Answered step by step

Verified Expert Solution

Question

1 Approved Answer

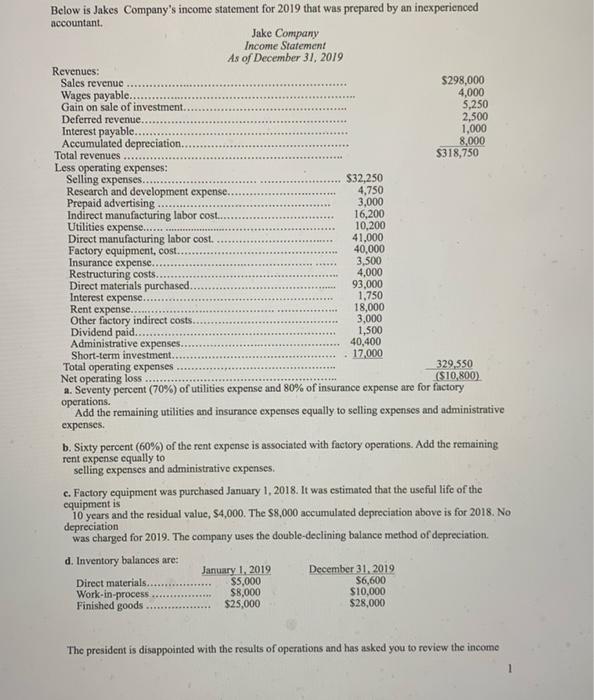

Below is Jakes Company's income statement for 2019 that was prepared by an inexperienced accountant. Jake Company Income Statement As of December 31, 2019

Below is Jakes Company's income statement for 2019 that was prepared by an inexperienced accountant. Jake Company Income Statement As of December 31, 2019 Revenues: Sales revenue $298,000 4,000 5,250 2,500 1,000 8,000 $318,750 Wages payable.. Gain on sale of investment.. Deferred revenue. Interest payable.. Accumulated depreciation. Total revenues Less operating expenses: Selling expenses.. Research and development expense. Prepaid advertising Indirect manufacturing labor cost.. Utilities expense.. Direct manufacturing labor cost. Factory equipment, cost. Insurance expense.. Restructuring costs. Direct materials purchased. Interest expense... Rent expense. Other factory indirect costs. Dividend paid.. Administrative expenses. Short-term investment. Total operating expenses Net operating loss a. Seventy percent (70%) of utilities expense and 80% of insurance expense are for factory operations. Add the remaining utilities and insurance expenses equally to selling expenses and administrative $32,250 4,750 3,000 16,200 10,200 41,000 40,000 3,500 4,000 93,000 1,750 18,000 3,000 1,500 40,400 17,000 329,550 (S10,800) expenses. b. Sixty percent (60%) of the rent expense is associated with factory operations. Add the remaining rent expense equally to selling expenses and administrative expenses. c. Factory equipment was purchased January 1, 2018. It was estimated that the useful life of the cquipment is 10 years and the residual value, $4,000. The $8,000 accumulated depreciation above is for 2018. No depreciation was charged for 2019. The company uses the double-declining balance method of depreciation. d. Inventory balances are: Direct materials.. Work-in-process Finished goods January 1, 2019 $5,000 $8,000 $25,000 December 31, 2019 $6,600 $10,000 $28,000 The president is disappointed with the results of operations and has asked you to review the income statement and make a recommendation as to whether the company should look for a buyer for its assets. Required: 1. As one step in gathering data for the president, prepare a corrected Statement of Cost of Goods Manufactured for the year ended December 31, 2019 2. As a second step, prepare a corrected multiple-step income statement for the year ended December 31, 2019. INSTRUCTIONS: A. This assignment must be completed in Excel. B. Handwritten work or late assignments will not be accepted. B. Grading of this assignment will be based on: 1. Accuracy of your statement of cost of goods manufactured and income statement 2. Use of formulas, neatness and formatting of your Excel schedule of cost of goods manufactured and income statement. NOTE: a) Do not use .00 after each number, or color your work.

Step by Step Solution

★★★★★

3.36 Rating (165 Votes )

There are 3 Steps involved in it

Step: 1

1 2 COST OF GOODS MANUFACTURED For the Year End December 31 2019 Direct ma...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started