Answered step by step

Verified Expert Solution

Question

1 Approved Answer

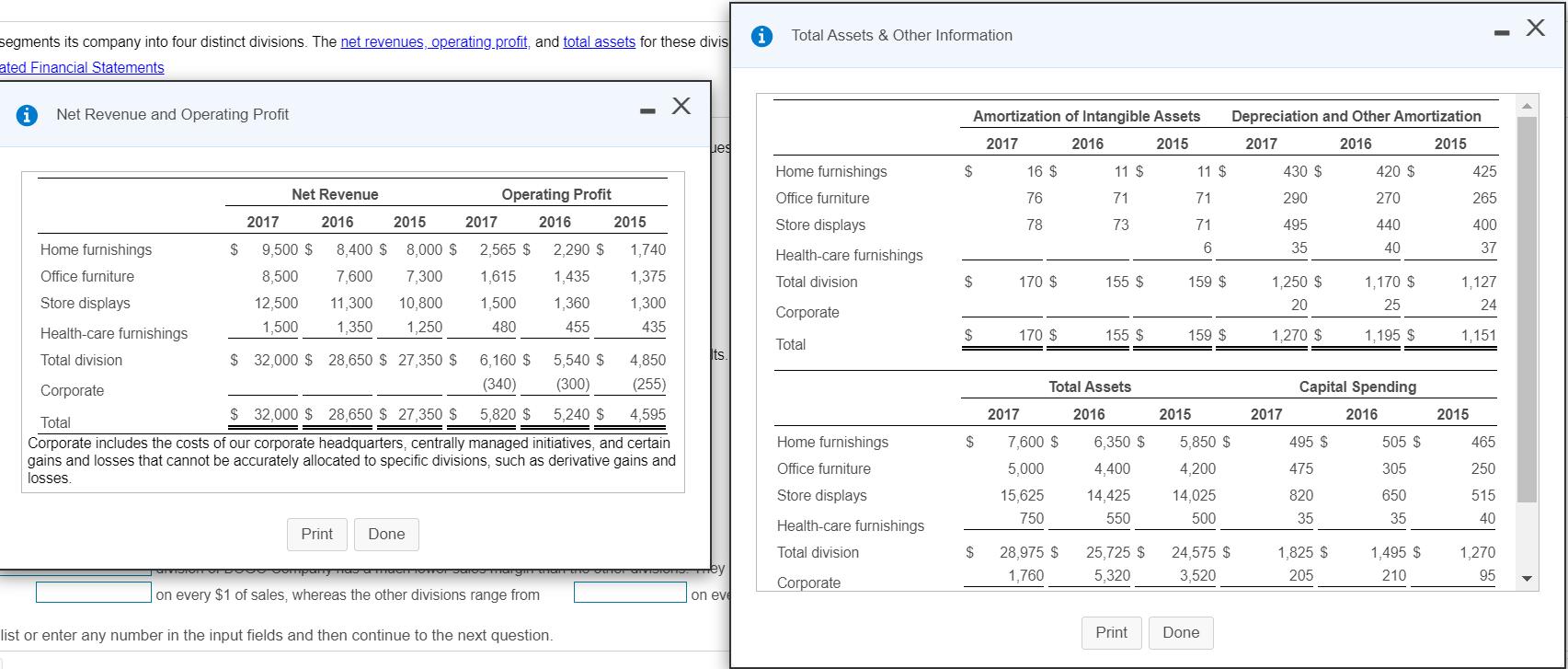

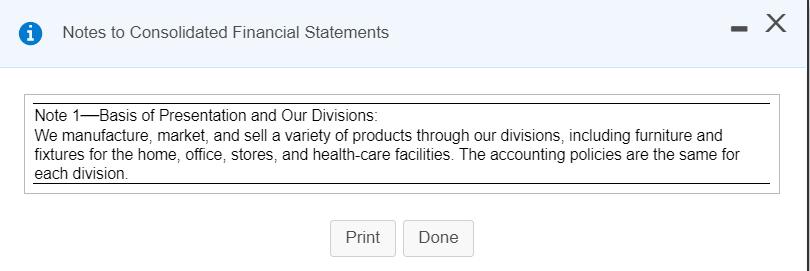

BOGO Company segments its company into four distinct divisions. The net revenues, operating profit, and total assets for these divisions are disclosed in the

