Answered step by step

Verified Expert Solution

Question

1 Approved Answer

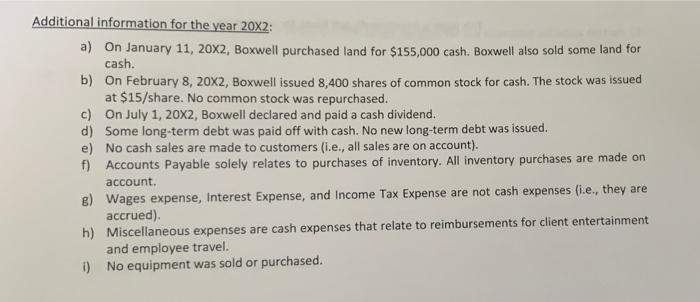

Additional information for the vear 20X2: a) On January 11, 20X2, Boxwell purchased land for $155,000 cash. Boxwell also sold some land for cash.

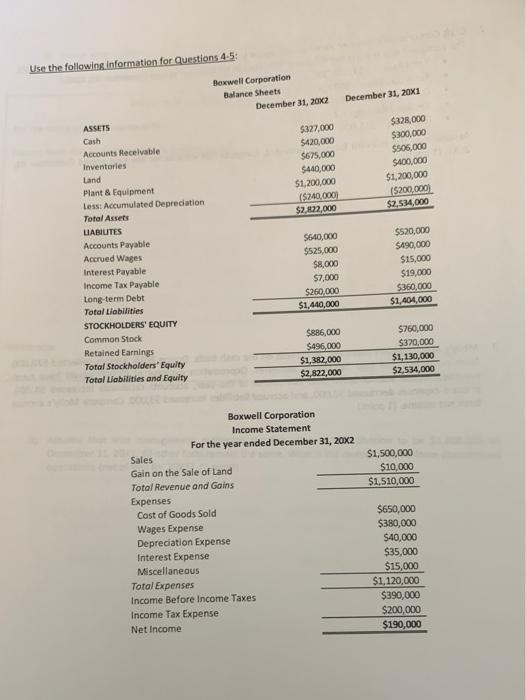

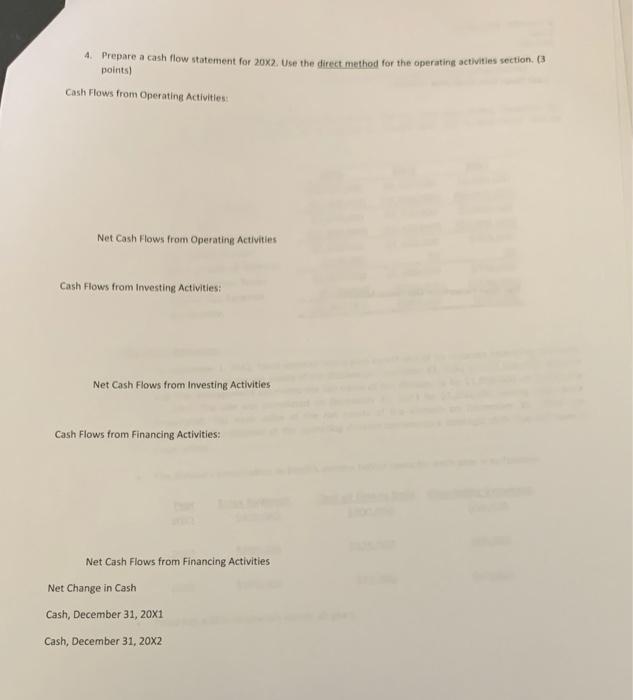

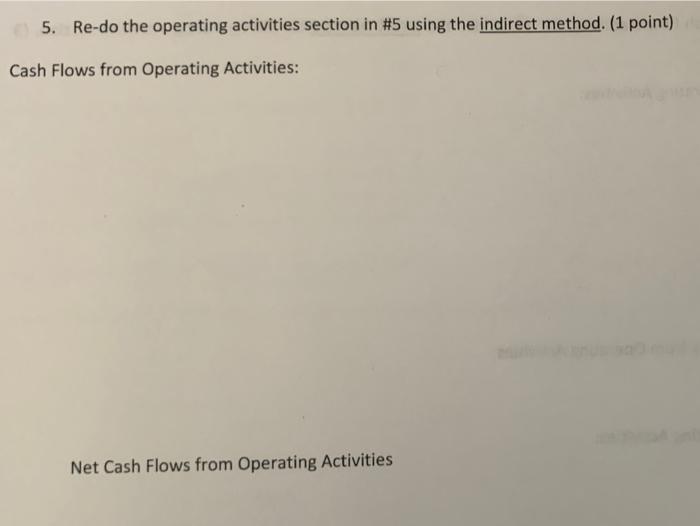

Additional information for the vear 20X2: a) On January 11, 20X2, Boxwell purchased land for $155,000 cash. Boxwell also sold some land for cash. b) On February 8, 20x2, Boxwell issued 8,400 shares of common stock for cash. The stock was issued at $15/share. No common stock was repurchased. c) On July 1, 20x2, Boxwell declared and paid a cash dividend. d) Some long-term debt was paid off with cash. No new long-term debt was issued. e) No cash sales are made to customers (i.e., all sales are on account). f) Accounts Payable solely relates to purchases of inventory. All inventory purchases are made on account. g) Wages expense, Interest Expense, and Income Tax Expense are not cash expenses (i.e., they are accrued). h) Miscellaneous expenses are cash expenses that relate to reimbursements for client entertainment and employee travel. i) No equipment was sold or purchased. Use the following information for Questions 4-5: Bexwell Corporation Balance Sheets December 31, 20x2 December 31, 20X1 ASSETS $328,000 $300,000 $506,000 Cash $327,000 Accounts Recelvable $420,000 Inventories $675,000 $440,000 $400,000 Land $1,200,000 (5200,000) $2.534.000 Plant & Equipment $1,200,000 Less: Accumulated Depreciation Total Assets (5240,000) $2.822,000 