (210) 11,394 Debit Accounts Purchases Payable 9,191 9,595 6,699 44,709 (400) 3,750 3,750 (500) 3,326 1,000 2,757 3,027 10,110 (110) Other Accounts 5,746 5,323 5,300 16,369 (X) 43,000 (X) Cash Credit 1,787 2.787 3,750 1,919 5,746 4,227 3,644 5,323 5,300 34,483 (100) Purchase Discounts 18 57 75 (502) Show All Bank Reconciliation 0000000000001 Balance per bank: Add: deposit in transit deposit in transit Deduct: outstanding check outstanding check Adjusted balance per bank Balance per book Add: interest earned Deduct: bank service charge NSF check General Journal Subsidiary Ledgers General Ledger Cover 2 Cover Bank Reconciliation Statement June 30, 2020 Adjusted balance per book + + + + No. No. + No. + + + + 909 911 $ 2757 6699 3644 5300 231 7 1000 $ 97692 9456 107148 8944 98204 231 1007 GENERAL JOURNAL Date Jun 9 Sales Returns and Allowances Jun 9 ARC Outlines (sales return) Jun 18 APC - Stompson Jun 18 Purchase Returns and Allowances (purchase return) Jun 30 Cash Jun 30 Jun 30 Admin. Expense - Bank Charges (select) Cash (select) Jun 30 ARC - Gimmicks Date Account and Explanation Interest Revenue SUBSIDIARY LEDGERS Account: ARC - Congo.com Account No. 110-5 Jun Cash Jun May 31 Balance Jun 15 Credit sale Jun 30 30 30 Description (select) (select) Jun 30 Balance (select) (select) (select) (select) Ref. Post Ref. SJ + + 401 110/110-3 210/210-3 501 100 403 572 100 110/110-6 100 Debit 4,060 Debit 5,204 ay sheldon 1,434 231 0 7 0 1000 0 Credit Credit 5,204 DANC ey sheldon ONEY SHELDON 1,434 STROF 0 231 0 7 0 1000 Account: ARC - Gimmicks Account No. 110-6 Date Jun May Jun Jun 19 Repayment Jun 24 Credit sale Jun 30 NSF check Jun Jun 30 Date GENERAL LEDGER Account: Cash Account No. 100. May Jun Jun Jun Jun 31 Balance 13 Credit sale 30 31 Balance 30 Total from cash receipts journal 30 Total from cash payments journal 30 interest earned Jun 30 bank charges Jun 30 NSF check Date 30 Balance Jun 30 Balance Description 30 Jun Jun Jun 30 Account: ARC - Accounts Receivable Control Account No. 110 Jun 30 May 31 Balance Jun 9 Sales return from Outlines Jun 30 Total from sales journal Jun 30 Total from cash receipts journal Jun 30 NSF check Description 30 30 Balance Description Ref. GJ SJ CRJ SJ + + + Ref. GJ GJ GJ GJ CRJ CPJ Ref. GJ SJ CRJ Debit 1,440 6,090 1000 Debit 97,486 231 1000 Debit 16,665 0 1000 By sheldon NEY SHELDON MIDDHIS DARAINER Credit 1,000 0 NETSHELDON SHELDRIS DNEY SELELDON Credit 34,483 Credit 20 RACE OF 0 0 7 5,204 ey sheldo 10,110 TH RAN OCEAN NOO O Balance 7530 0 1,440 DR 440 DR 6,530 DR DR 7530 DR Balance VERS HEART (Q-825-100.Cash_bankRec) HAROLD ROS SpePads Ferdit Relmes + 27,359 DR 124,845 DR 90,362 DR 90593 DR 90586 DR = 89586 EU DIANG 89586 DR Balance 10,456 DR 5,252 DR 21,917 DR 11,807 DR 12807 DR + 12807 DR + DEMIA SOTT TERRE (Q=825-110-0.ARControl_bankRec) CROSS MUTT TU CROSS DEMIN SOTT TER Lla SITE OFFISS DEMI AKOTT TE (Q=825-210-0.APControl_bankRec). Account: APC - Accounts Payable Control Account No. 210 Date May 31 Balance Jun 18 Purchase return to Stompson Jun 30 Total from purchases journal Jun Jun 30 Jun 30 Jun Jun Date 30 Total from cash payments journal Account: Interest Revenue Account No. 403 Jun 30 30 Balance Jun 30 Date May 31 Balance Jun 30 interested earned Jun 30 May Jun 30 Balance Account: Interest Expense Account No. 571 31 Balance 30 Description Jun 30 Jun 30 Description Jun 30 Balance Jun 30 Description Account: Admin. Expense - Bank Charges Account No. 572 Jun 30 Date May 31 Balance Jun 30 Bank service charg Description Jun 30 Balance Ref. Ref. GJ + Ref. Ref. GJ + + # GJ PJ CPJ Debit 14,439 Debit Debit 1,434 Debit 0 7 Credit SHELIHIN NG SHELDHES DA DNEY SHELDON SAN Credit 6,430 231 Credit (Q-825-403. InterestRevenue_bankRec) ONEY SHELDON HEART By sheldon NEYSHELDON RAGE OF Credit By sheldon OKEY SHELDON 0 Balance REA NOT 11,473 CR 10,039 CR 16,469 CR 2,030 CR 2030 CR + COONTZ DEAN NOG HABOLD Balance 231 CR 231 SEDUNTY Mt. Minder (Q=825-571. Interest Expense_bankRec) 0 DMAN BOO Balance CRE DRAN Balance 0 7 DR 7 DR recelia RIVERS (Q=825-572.BankCharges_bankRec) HEART 0 + HAROLD ROO WANTED DEMO MUTT TLUE RIVERS SCOTT TER COROSS DEMI SKOTT TEMAN MOTT TER

Step by Step Solution

★★★★★

3.68 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

ANSWER Note Ba...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started