Answered step by step

Verified Expert Solution

Question

1 Approved Answer

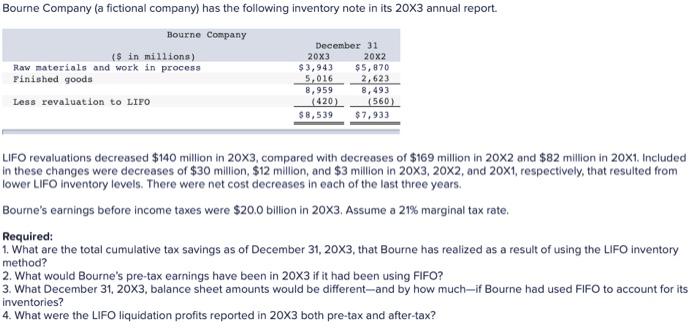

Bourne Company (a fictional company) has the following inventory note in its 20X3 annual report. Bourne Company December 31 ($ in millions) 20X3 20x2

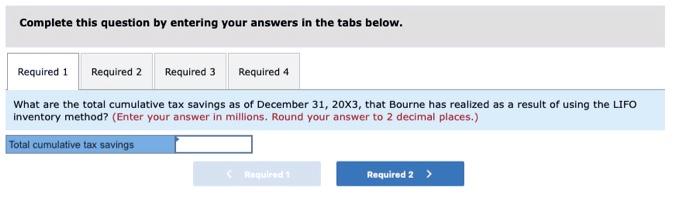

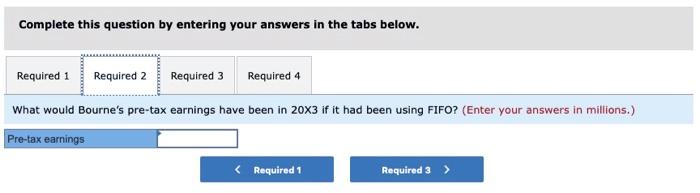

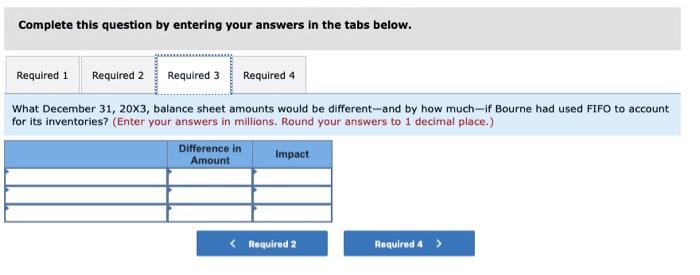

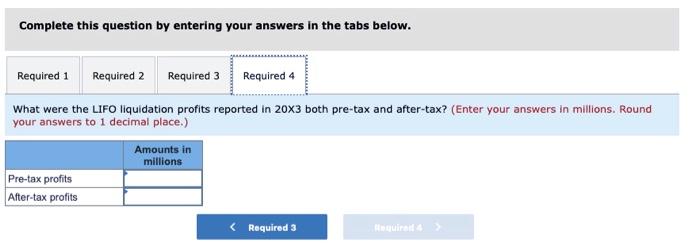

Bourne Company (a fictional company) has the following inventory note in its 20X3 annual report. Bourne Company December 31 ($ in millions) 20X3 20x2 Raw materials and work in process Finished goods $3,943 5,016 8,959 (420) $5,870 2,623 8,493 (560) Less revaluation to LIFO $8,539 $7,933 LIFO revaluations decreased $140 million in 20X3, compared with decreases of $169 million in 20x2 and $82 million in 20x1. Included in these changes were decreases of $30 million, $12 million, and $3 million in 20X3, 20X2, and 20X1, respectively, that resulted from lower LIFO inventory levels. There were net cost decreases in each of the last three years. Bourne's earnings before income taxes were $20.0 billion in 20X3. Assume a 21% marginal tax rate. Required: 1. What are the total cumulative tax savings as of December 31, 20X3, that Bourne has realized as a result of using the LIFO inventory method? 2. What would Bourne's pre-tax earnings have been in 20X3 if it had been using FIFO? 3. What December 31, 20X3, balance sheet amounts would be different-and by how much-if Bourne had used FIFO to account for its inventories? 4. What were the LIFO liquidation profits reported in 20X3 both pre-tax and after-tax? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Required 4 What are the total cumulative tax savings as of December 31, 20X3, that Bourne has realized as a result of using the LIFO inventory method? (Enter your answer in millions. Round your answer to 2 decimal places.) Total cumulative tax savings Requlred 1 Required 2 > Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Required 4 What would Bourne's pre-tax earnings have been in 20X3 if it had been using FIFO? (Enter your answers in millions.) Pre-tax earnings < Required 1 Required 3 > Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Required 4 What December 31, 20x3, balance sheet amounts would be different-and by how much-if Bourne had used FIFO to account for its inventories? (Enter your answers in millions. Round your answers to 1 decimal place.) Difference in Amount Impact < Required 2 Required 4 > Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Required 4 What were the LIFO liquidation profits reported in 20X3 both pre-tax and after-tax? (Enter your answers in millions. Round your answers to 1 decimal place.) Amounts in millions Pre-tax profits After-tax profits < Required 3 Hequired 4

Step by Step Solution

★★★★★

3.42 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started