Question: Ashley, Brian, and Carina have been in partnership for many years. The partners, who share profits and losses on a 2:4:4 basis, respectively, wish

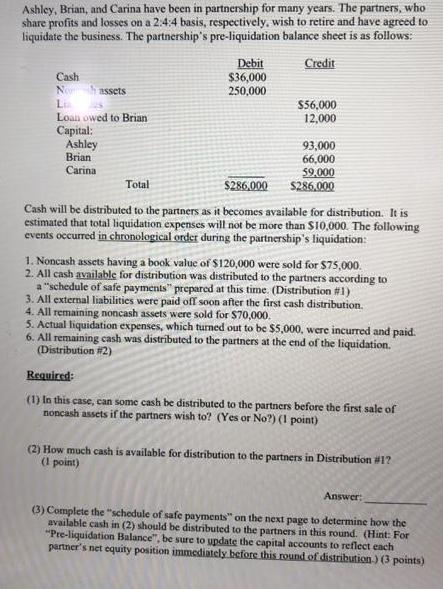

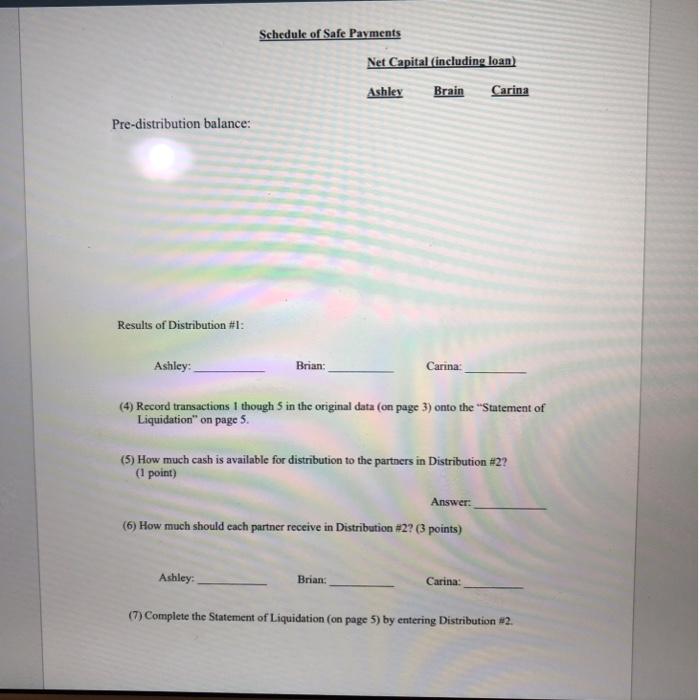

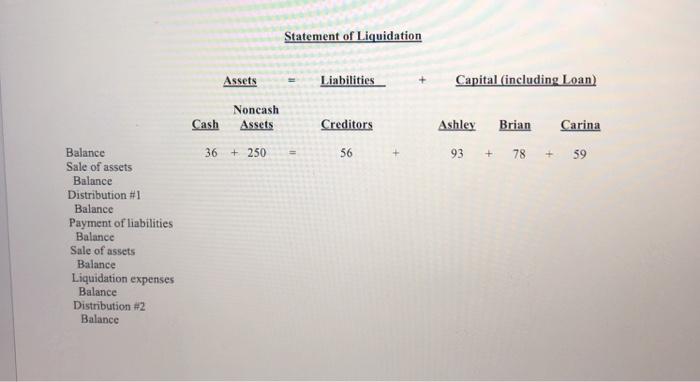

Ashley, Brian, and Carina have been in partnership for many years. The partners, who share profits and losses on a 2:4:4 basis, respectively, wish to retire and have agreed to liquidate the business. The partnership's pre-liquidation balance sheet is as follows: Credit Cash Now assets Lia Loan owed to Brian Capital: Ashley Brian Carina Debit $36,000 250,000 $56,000 12,000 93,000 66,000 59,000 $286.000 Total $286.000 Cash will be distributed to the partners as it becomes available for distribution. It is estimated that total liquidation expenses will not be more than $10,000. The following events occurred in chronological order during the partnership's liquidation: 1. Noncash assets having a book value of $120,000 were sold for $75,000. 2. All cash available for distribution was distributed to the partners according to a "schedule of safe payments" prepared at this time. (Distribution #1) 3. All external liabilities were paid off soon after the first cash distribution. 4. All remaining noncash assets were sold for $70,000. 5. Actual liquidation expenses, which turned out to be $5,000, were incurred and paid. 6. All remaining cash was distributed to the partners at the end of the liquidation. (Distribution #2) Required: (1) In this case, can some cash be distributed to the partners before the first sale of noncash assets if the partners wish to? (Yes or No?) (1 point) (2) How much cash is available for distribution to the partners in Distribution #1? (1 point) Answer: (3) Complete the "schedule of safe payments" on the next page to determine how the available cash in (2) should be distributed to the partners in this round. (Hint: For "Pre-liquidation Balance", be sure to update the capital accounts to reflect each partner's net equity position immediately before this round of distribution-) (3 points) Pre-distribution balance: Results of Distribution #1: Ashley: Schedule of Safe Payments Brian: Ashley: Net Capital (including loan) Carina Ashley Brain (4) Record transactions I though 5 in the original data (on page 3) onto the "Statement of Liquidation" on page 5. Brian: Carina: (5) How much cash is available for distribution to the partners in Distribution # 2? (1 point) Answer: (6) How much should each partner receive in Distribution #2? (3 points) Carina: (7) Complete the Statement of Liquidation (on page 5) by entering Distribution #2. Balance Sale of assets Balance Distribution #1 Balance Payment of liabilities Balance Sale of assets Balance Liquidation expenses Balance Distribution #2 Balance Cash Assets Noncash Assets 36 + 250 Statement of Liquidation Liabilities Creditors 56 Capital (including Loan) Ashley 93 Brian Carina + 78 +59

Step by Step Solution

3.54 Rating (157 Votes )

There are 3 Steps involved in it

1 No cash cannot be distributed to the partners before the first sale of noncash assets ... View full answer

Get step-by-step solutions from verified subject matter experts