Answered step by step

Verified Expert Solution

Question

1 Approved Answer

For each of the following, indicate how they would be taxed in Canada for the year ending December 31, 2020. Your answer should explain

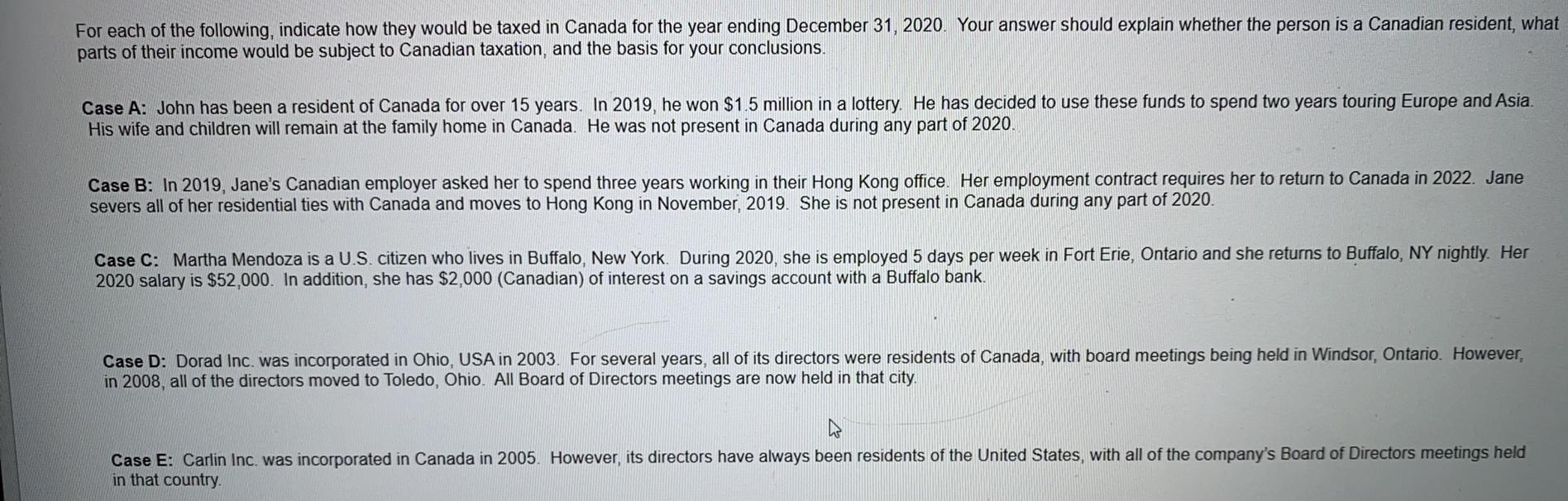

For each of the following, indicate how they would be taxed in Canada for the year ending December 31, 2020. Your answer should explain whether the person is a Canadian resident, what parts of their income would be subject to Canadian taxation, and the basis for your conclusions. Case A: John has been a resident of Canada for over 15 years. In 2019, he won $1.5 million in a lottery. He has decided to use these funds to spend two years touring Europe and Asia. His wife and children will remain at the family home in Canada. He was not present in Canada during any part of 2020. Case B: In 2019, Jane's Canadian employer asked her to spend three years working in their Hong Kong office. Her employment contract requires her to return to Canada in 2022. Jane severs all of her residential ties with Canada and moves to Hong Kong in November, 2019. She is not present in Canada during any part of 2020. Case C: Martha Mendoza is a U.S. citizen who lives in Buffalo, New York. During 2020, she is employed 5 days per week in Fort Erie, Ontario and she returns to Buffalo, NY nightly. Her 2020 salary is $52,000. In addition, she has $2,000 (Canadian) of interest on a savings account with a Buffalo bank. Case D: Dorad Inc. was incorporated in Ohio, USA in 2003. For several years, all of its directors were residents of Canada, with board meetings being held in Windsor, Ontario. However, 08, all of the directors moved to Toledo, Ohio. All Board of Directors meetings are now held in that city. in Case E: Carlin Inc. was incorporated in Canada in 2005. However, its directors have always been residents of the United States, with all of the company's Board of Directors meetings held in that country.

Step by Step Solution

★★★★★

3.46 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

case A Based on the data John will be considered as a resident Because the people depended on him wi...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started