Answered step by step

Verified Expert Solution

Question

1 Approved Answer

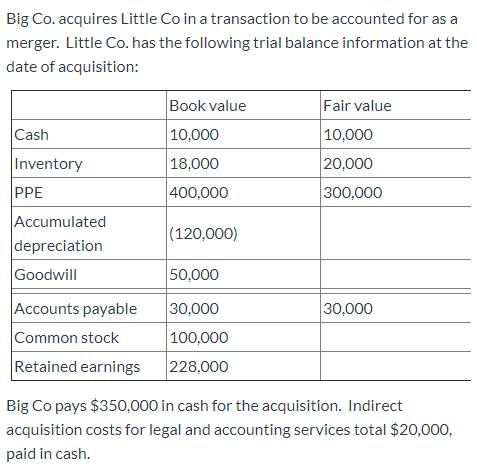

Big Co. acquires Little Co in a transaction to be accounted for as a merger. Little Co. has the following trial balance information at

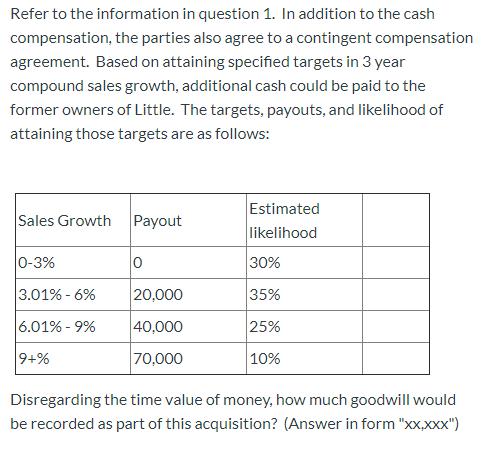

Big Co. acquires Little Co in a transaction to be accounted for as a merger. Little Co. has the following trial balance information at the date of acquisition: Book value Fair value Cash 10,000 10,000 Inventory 18,000 20,000 PPE 400,000 300,000 Accumulated depreciation (120,000) Goodwill 50,000 Accounts payable 30,000 30,000 Common stock Retained earnings 100,000 228,000 Big Co pays $350,000 in cash for the acquisition. Indirect acquisition costs for legal and accounting services total $20,000, paid in cash. Refer to the information in question 1. In addition to the cash compensation, the parties also agree to a contingent compensation agreement. Based on attaining specified targets in 3 year compound sales growth, additional cash could be paid to the former owners of Little. The targets, payouts, and likelihood of attaining those targets are as follows: Estimated Sales Growth Payout likelihood 0-3% 30% 3.01% - 6% 20,000 35% 6.01% - 9% 40,000 25% 9+% 70,000 10% Disregarding the time value of money, how much goodwill would be recorded as part of this acquisition? (Answer in form "xx,xXx")

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Calculation of Goodwill Particulars Amount Acquisition Cons...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started