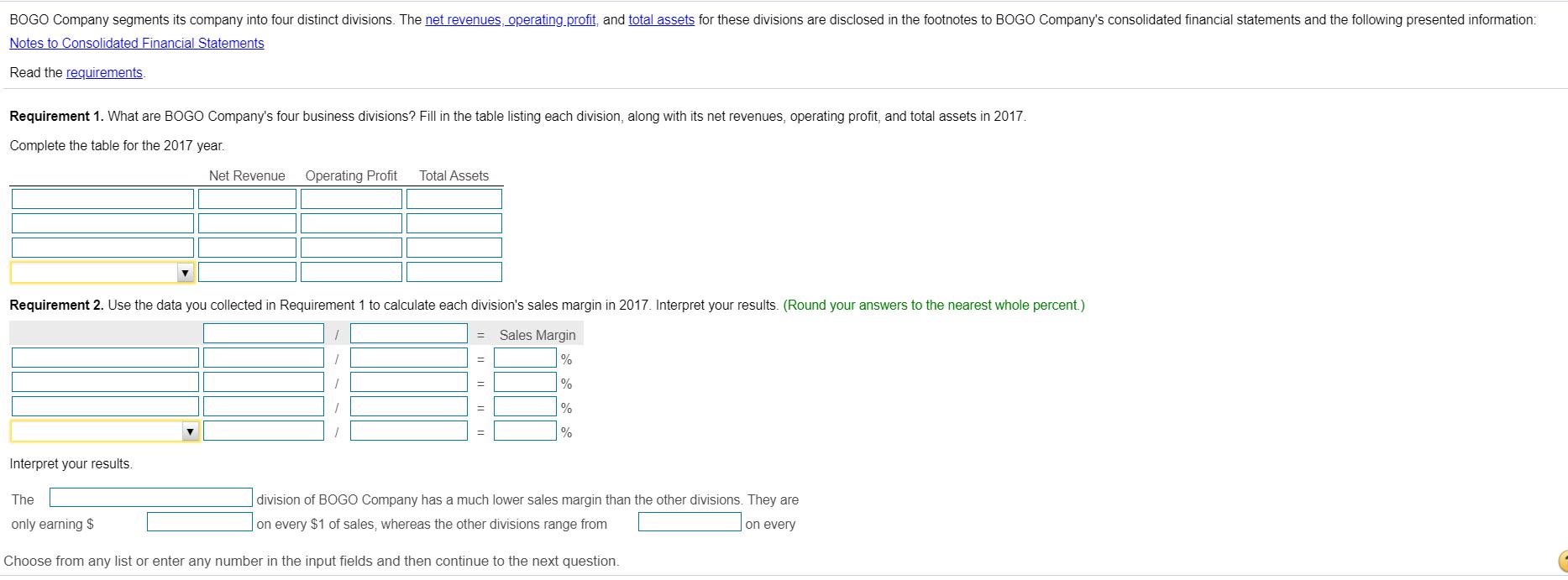

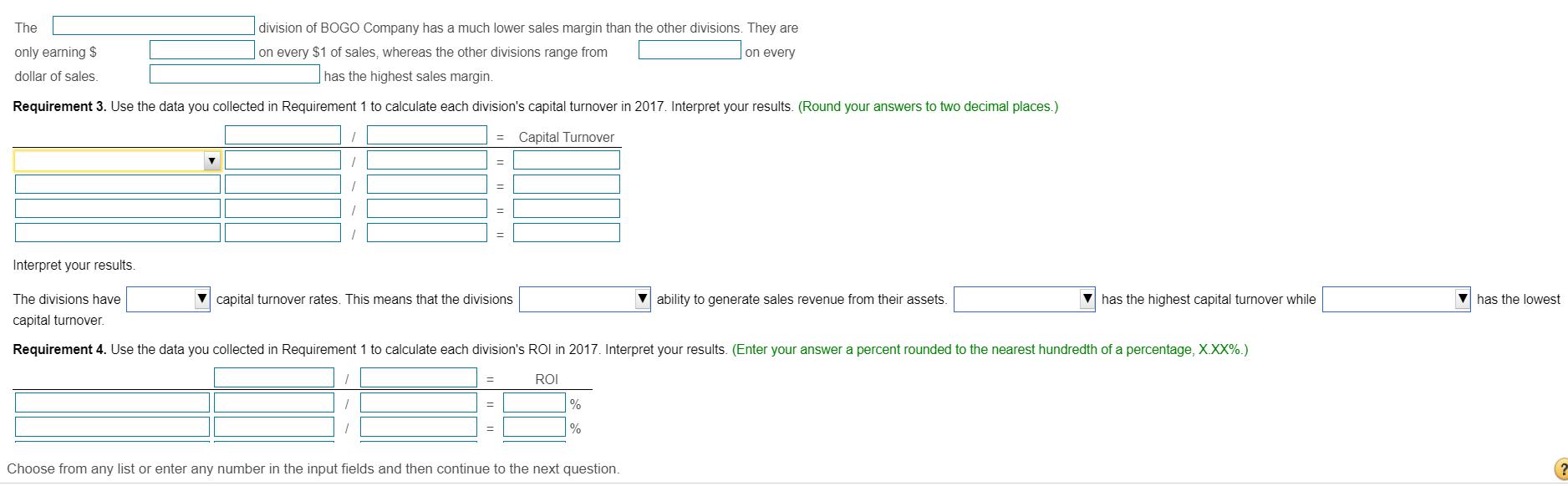

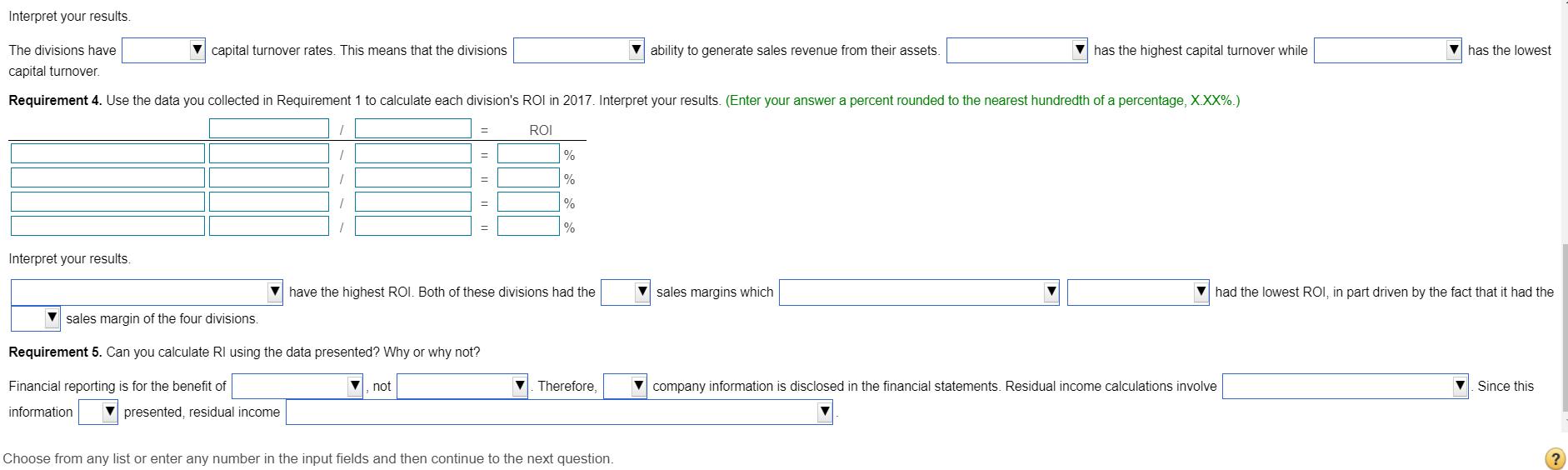

BOGO Company segments its company into four distinct divisions. The net revenues, operating profit, and total assets for these divisions are disclosed in the footnotes to BOGO Company's consolidated financial statements and the following presented information: Notes to Consolidated Financial Statements Read the requirements. Requirement 1. What are BOGO Company's four business divisions? Fill in the table listing each division, along with its net revenues, operating profit, and total assets in 2017. Complete the table for the 2017 year. Net Revenue Operating Profit Interpret your results. Requirement 2. Use the data you collected in Requirement 1 to calculate each division's sales margin in 2017. Interpret your results. (Round your answers to the nearest whole percent.) = Sales Margin % % % % Total Assets 1 = division of BOGO Company has a much lower sales margin than the other divisions. They are on every $1 of sales, whereas the other divisions range from on every The only earning $ Choose from any list or enter any number in the input fields and then continue to the next question. The division of BOGO Company has a much lower sales margin than the other divisions. They are on every $1 of sales, whereas the other divisions range from on every only earning $ dollar of sales. has the highest sales margin. Requirement 3. Use the data you collected in Requirement 1 to calculate each division's capital turnover in 2017. Interpret your results. (Round your answers to two decimal places.) Capital Turnover Interpret your results. The divisions have capital turnover. T 1 1 1 capital turnover rates. This means that the divisions = = = = = = Requirement 4. Use the data you collected in Requirement 1 to calculate each division's ROI in 2017. Interpret your