Question

Required A) Should Cadbury be classified as self-sustaining or an integrated subsidiary? State three facts from the question to support your answer. (2 marks) B)

Required

A) Should Cadbury be classified as self-sustaining or an integrated subsidiary? State three facts from the question to support your answer. (2 marks)

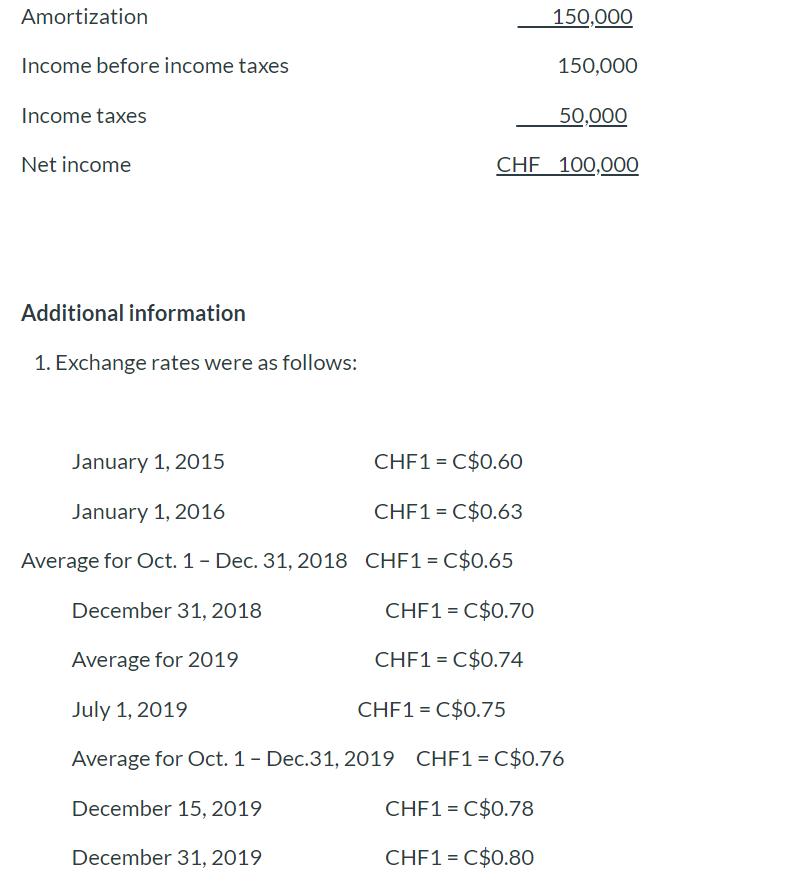

B) Disregard your response to part (a) and translate Cadbury’s 2019 statement of income, assuming that Cadbury’s functional currency is the Canadian dollar (temporal method). As part of your solution, provide a detailed calculation of the foreign exchange gain or loss.

C) Disregard your responses to parts (a) and (b), and translate the following December 31, 2019 accounts, assuming Cadbury’s functional currency is the Swiss francs (CHF) (current rate method).

- Equipment

- Bonds payable

- Cumulative (other comprehensive income/loss) translation adjustment

D) Since the current rate method uses the closing rate to translate equipment, the translated equipment amount should represent the fair value of the equipment in Canadian dollars. Do you agree or disagree? Briefly explain.

