Answered step by step

Verified Expert Solution

Question

1 Approved Answer

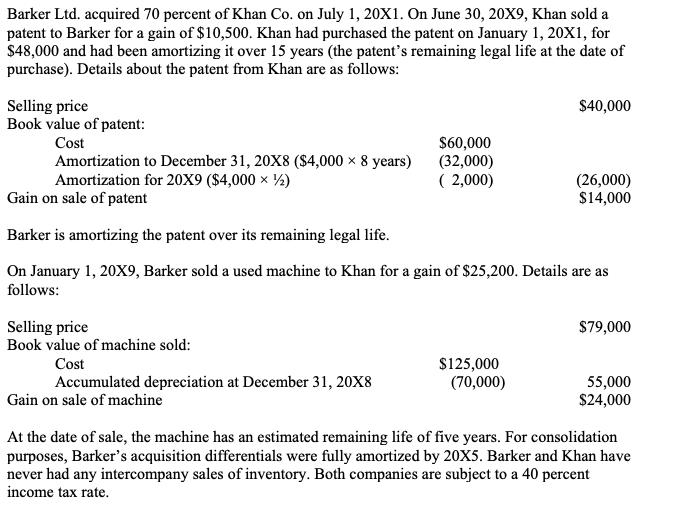

Barker Ltd. acquired 70 percent of Khan Co. on July 1, 20X1. On June 30, 20X9, Khan sold a patent to Barker for a

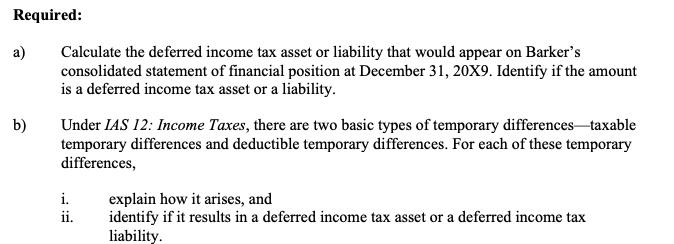

Barker Ltd. acquired 70 percent of Khan Co. on July 1, 20X1. On June 30, 20X9, Khan sold a patent to Barker for a gain of $10,500. Khan had purchased the patent on January 1, 20X1, for $48,000 and had been amortizing it over 15 years (the patent's remaining legal life at the date of purchase). Details about the patent from Khan are as follows: Selling price Book value of patent: Cost Amortization to December 31, 20X8 ($4,000 8 years) Amortization for 20X9 ($4,000 ) X Selling price Book value of machine sold: Cost Accumulated depreciation at December 31, 20X8 $60,000 (32,000) (2,000) Gain on sale of patent Barker is amortizing the patent over its remaining legal life. On January 1, 20X9, Barker sold a used machine to Khan for a gain of $25,200. Details are as follows: Gain on sale of machine $125,000 $40,000 (70,000) (26,000) $14,000 $79,000 55,000 $24,000 At the date of sale, the machine has an estimated remaining life of five years. For consolidation purposes, Barker's acquisition differentials were fully amortized by 20X5. Barker and Khan have never had any intercompany sales of inventory. Both companies are subject to a 40 percent income tax rate. Required: a) b) Calculate the deferred income tax asset or liability that would appear on Barker's consolidated statement of financial position at December 31, 20X9. Identify if the amount is a deferred income tax asset or a liability. Under IAS 12: Income Taxes, there are two basic types of temporary differences taxable temporary differences and deductible temporary differences. For each of these temporary differences, i. ii. explain how it arises, and identify if it results in a deferred income tax asset or a deferred income tax liability.

Step by Step Solution

★★★★★

3.41 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

a The deferred income tax asset or liability that would appear on Barkers conso...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started