results. (Enter your answer a percent rounded to the nearest hundredth of a percentage, X.XX%.) ROI = % % ability to generate sales revenue from their assets. Choose from any list or enter any number in the input fields and then continue to the next question. has the highest capital turnover while has the lowest Interpret your results. The divisions have capital turnover. capital turnover rates. This means that the divisions Interpret your results. Requirement 4. Use the data you collected in Requirement 1 to calculate each division's ROI in 2017. Interpret your results. (Enter your answer a percent rounded to the nearest hundredth of a percentage, X.XX%.) ROI 7 1 1 presented, residual income = = sales margin of the four divisions. Requirement 5. Can you calculate RI using the data presented? Why or why not? Financial reporting is for the benef information not have the highest ROI. Both of these divisions had the % % % % Therefore, ability to generate sales revenue from their assets. Choose from any list or enter any number in the input fields and then continue to the next question. has the highest capital turnover while sales margins which has the lowest had the lowest ROI, in part driven by the fact that it had the company information is disclosed in the financial statements. Residual income calculations involve Since this ? segments its company into four distinct divisions. The net revenues, operating profit, and total assets for these divis ated Financial Statements i Net Revenue and Operating Profit Home furnishings Office furniture Store displays Net Revenue 2017 2,565 $ 1,615 1,500 480 6,160 $ 5,540 $ (340) (300) 5,820 $ 5,240 $ Health-care furnishings Total division Corporate 4,595 Total $32,000 $28,650 $ 27,350 $ Corporate includes the costs of our corporate headquarters, centrally managed initiatives, and certain gains and losses that cannot be accurately allocated