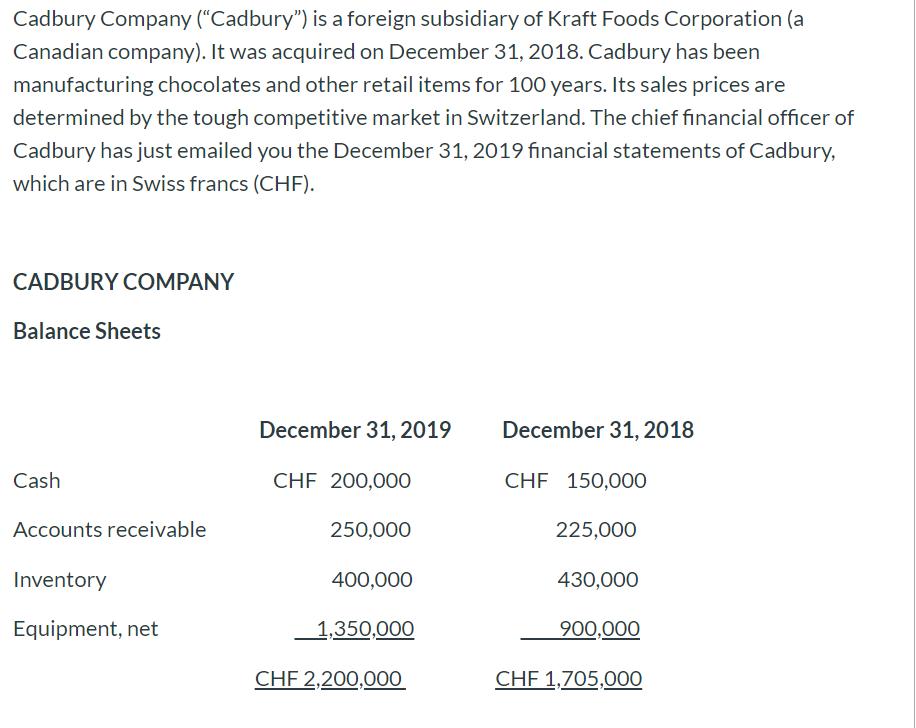

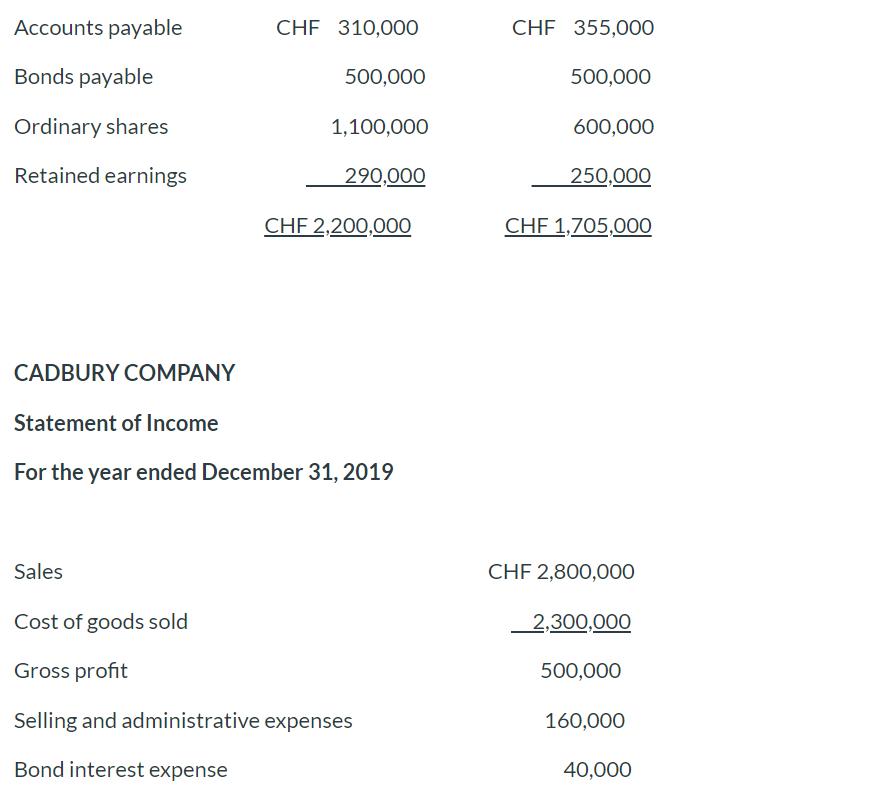

Cadbury Company ("Cadbury") is a foreign subsidiary of Kraft Foods Corporation (a Canadian company). It was acquired on December 31, 2018. Cadbury has been manufacturing chocolates and other retail items for 100 years. Its sales prices are determined by the tough competitive market in Switzerland. The chief financial officer of Cadbury has just emailed you the December 31, 2019 financial statements of Cadbury, which are in Swiss francs (CHF). CADBURY COMPANY Balance Sheets Cash Accounts receivable Inventory Equipment, net December 31, 2019 CHF 200,000 250,000 400,000 1,350,000 CHF 2,200,000 December 31, 2018 CHF 150,000 225,000 430,000 900,000 CHF 1,705,000

Step by Step Solution

3.28 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

A Should Cadbury be classified as selfsustaining or an integrated subsidiary State three facts from the question to support your answer 2 marks Answer Cadbury should be classified as an integrated sub...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started