Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Bartz Oil Company aquired the shooting rights on 25,000 acres at a cost of $1.00/acre on June 1, 2019. Bartz contract and paid $98,000

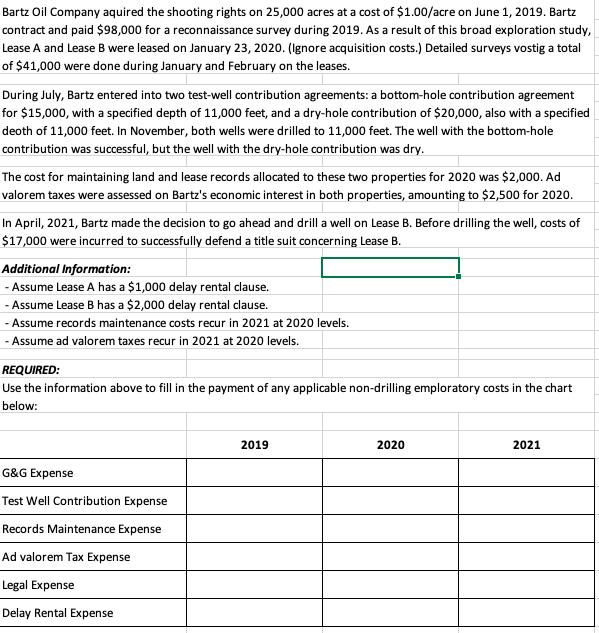

Bartz Oil Company aquired the shooting rights on 25,000 acres at a cost of $1.00/acre on June 1, 2019. Bartz contract and paid $98,000 for a reconnaissance survey during 2019. As a result of this broad exploration study, Lease A and Lease B were leased on January 23, 2020. (Ignore acquisition costs.) Detailed surveys vostig a total of $41,000 were done during January and February on the leases. During July, Bartz entered into two test-well contribution agreements: a bottom-hole contribution agreement for $15,000, with a specified depth of 11,000 feet, and a dry-hole contribution of $20,000, also with a specified deoth of 11,000 feet. In November, both wells were drilled to 11,000 feet. The well with the bottom-hole contribution was successful, but the well with the dry-hole contribution was dry. The cost for maintaining land and lease records allocated to these two properties for 2020 was $2,000. Ad valorem taxes were assessed on Bartz's economic interest in both properties, amounting to $2,500 for 2020. In April, 2021, Bartz made the decision to go ahead and drill a well on Lease B. Before drilling the well, costs of $17,000 were incurred to successfully defend a title suit concerning Lease B. Additional Information: - Assume Lease A has a $1,000 delay rental clause. - Assume Lease B has a $2,000 delay rental clause. - Assume records maintenance costs recur in 2021 at 2020 levels. - Assume ad valorem taxes recur in 2021 at 2020 levels. REQUIRED: Use the information above to fill in the payment of any applicable non-drilling emploratory costs in the chart below: G&G Expense Test Well Contribution Expense Records Maintenance Expense Ad valorem Tax Expense Legal Expense Delay Rental Expense 2019 2020 2021

Step by Step Solution

★★★★★

3.29 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

GG Expense 98000 2019 41000 2020 139000 Test Well Contri...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started