to specific divisions, such as derivative gains and losses. DIVISION OF 2016 2015 8,400 $8,000 $ 7,600 7,300 11,300 10,800 1,350 1,250 $32,000 $28,650 $ 27,350 $ $ 2017 9,500 $ 8,500 12,500 1,500 Print Operating Profit 2016 2,290 $ 1,435 1,360 455 Done ompany mers of mere Toffor Sands margm on every $1 of sales, whereas the other divisions range from - X list or enter any number in the input fields and then continue to the next question. 2015 1,740 1,375 1,300 435 4,850 (255) ues ts. the other affidione. mey on eve i Total Assets & Other Information Home furnishings Office furniture Store displays Health-care furnishings Total division Corporate Total Home furnishings Office furniture Store displays Health-care furnishings Total division Corporate Amortization of Intangible Assets 2017 2016 2015 $ $ $ $ $ 16 $ 76 78 170 $ 170 $ 2017 7,600 $ 5,000 15,625 750 28,975 $ 1,760 11 $ 71 73 155 $ 155 $ Total Assets 2016 6,350 $ 4,400 14,425 550 25,725 $ 5,320 Print 11 $ 71 71 6 159 $ 159 $ 2015 5,850 $ 4,200 14,025 500 24,575 $ 3,520 Done Depreciation and Other Amortization 2017 2016 2015 430 $ 290 495 35 1,250 $ 20 1,270 $ 2017 495 $ 475 820 35 420 $ 270 440 40 Capital Spending 2016 1,825 $ 205 1,170 $ 25 1,195 $ 505 $ 305 650 35 1,495 $ 210 - 2015 425 265 400 37 1,127 24 1,151 465 250 515 40 1,270 95 X i Notes to Consolidated Financial Statements Note 1-Basis of Presentation and Our Divisions: We manufacture, market, and sell a variety of products through our divisions, including furniture and fixtures for the home, office, stores, and health-care facilities. The accounting policies are the same for each division. Print Done X

Step by Step Solution

★★★★★

3.43 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

Net Revenue Operating Profit Total Assets Home Furnishings 9500 2565 7600 Office Furniture 8500 1615 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started