Answered step by step

Verified Expert Solution

Question

1 Approved Answer

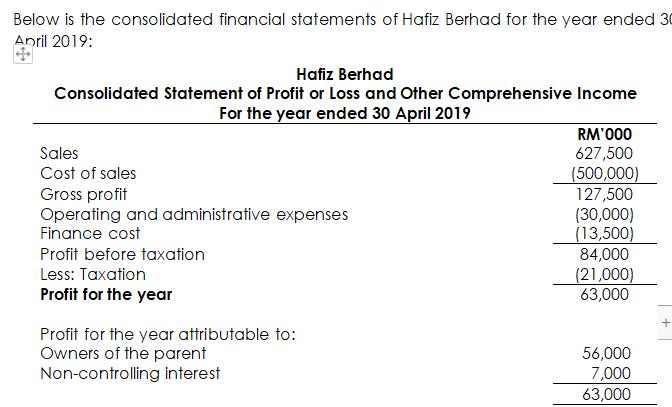

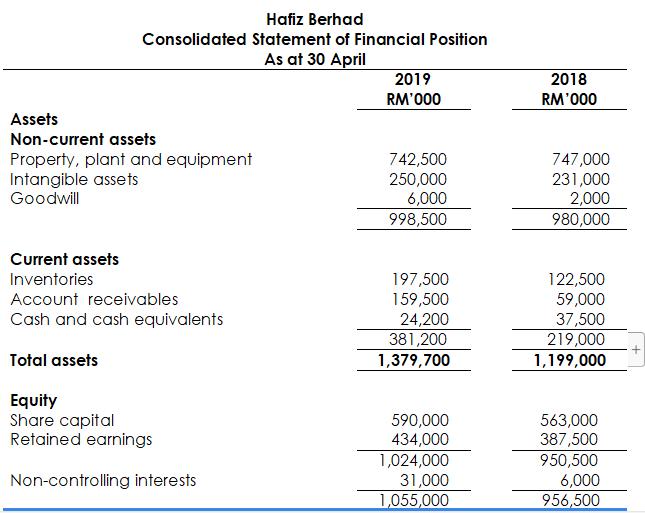

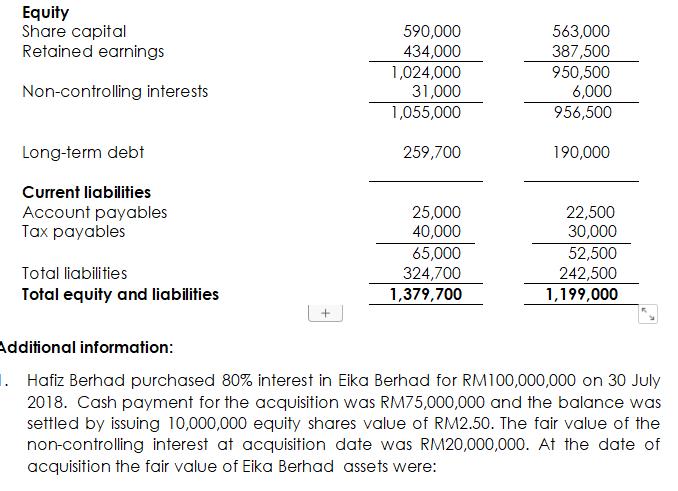

Below is the consolidated financial statements of Hafiz Berhad for the year ended 30 Anril 2019: Hafiz Berhad Consolidated Statement of Profit or Loss

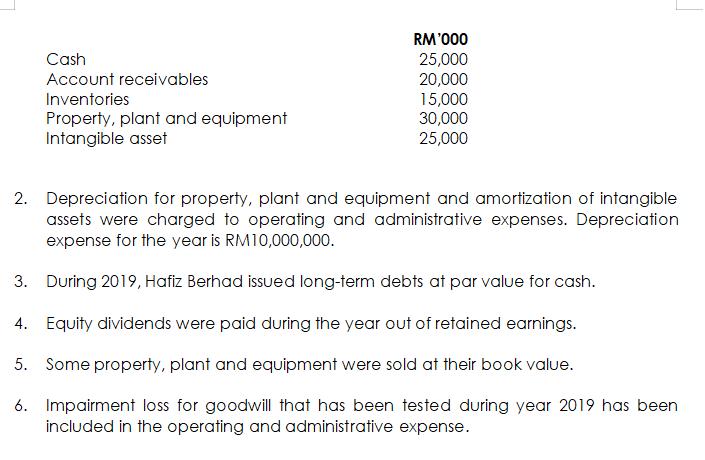

Below is the consolidated financial statements of Hafiz Berhad for the year ended 30 Anril 2019: Hafiz Berhad Consolidated Statement of Profit or Loss and Other Comprehensive Income For the year ended 30 April 2019 RM'000 Sales 627,500 (500,000) 127,500 (30,000) (13,500) 84,000 (21,000) 63,000 Cost of sales Gross profit Operating and administrative expenses Finance cost Profit before taxation Less: Taxation Profit for the year Profit for the year attributable to: Owners of the parent Non-controlling interest 56,000 7,000 63,000 Hafiz Berhad Consolidated Statement of Financial Position As at 30 April 2019 2018 RM'000 RM'000 Assets Non-current assets Property, plant and equipment Intangible assets Goodwill 742,500 250,000 6,000 747,000 231,000 2,000 998,500 980,000 Current assets 122,500 59,000 37,500 219,000 Inventories 197,500 159,500 24,200 381,200 1,379,700 Account receivables Cash and cash equivalents Total assets 1,199,000 Equity Share capital Retained earnings 590,000 434,000 1,024,000 31,000 1,055,000 563,000 387,500 950,500 6,000 956,500 Non-controlling interests Equity Share capital Retained earnings 563,000 387,500 950,500 6,000 956,500 590,000 434,000 1,024,000 31,000 1,055,000 Non-controlling interests Long-term debt 259,700 190,000 Current liabilities Account payables Tax payables 25,000 40,000 22,500 30,000 65,000 324,700 52,500 242,500 Total liabilities Total equity and liabilities 1,379,700 1,199,000 Additional information: 1. Hafiz Berhad purchased 80% interest in Eika Berhad for RM100,000,000 on 30 July 2018. Cash payment for the acquisition was RM75,000,000 and the balance was settled by issuing 10,000,000 equity shares value of RM2.50. The fair value of the non-controlling interest at acquisition date was RM20,000,000. At the date of acquisition the fair value of Eika Berhad assets were: RM'000 Cash 25,000 20,000 15,000 30,000 25,000 Account receivables Inventories Property, plant and equipment Intangible asset 2. Depreciation for property, plant and equipment and amortization of intangible assets were charged to operating and administrative expenses. Depreciation expense for the year is RM10,000,000. 3. During 2019, Hafiz Berhad issued long-term debts at par value for cash. 4. Equity dividends were paid during the year out of retained earnings. 5. Some property, plant and equipment were sold at their book value. 6. Impairment loss for goodwill that has been tested during year 2019 has been included in the operating and administrative expense. REQUIRED: Prepare the Consolidated Statement of Cash Flows of Hafiz Berhad for the financial year ended 30 April 2019 in accordance with MFRS 107 Statement of Cash Flows using the indirect method.

Step by Step Solution

★★★★★

3.45 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Hafiz Berhad Purchase 80 Intesrt in Eika Berhad Step 1 Hafiz Berhad buys 80 Eika Be...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started