Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Assume that the Florence Cavelier Companies, Inc., faced the following liability situations at June 30, 2018, the end of the company's fiscal year Show

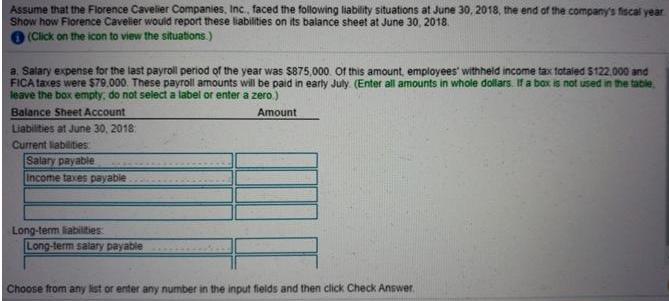

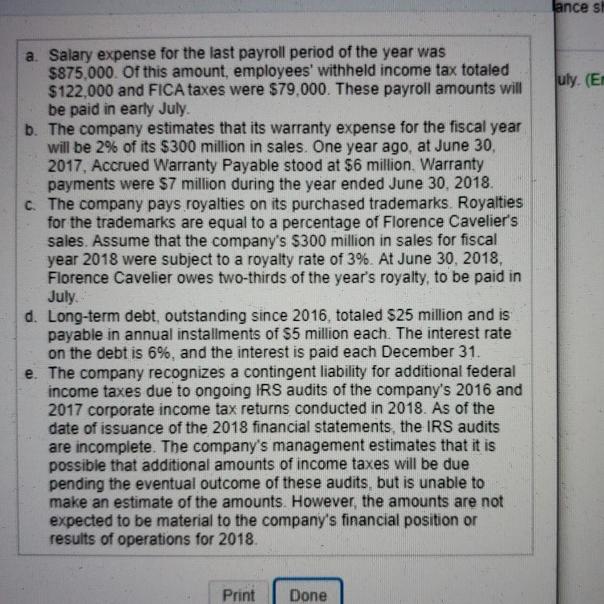

Assume that the Florence Cavelier Companies, Inc., faced the following liability situations at June 30, 2018, the end of the company's fiscal year Show how Florence Cavelier would report these liabilities on its balance sheet at June 30, 2018. O (Click on the icon to view the situations.) a. Salary expense for the last payroll period of the year was $875,000. Of this amount, employees' withheid income tax totaled $122.000 and FICA taxes were $79.000. These payroll amounts will be paid in earty July (Enter all amounts in whole dollars. If a box is not used in the table. leave the box empty, do not select a label or enter a zero) Balance Sheet Account Amount Liabilities at June 30, 2018: Current labilities Salary payable Income taxes payable Long-term liabilties Long-term salary payable Choose from any ist or enter any number in the input fields and then click Check Answer. ance st a. Salary expense for the last payroll period of the year was $875,000. Of this amount, employees' withheld income tax totaled $122,000 and FICA taxes were $79,000. These payroll amounts will be paid in early July. b. The company estimates that its warranty expense for the fiscal year will be 2% of its $300 million in sales. One year ago, at June 30, 2017, Accrued Warranty Payable stood at $6 million. Warranty payments were $7 million during the year ended June 30, 2018. C. The company pays royalties on its purchased trademarks. Royalties for the trademarks are equal to a percentage of Florence Cavelier's sales. Assume that the company's $300 million in sales for fiscal year 2018 were subject to a royalty rate of 3%. At June 30, 2018, Florence Cavelier owes two-thirds of the year's royalty, to be paid in July. d. Long-term debt, outstanding since 2016, totaled $25 million and is payable in annual installments of $5 million each. The interest rate on the debt is 6%, and the interest is paid each December 31. e. The company recognizes a contingent liability for additional federal income taxes due to ongoing IRS audits of the company's 2016 and 2017 corporate income tax returns conducted in 2018. As of the date of issuance of the 2018 financial statements, the IRS audits are incomplete. The company's management estimates that it is possible that additional amounts of income taxes will be due pending the eventual outcome of these audits, but is unable to make an estimate of the amounts. However, the amounts are not expected to be material to the company's financial position or results of operations for 2018. uly. (Em Print Done

Step by Step Solution

★★★★★

3.44 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

Reporting of liabilities by Florence Cavelier on its balance sheet at june 30 2018 are as under 1 Reporting of salary expenses Salary expenses payble ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started