LIABIITES $520,000 Accounts Payable Accrued Wages Interest Payable S640,000 $525,000 S490,000 $,000 $15,000 $19,000 $360,000 $1,404,000 Income Tax Payable Long-term Debt Total Liabilities $7,000 $260,000 $1,440,000 STOCKHOLDERS' EQUITY Common Stock $760,000 $370,000 $886,000 Retained Earnings Total Stockholders' Equity Total Liabilities and Equity $496,000 $1,382,000 $2,822,000 $1,130,000 $2.534,000 Boxwell Corporation Income Statement For the year ended December 31, 20X2 Sales $1,500,000 Gain on the Sale of Land $10,000 $1,510,000 Total Revenue and Gains Expenses Cost of Goods Sold Wages Expense Depreciation Expense Interest Expense Miscellaneous Total Expenses Income Before Income Taxes $650,000 $380,000 $40,000 $35,000 $15,000 $1,120,000 $390,000 Income Tax Expense $200,000 $190,000 Net Income 4. Prepare a cash flow statement for 20x2. Use the direct method for the operating activities section. (3 points) Cash Flows from Operating Activities: Net Cash Flows from Operating Activities Cash Flows from Investing Activities: Net Cash Flows from Investing Activities Cash Flows from Financing Activities: Net Cash Flows from Financing Activities Net Change in Cash Cash, December 31, 20x1 Cash, December 31, 20X2 5. Re-do the operating activities section in #5 using the indirect method. (1 point) Cash Flows from Operating Activities: Net Cash Flows from Operating Activities

Step by Step Solution

★★★★★

3.51 Rating (171 Votes )

There are 3 Steps involved in it

Step: 1

Answer Boxwell Corporation Statement of Cash Flows Direct method For the Year Ended December 31 20X2 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started